Canara Bank 15H Form - Summary

The Canara Bank 15H Form is important for senior citizens, specifically those aged 60 years and above. This form must be submitted every financial year by eligible individuals who wish to claim TDS deductions on their investment interest. Submitting the form helps in effective financial planning and prevents any unnecessary tax deductions.

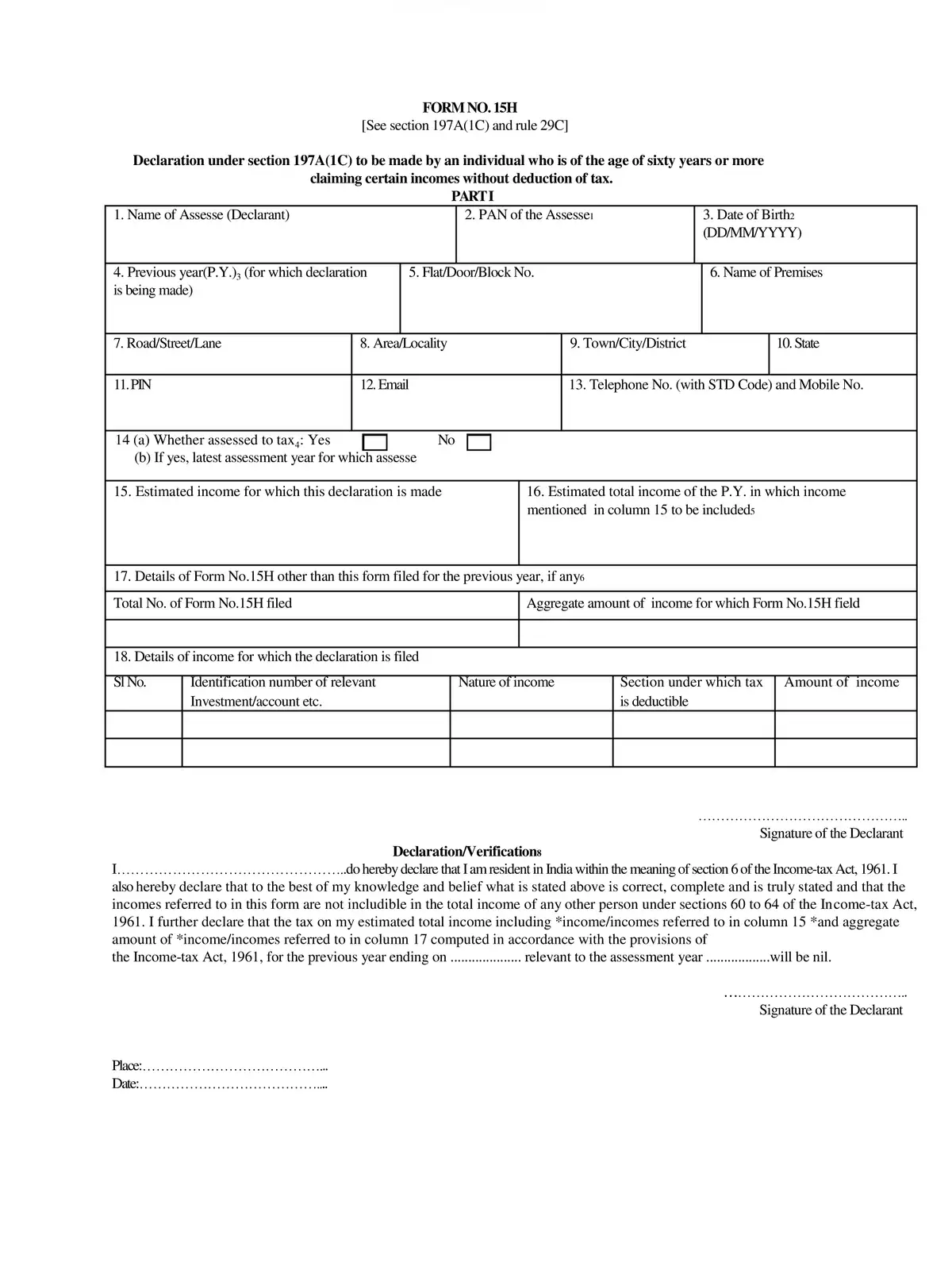

Understanding the Canara Bank 15H Form

It is best to submit the Canara Bank 15H Form before receiving your first interest payment. While it’s not a must, submitting this form can help you avoid TDS deductions. If the interest earned from any bank branch goes beyond Rs. 10,000 in a financial year, you must submit the 15H form to the bank.

Mandatory Details for Canara Bank 15H Form

- Name of Assessee (Declarant)

- PAN of the Assessee

- Date of Birth

- Name of Premises

- Flat/Door/Block No.

- Previous Year (P.Y.) for which declaration is made

- Road/Street/Lane

- Area/Locality

- Town/City/District

- State

- PIN Code

- Telephone Number

- Estimated Income for which this declaration is made

- Estimated Total Income of the previous year in which income mentioned in column 15 will be included

- Details of other Form No. 15H filed for the previous year, if any

- Details of income for which the declaration is filed

- Signature of the Declarant

You can easily download the Canara Bank 15H Form in PDF format using the link below. This helps ensure you have all the necessary documents ready for submission!