Children Education Allowance Form - Summary

This is the Children Education Allowance Form for parents and guardians who wish to avail tax benefits. You can easily download the PDF from the link provided below. If you are receiving the children’s education allowance from your employer, it allows you to claim a tax exemption under the Income-tax Act. Remember, the maximum amount exempted is Rs. 100 per month or Rs. 1200 per year for up to 2 children.

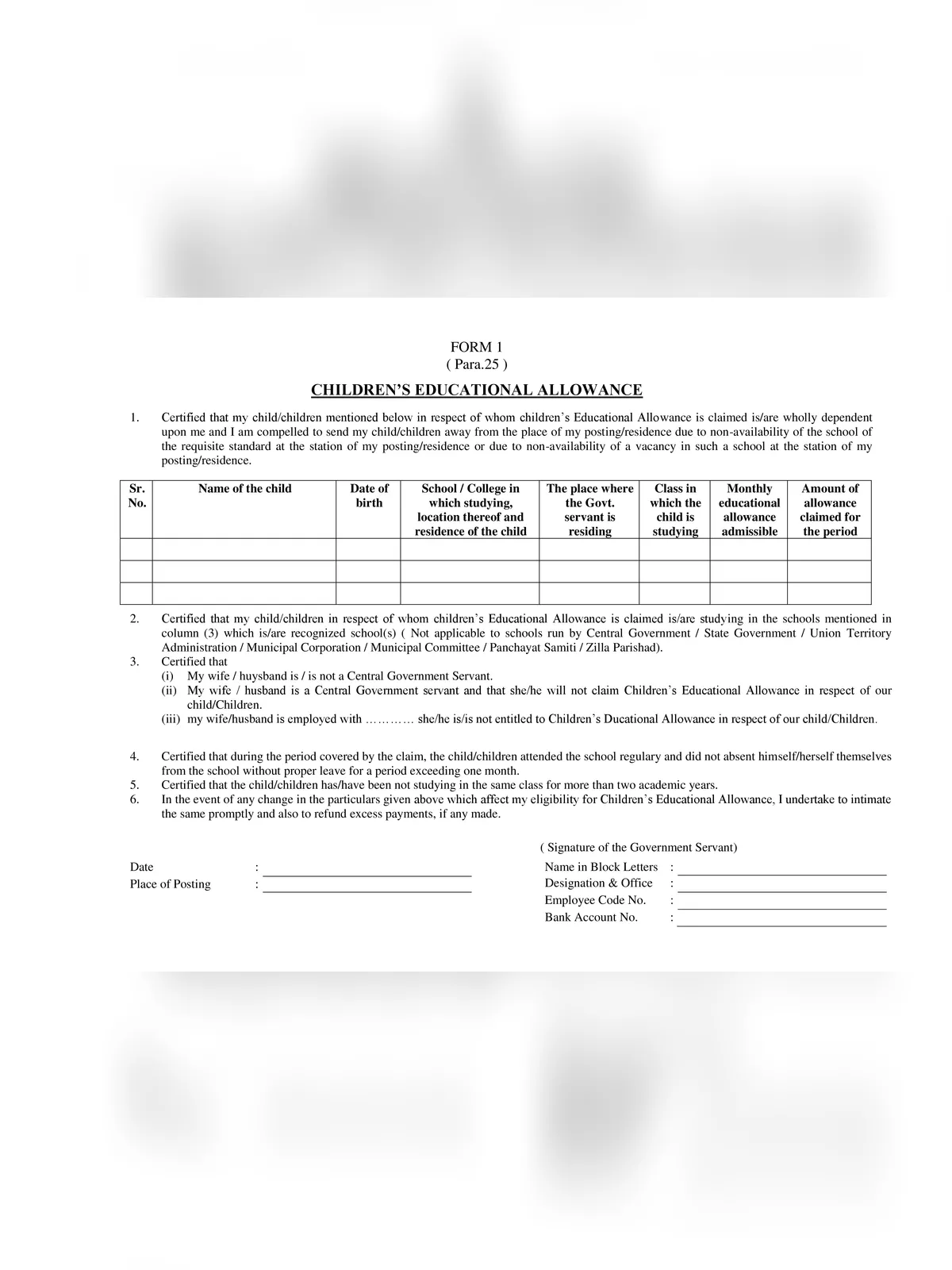

How to Claim Children Education Allowance?

To claim reimbursement for the Children Education Allowance (CEA), the government employee must submit a certificate issued by the Head of the Institution. This certificate should indicate that the child was enrolled in the school during the previous academic year.

Children Education Allowance Form Rules

- The maximum ceiling amount for the reimbursement of Children Education Allowance (CEA) is Rs. 2250/- per month per child, while the Hostel Subsidy can go up to Rs. 6750/- per month for each child. The CEA amount is fixed, no matter the actual expenses incurred. However, for Hostel Subsidy, a certificate from the educational institute is needed, stating the lodging and boarding charges paid by the employee.

- The reimbursable amount for Hostel Subsidy will be either the actual expenses incurred or Rs. 6750/- per month, whichever is lower. This subsidy is only applicable if the residential educational institute is at least 50KM away from the employee’s home.

- For Divyaang children, the reimbursement of CEA will be double the standard rate, amounting to Rs. 4500.00 per month (Rs. 2250 x 2).

- Only one spouse can claim the CEA and Hostel Subsidy if both are working employees.

You can download the Children Education Allowance Form in PDF format online from the link given below.