अटल पेंशन योजना चार्ट (APY Contribution Chart 2026) - Summary

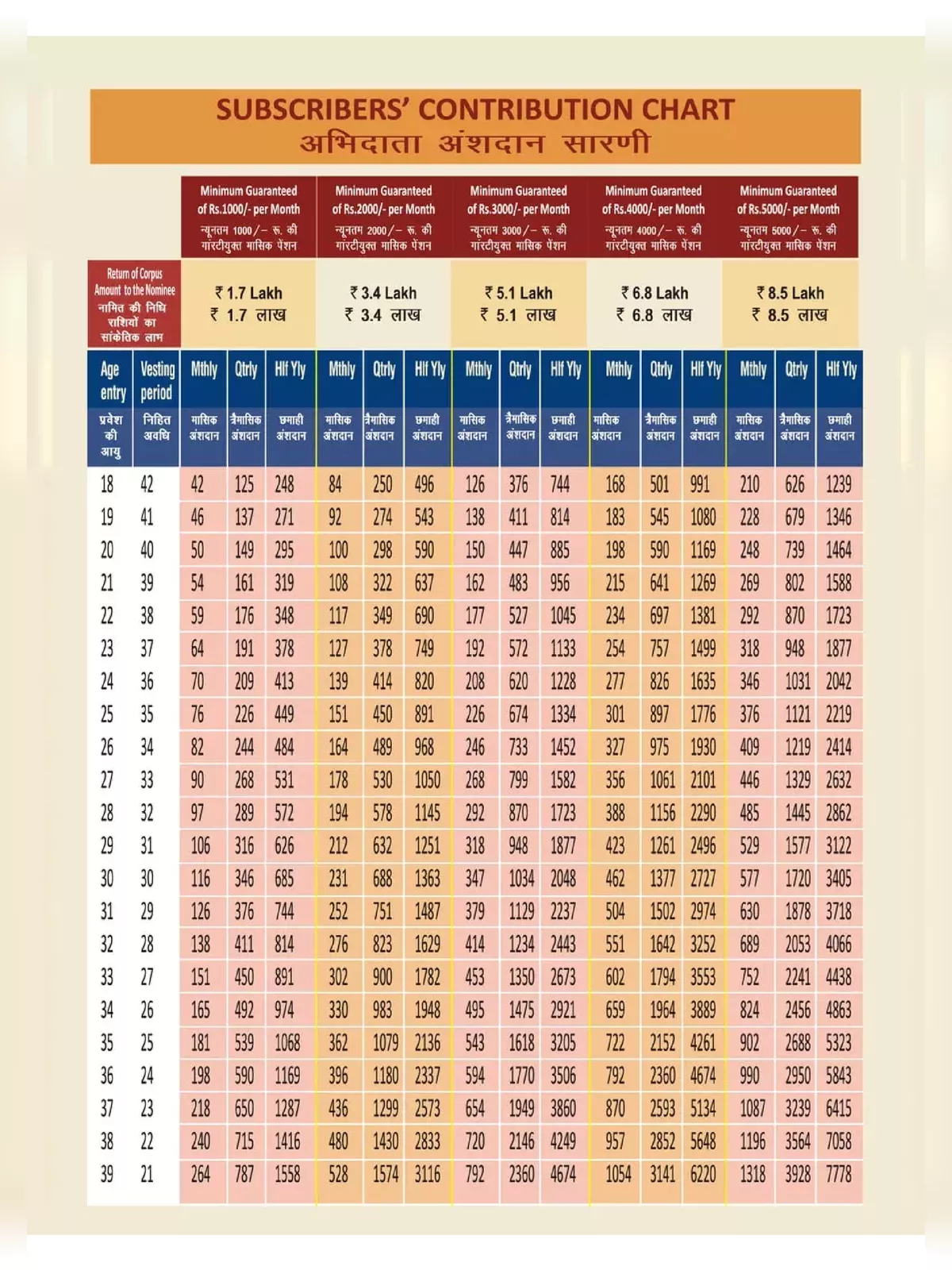

Atal Pension Yojana (APY) is a crucial pension scheme in India focused on supporting workers in the unorganized sector. This valuable initiative guarantees a minimum pension ranging from Rs. 1,000/- to Rs. 5,000/- per month for subscribers once they turn 60, depending on their contributions.

Eligibility for Atal Pension Yojana (APY)

Any Indian citizen can enroll in the APY scheme. To qualify, an applicant must meet the following criteria:

- The subscriber’s age should be between 18 and 40 years.

- The individual should possess a savings bank account or a post office savings bank account.

- When registering, the applicant may provide their Aadhaar number and mobile number to the bank to receive regular updates about their APY account. Aadhaar must be submitted at the time of enrollment.

Mode of Contribution to the APY (अटल पेंशन योजना) Account

Contributions to the APY can be made on a monthly, quarterly, or half-yearly basis. This is easily set up through the auto-debit option from the subscriber’s savings bank account.

अटल पेंशन योजना प्रीमियम चार्ट 2026–

SBI Bank Atal Pension Yojana Chart PDF 2026

PNB Bank Atal Pension Yojana Chart PDF

View and download the APY Contribution Chart PDF here.

How Contributions are Invested in APY

The contributions made under APY are invested according to guidelines set by PFRDA for various government schemes, including the Central Government, State Government, NPS-Lite, Swavalamban Scheme, and the APY itself. The funds are managed by established entities like SBI Pension Fund Pvt. Ltd, LIC Pension Fund Ltd, and UTI Retirement Solution Ltd.

Benefits under the APY Scheme at Age 60

Central Government Guaranteed Minimum Pension: Each subscriber will receive a guaranteed minimum pension from the Central Government of Rs. 1,000 per month, Rs. 2,000 per month, Rs. 3,000 per month, Rs. 4,000 per month, or Rs. 5,000 per month starting at age 60, continuing until their death.

Pension to the Spouse: In the event of the subscriber’s demise, the spouse will receive the same pension amount as the subscriber until their own death.

Return of Pension Wealth to the Nominee: After both the subscriber and spouse have passed away, the nominee chosen by the subscriber will be entitled to receive the accumulated pension wealth until the subscriber reached 60.

Download the APY Contribution Chart PDF using the link provided below for detailed information on your contributions to the Atal Pension Yojana (APY).