From 26AS Tax Credit statement - Summary

Form 26AS is an important document that contains details of the tax deducted on your behalf. This official tax credit statement gives you a complete view of the tax deductions made by your employer, bank, or other deductors. It also includes advance tax payments and refunds. With Form 26AS, you can easily monitor your tax information in one place.

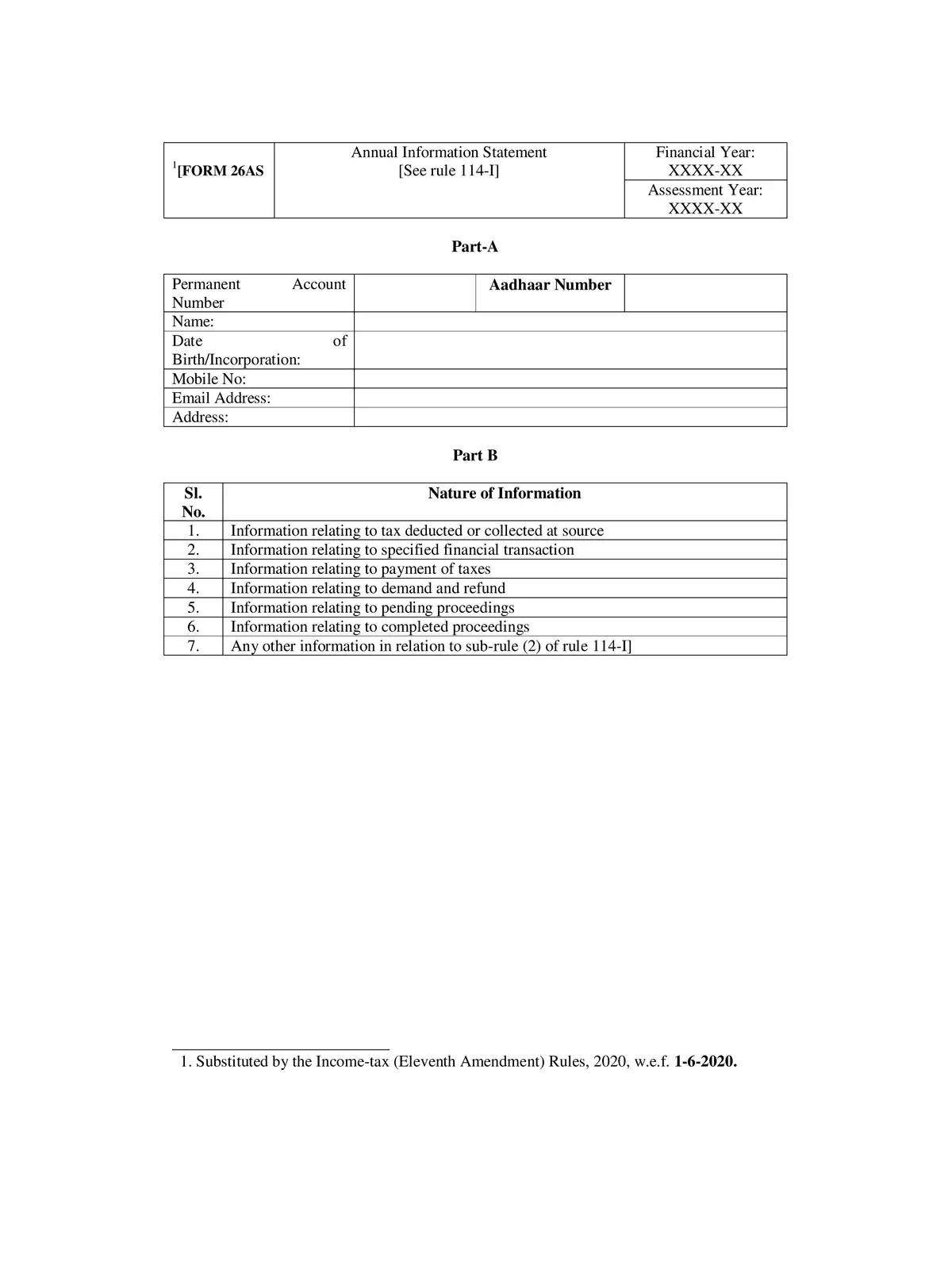

Understanding the Form 26AS Tax Credit Statement

Form 26AS, often called the annual consolidated statement, collects all the vital tax-related information for individuals. You can access your Form 26AS online through the income tax website using your PAN (Permanent Account Number). This statement includes several important details:

- Details of Annual Information Report transactions

- Information on tax collected by various authorities on your behalf

- Tax deducted by the deductor on your income

- Advance tax, self-assessment tax, and regular assessment tax payments you’ve made

- Information on refunds received during the financial year

- High-value transaction details related to shares, mutual funds, etc.

How to Download Form 26AS

You can easily download the Form 26AS online using two different methods. Here’s how to view your Form 26AS hassle-free:

- Using the TRACES Portal: You can download Form 26AS from the TRACES portal. Just follow these simple steps:

1) Visit the Income Tax e-filing website at www.incometaxindiaefiling.gov.in and locate the Form 26AS section.

2) Log in using your PAN. If you haven’t created an account yet, you will need to register.

3) Your password for accessing Form 26AS is your Date of Birth (in DDMMYYYY format).

4) You can then view your Form 26AS from the financial year 2008-09 and onwards.

- Using NET Banking: If your bank account has net banking enabled, you can access Form 26AS through this service.

Please note: Make sure your PAN number is linked to your bank account to successfully retrieve Form 26AS.

This PDF is designed to help you understand and easily download Form 26AS. Don’t miss out—download our guide below for a complete overview and assistance!