Form 15CA - Summary

Form 15CA is an important declaration for remittances, serving as a means to gather information about payments that are taxable for a non-resident recipient. This form is vital for tracking foreign remittances and ensuring proper tax compliance in India.

To ensure smoother foreign transactions, you can easily download the Form 15CA PDF from the official website [https://www.incometaxindia.gov.in/](https://www.incometaxindia.gov.in/) or directly download it from the link at the bottom of this page.

Essential Information about Form 15CA

Income Tax Form 15CA is required to be filled only when the remittances attract tax in India. If the payment does not fall under tax obligations for Non-Resident Indians, then Form 15CA is not necessary. According to Income Tax Rule 37BB, it is the responsibility of authorized banks or dealers to obtain this form from the remitter.

Key Details Required in Form 15CA

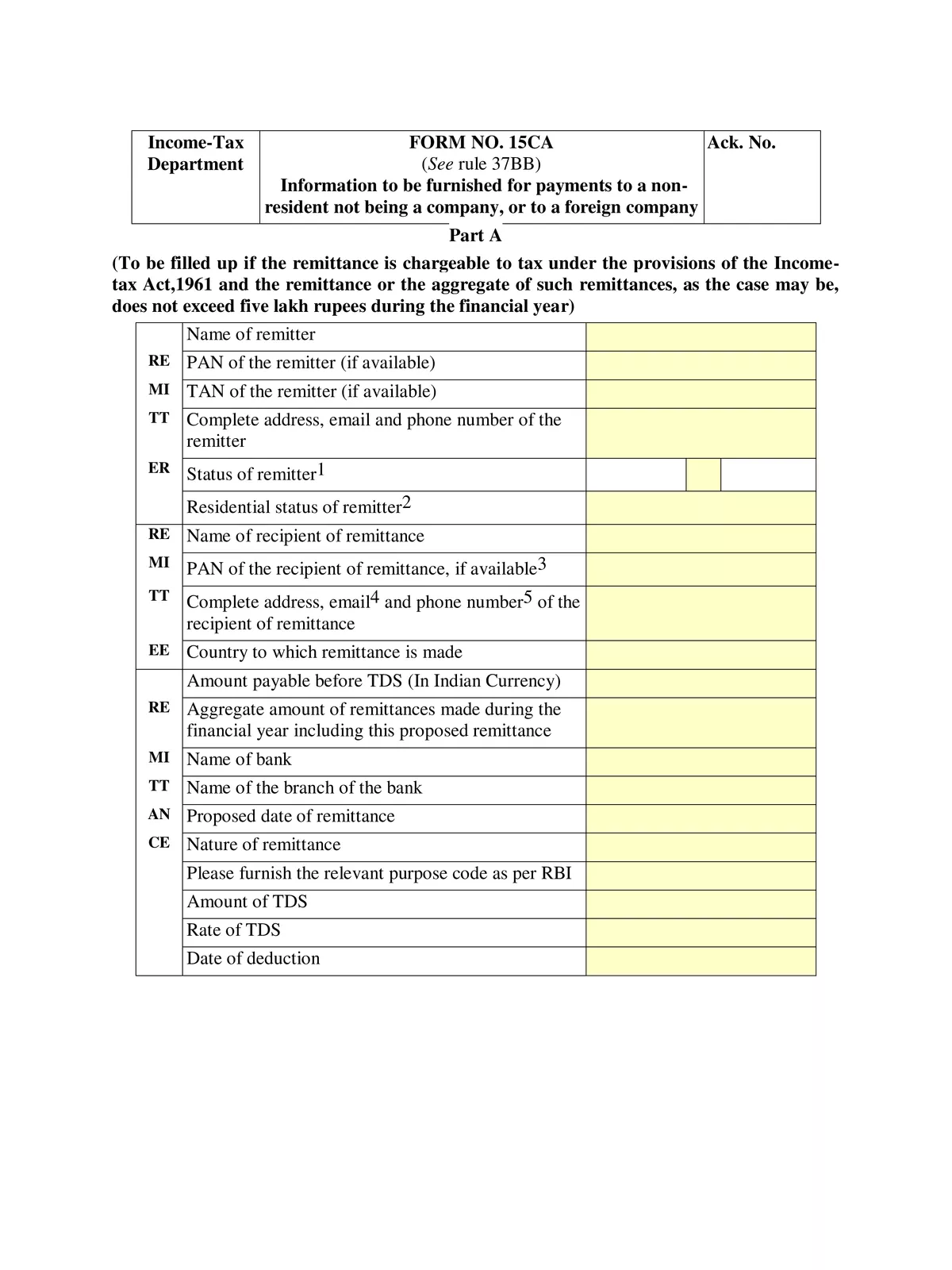

When filing the Income Tax Form 15CA, the following information must be provided:

- Details of the Remitter

- Name of the remitter

- Address of the remitter

- Principal place of business of the remitter

- PAN of the remitter

- Email address and phone number of the remitter

- Status of the remitter (firm/company/other)

- Details of the Remittee

- Name and status of the remittee

- Address of the remittee

- Principal place of business of the remittee

- Country of the remittee (to which the remittance is made)

- Details of the Remittance

- Country to which remittance is made

- Amount of remittance in Indian currency

- Currency in which remittance is made

- Nature of the remittance as per agreement (invoice copy may be required from the client)

- Proposed date of remittance

- Bank Details of the Remitter

- Name of the bank of the remitter

- Name of the branch of the bank

- BSR Code of the bank

- Other Details

- Designation of the signing person

- Father’s name of the signing person

- Documents Required from the Remittee

- A duly filled Income Tax Form 10F by the authorized individual of the remittee

- Tax residency certificate from the appropriate remittee or tax registration of the country where the remittee is registered

- A certificate confirming the remittee does not have any permanent establishment in India

This is essential if the income is from business and is not subject to tax according to the Double Taxation Avoidance Agreement (DTAA) when there is no permanent establishment in India.

Download the Form 15CA PDF using the link provided below.