Bank of Baroda Car Loan Form - Summary

This is an application form for a Car Loan by the Bank of Baroda. You can easily get this form from the bank’s official website at https://www.bankofbaroda.in/, or you can quickly download it as a PDF using the link provided below.

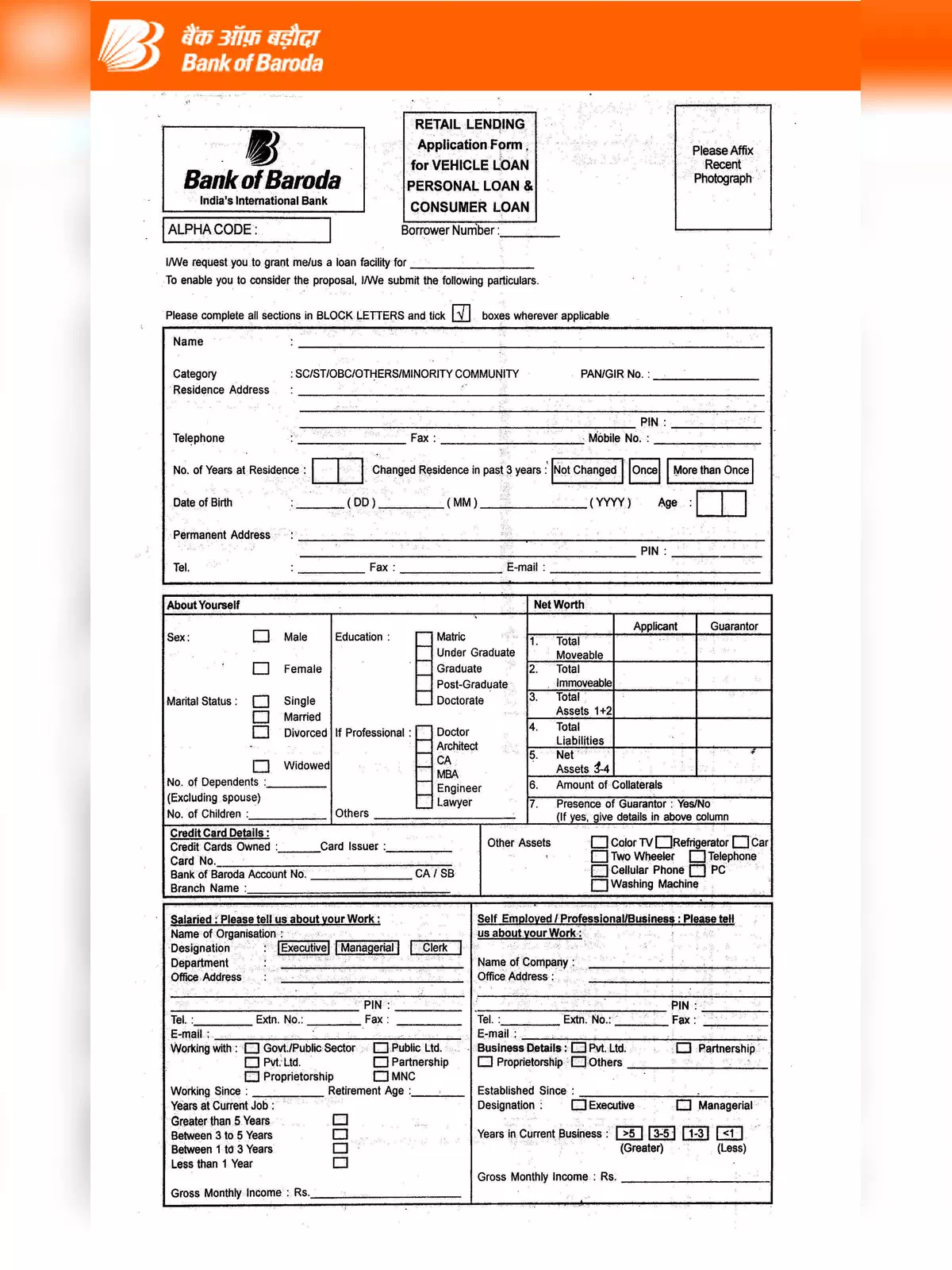

Fill Out the Bank of Baroda Car Loan Form

- Applicant’s Name

- Category Type of Applicants (i.e., SC/ST/OBC/Other)

- Residence Address

- About Yourself

- Credit Card Details

- Self Employed/Professional/Business Information

- Salaried Person Details

- Proposed Loan Information

- Income Details

- And any other required details

Eligibility Criteria for the Bank of Baroda Car Loan

- Salaried Employees

- Businessmen, Professionals, and Farmers

- Directors of Private and Public Limited Companies, Proprietors of Proprietorship Firms, Partners of Partnership Firms

- Corporates (Partnership, Private Limited, Public Limited, and Trust)

- NRIs/PIOs

Documents Needed for the Car Loan Application

Make sure you have these important documents ready:

- Photo ID with age proof (like PAN card, passport, driving license)

- Signed application form with 3 passport-sized photographs

- Residence proof, such as:

- Valid Passport

- Voter ID Card

- Driving License

- Postpaid Utility Bill (like gas or electricity bill)

- Updated Passbook or Bank Account Statement

- Notarized Registered Rent Agreement

- Bank Statement for the last six months

- If you are a salaried individual:

- Last 3 months’ Salary Slips

- Form 16 or Income Tax Returns

- If you are self-employed:

- Balance Sheet and Profit and Loss Account, Computation of Income for the last 2 years

- Income Tax Returns for the last 2 years, 26 AS, Traces

- Business Proof: Gomasta License, Registration Certificate, Service Tax Registration, etc.

- IT Assessment/Clearance Certificate, Income Tax Challans/TDS Certificate (Form 16A)/Form 26 AS for income declared in ITR

Highlights of Bank of Baroda’s Car Loan and Interest Rates

- Processing Fee: Rs. 1500/- + GST

- Loan Tenure: Up to 7 years for new cars

- Loan Amount: Up to 90% of the on-road price of the car, with no prepayment charges

- Interest Rate: Based on BRLLR

- Daily Reducing Balance System

- Credit Score or CIBIL Score, which should be within the defined scores of the Bank

- Repayment Period: Up to 84 months, determined by EMI

- All cars financed by the bank are hypothecated to the Bank, and this is removed upon full and final payment of the loan

- Eligible Profiles: Salaried Employees, Businessmen, Professionals, Corporates, NRIs, and PIOs

- Age Range: 21 to 70 years for obtaining an auto loan

- Bank of Baroda also offers car loan balance transfers from another bank and top-up car loans, provided the borrower meets the eligibility criteria

You can download the Bank of Baroda Car Loan Form in PDF format using the link provided below, or find more details through an alternate link.