Final Accounts Format 2026 - Summary

Knowing the Final accounts format is very important to see how a business is doing financially at the end of the year. This format helps owners, managers, and anyone interested in the business’s money matters understand everything clearly. To prepare the final accounts, you start by recording all money transactions (journal entries), then put them into different accounts (ledgers), and finally summarise everything in the final statements. For your convenience, you can download the Final Accounts Format PDF to have a handy reference.

Overview: What Is Included in the Final Accounts Format?

The Final accounts format usually includes several important parts that give a complete picture of the business’s financial health. These include:

- Trading Account

- Manufacturing Account

- Profit and Loss Account

- Balance Sheet

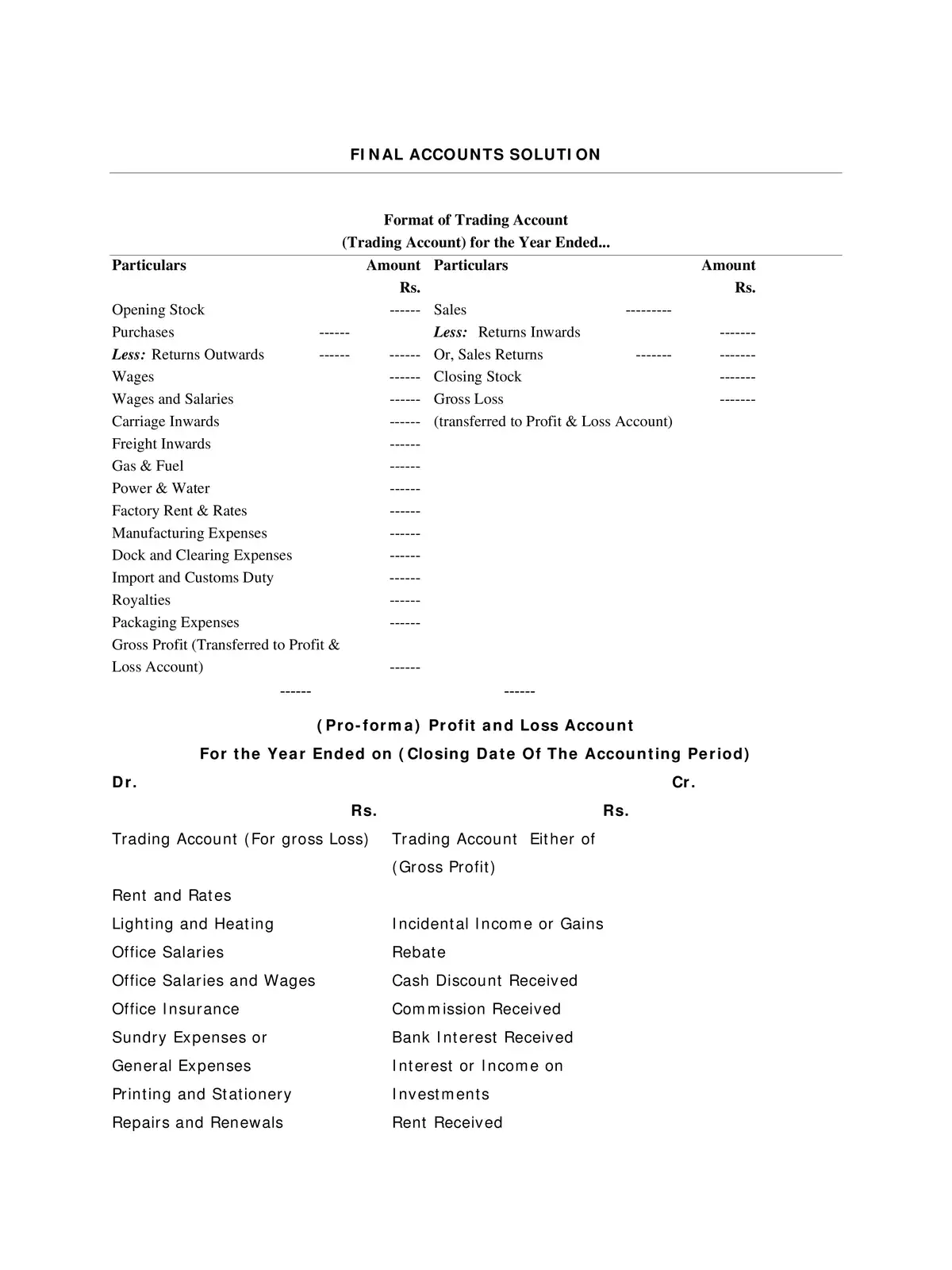

Understanding the Trading Account in the Final Accounts Format

The trading account is part of the Final accounts format and shows the total profit or loss from sales and the cost of buying or making those goods during the year. It focuses on the direct costs involved.

Main Details Found in the Trading Account (Part of Final Accounts Format)

- Opening Stock: This is the inventory that wasn’t sold last year. In the trading account, it’s shown on the left (debit) side as “To Opening Stock.”

- Purchases: All the goods the business bought during the year, after returns, are listed here as “To Purchases.” This includes purchases made with cash or on credit.

- Direct Expenses: These are costs directly linked to preparing goods for sale, such as transport fees (freight), carrying costs (cartage), customs taxes, gas, electricity used in the factory, and wages for workers who make the products. They appear on the left as “To Particular Name of the Expenses.”

- Sales Account: All the money received from selling goods during the year, whether cash or credit, is recorded on the right (credit) side as “By Sales.” This figure should not include taxes.

- Closing Stock: This is the value of goods still unsold at the end of the year. It’s shown on the right side. A simple way to calculate it is: Closing Stock = Opening Stock + Total Purchases – Total Sales

- Gross Profit: This shows the profit made after paying for the goods sold but before covering other office or selling costs. It’s calculated as: Gross Profit = Sales – Cost of Goods Sold

- Operating Profit: This is the profit from the main activities of the business, not from selling old assets or earning interest. Operating Profit = Gross Profit – All Operating Expenses

- Net Profit: This is the final profit left after deducting all costs and expenses from the total income. It’s also called the take-home profit.

The trading account is a very important step in preparing Final accounts format documents. It helps keep everything clear about sales, purchases, and direct costs. The format usually has columns for the item name (Particulars), amount (Amount), Debit (Dr.), Credit (Cr.), Purchases, and Sales to make it easy to follow.

To get a detailed look and use it as a guide, you can download the Final Accounts Format PDF. This will help you understand how all these parts fit together in the Final accounts format for businesses in 2026.