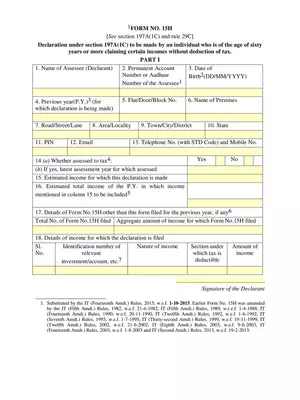

Form 15 H

Form 15H is a self-declaration form which helps individuals above 60 years of age save Tax Deducted at Source (TDS) on the interest income earned by him on his fixed deposits. The assessed is supposed to submit a declaration form to his banker to apply for no deduction or lower deduction for fixed deposits made by him.

Form 15H are valid for one financial year and these form submit every year at the beginning of the financial year. This will ensure that the bank does not deduct any TDS on your interest income.

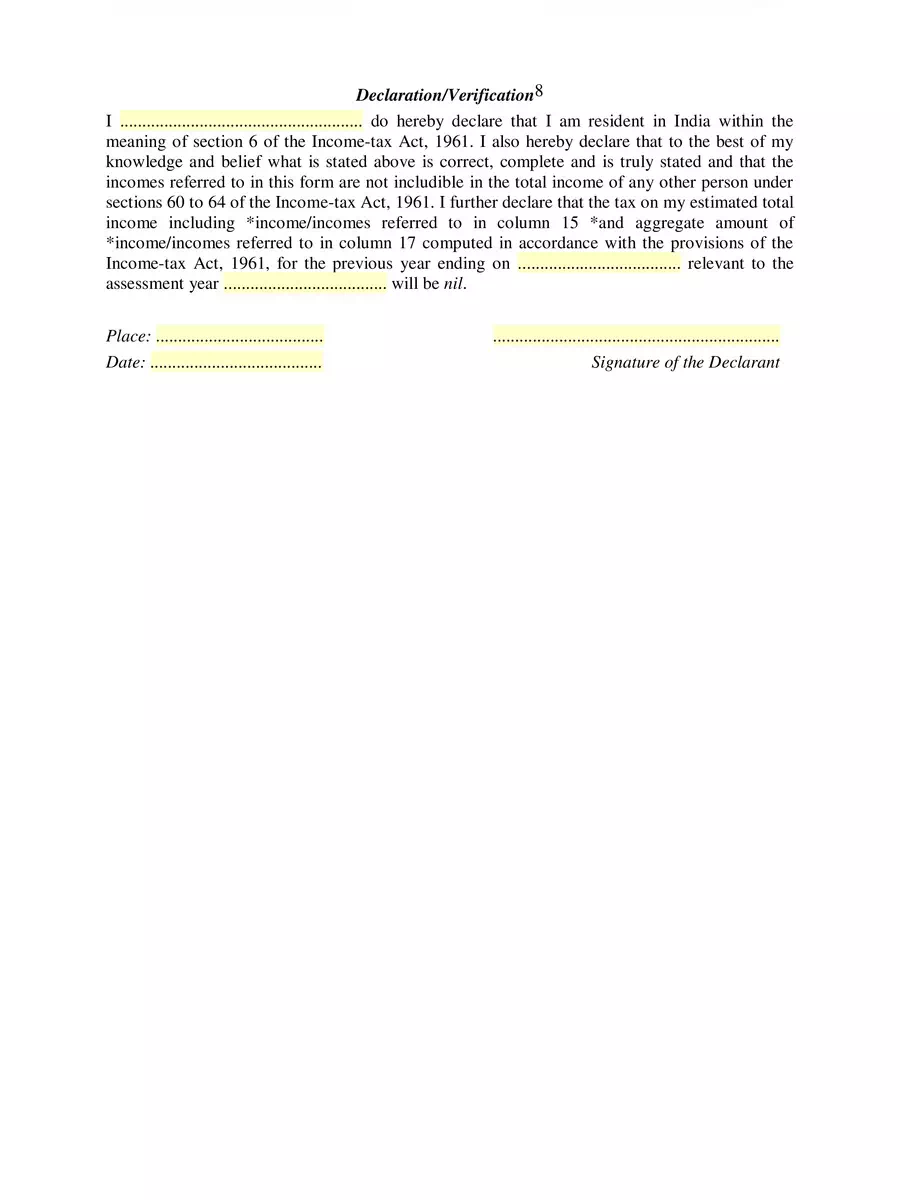

Details to be Mention in Form 15H

- Name of Assesses (Declaring) – Enter your name as per income tax records & PAN number.

- Status – Input Whether you are an individual or HUF

- Previous Year –Input current financial year for which you are filing up the form

- Residential Status – This form can only be filled by Residents.

- Fill Address details along with PIN code, email and telephone number.

- Whether assessed to tax under the income tax act, 1961? – If your income was above the taxable limit in any of the past 6 years, answer this question with ‘yes”.

- If yes, the latest assessment year for which assessed – mention the latest year in which your income was above the taxable limit.

- Estimated income for which declaration is made – full sum of interest or other income on which TDS should not be deducted.

- Estimated total income of the previous year in which income mentioned in column 16 to be included – Calculate your total income from all sources, salary, stipend, interest income, any other income that you have earned during the year. Include the income mentioned in 16, above

- Details of Form 15G other than this form filed during the previous year, if any;- please mention the total number of Form 15G filed for that particular year.

- Also fill aggregate amount of income for which form 15G filed – Also provide the total income for which Form 15G was filed

- Full Details of income for which declaration is filed; Identification number of relevant investment/account etc, Nature of Income, Section under which tax is deductible, Amount of income – Provide fixed deposit account number, recurring deposit details, details of NSCs, life insurance policy number etc. (many of these are chargeable to tax under section 56 of the income tax act)

- Signatures – mention your capacity when signing on behalf of an HUF or AOP

You can download the Form 15 H in PDF format using the link given below.