Application Form 49B - Summary

The Application Form 49B is crucial for tax deduction at source (TDS) and tax collection at source (TCS). To make sure your application is successful, it’s essential to follow these guidelines when filling out the form correctly.

Guidelines for Filling Application Form 49B

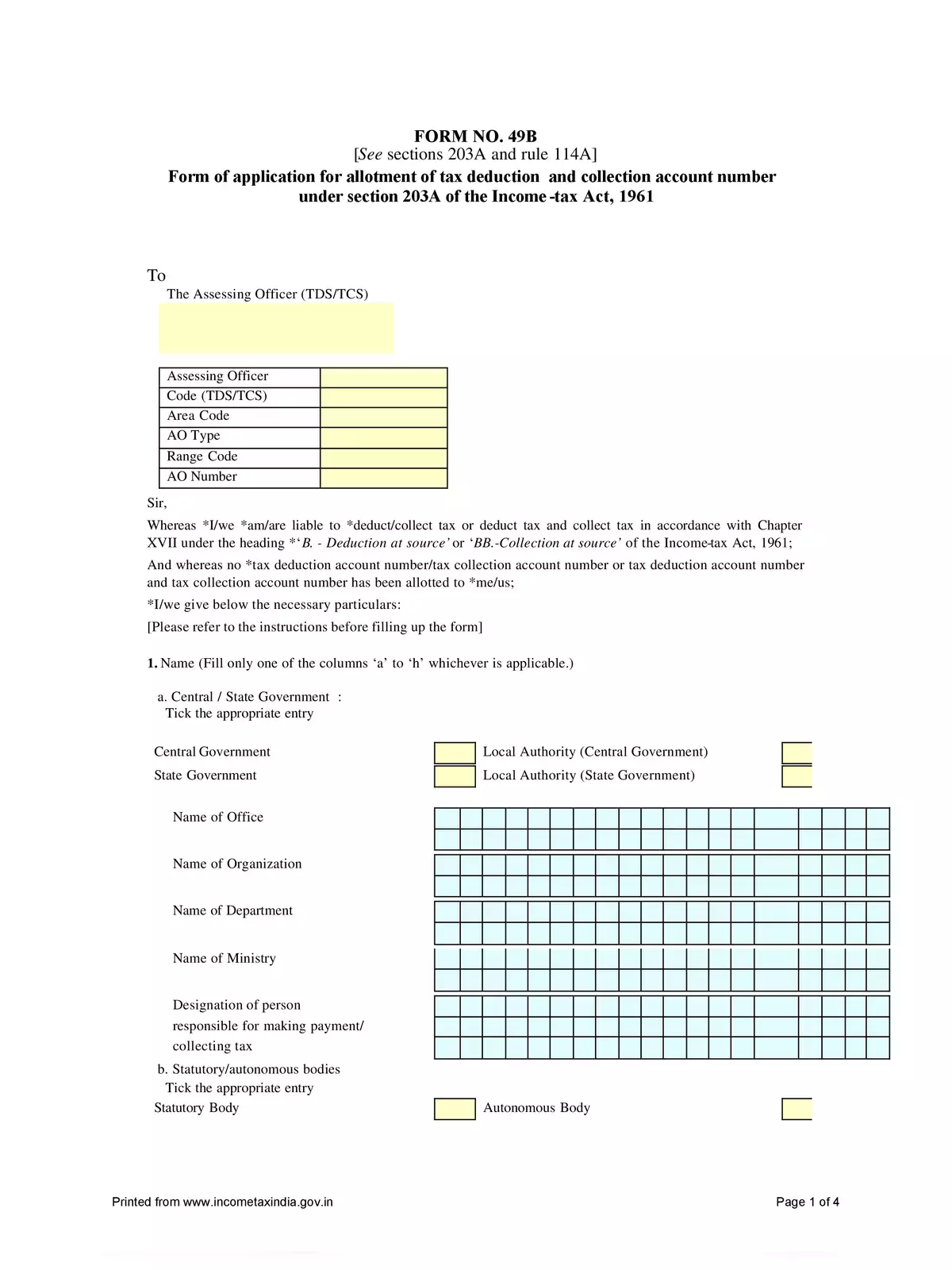

(a) The form must be filled legibly in ENGLISH using BLOCK LETTERS.

(b) Each box provided in the form should contain only one character, whether it’s an alphabet, number, or punctuation mark, with a blank box after each word.

(c) If a left-hand thumb impression is used, it must be attested by a Magistrate, Notary Public, or Gazetted Officer, with an official seal and stamp.

(d) Deductors and Collectors need to provide the details of the Assessing Officer (TDS/TCS) in the application. This information can be obtained from the Income Tax Office.

(e) It is important for the deductor/collector to fill in the Area Code, AO Type, Range Code, and AO Number. These details can be acquired from the Income Tax office or with assistance from the TIN Facilitation Centre (TIN-FC).

(f) Ensure that the entire form is filled out completely.

(g) The field for ‘Designation of the person responsible for making payment/collecting tax’ is mandatory and must be completed wherever applicable.

(h) The applicant’s address should only be an Indian address.

Application Procedure

- An applicant will fill Form 49B online and submit it.

- If there are any errors, they should be corrected before re-submitting the form.

- A confirmation screen displaying all the data filled by the applicant will appear.

- The applicant may either edit or confirm the information displayed.

- Applicants using a credit or debit card for the application fee will incur an additional charge up to 2% (plus applicable taxes) from the bank’s payment gateway.

- Those using Net Banking will be subject to a surcharge of ₹4.00 + Goods & Services Tax for the payment gateway service.

Download the Application Form 49B in PDF format using the link below for quick and easy access. Make sure to fill it out carefully and submit your application correctly to avoid any issues during the process. You can also download a PDF file of the form through the alternative link provided.