From 26QB TDS on Sale of Property - Summary

Understanding TDS Under Section 26QB for Sale of Property

TDS on sale of property is an essential consideration for both buyers and sellers in India. According to the Income Tax Act, TDS becomes applicable when the sale consideration of the immoveable property is Rs 50,00,000 (Rupees Fifty Lakhs) or more. 🏡 This regulation ensures that the government receives tax revenue from real estate transactions, and it is crucial for individuals involved in such dealings to be aware of these rules.

What You Need to Know About TDS on Sale of Property

When the property is sold for a value equal to or exceeding Rs 50 Lakhs, the buyer is mandated to deduct TDS at the rate of one per cent before making the payment to the seller. This process is detailed in Section 26QB of the Income Tax Act, and it plays a significant role in the larger tapestry of property transactions.

When preparing to sell or buy property, it is important to understand the procedural aspects of TDS. The buyer must ensure that TDS is correctly deducted and deposited with the government in a timely manner. 😊 Failure to do so could lead to penalties and interest, which can complicate future transactions.

Additionally, sellers of immoveable property should be on the lookout for the TDS deduction on their sale proceeds. They must provide the buyer with their Permanent Account Number (PAN) to facilitate this process. The deductor must also provide the seller with a TDS certificate in order for them to claim credit for the deduction in their income tax return. 📄

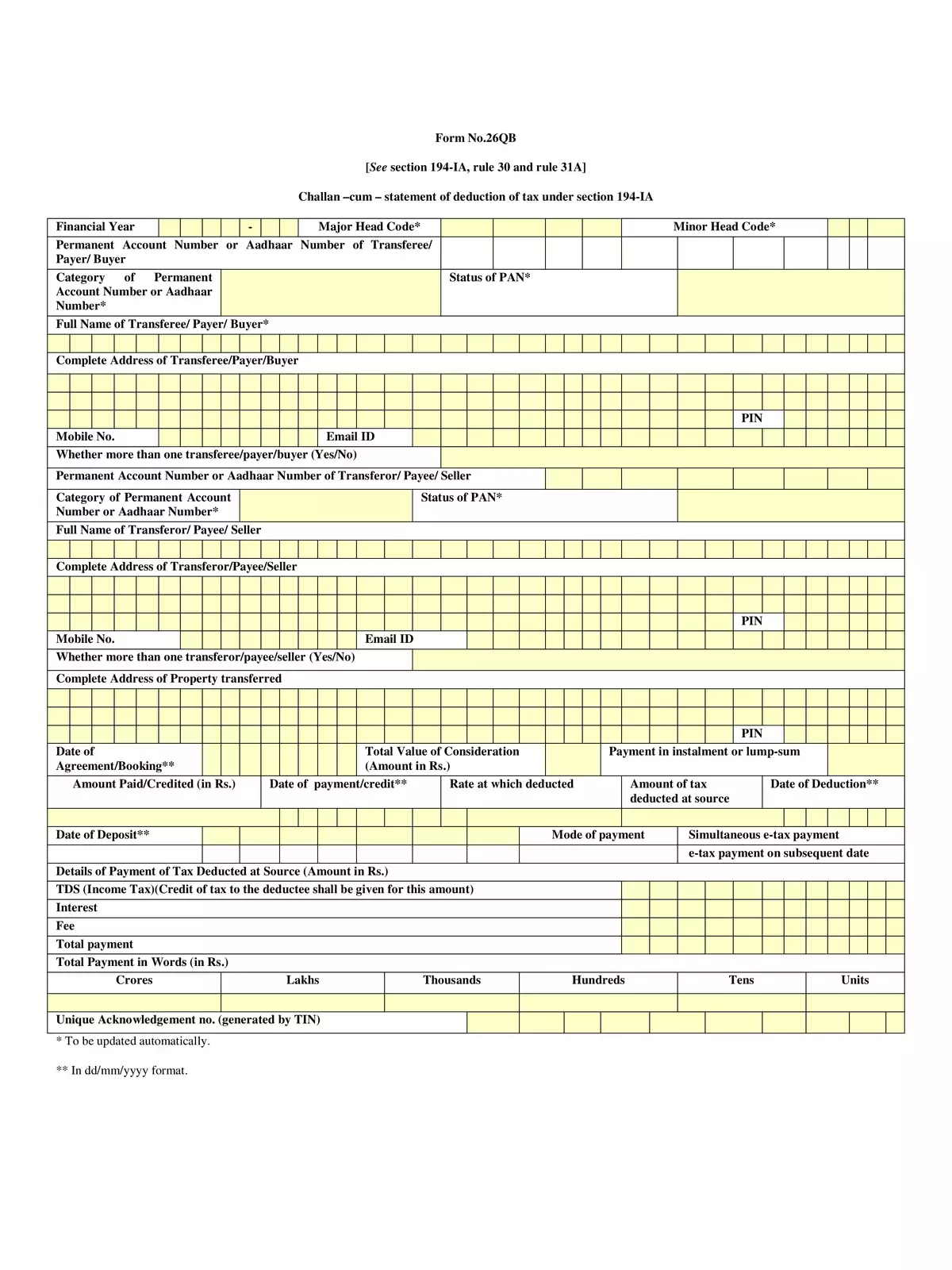

For those keen on delving deeper into tax regulations, insights on TDS and related provisions can be found in an accompanying PDF that details the requirements and compliance for TDS on sale of property. This PDF is a valuable resource for both buyers and sellers as it outlines necessary documentation and procedural steps.

In summary, keeping yourself informed about TDS on sale of property and adhering to these tax regulations is crucial for a seamless property transaction. 🌟 By understanding the implications and ensuring compliance, you can streamline the buying or selling process and avoid complications. Always make sure to consult with a tax advisor or financial consultant if you have specific questions regarding your transaction.