Canara Bank 15G Form - Summary

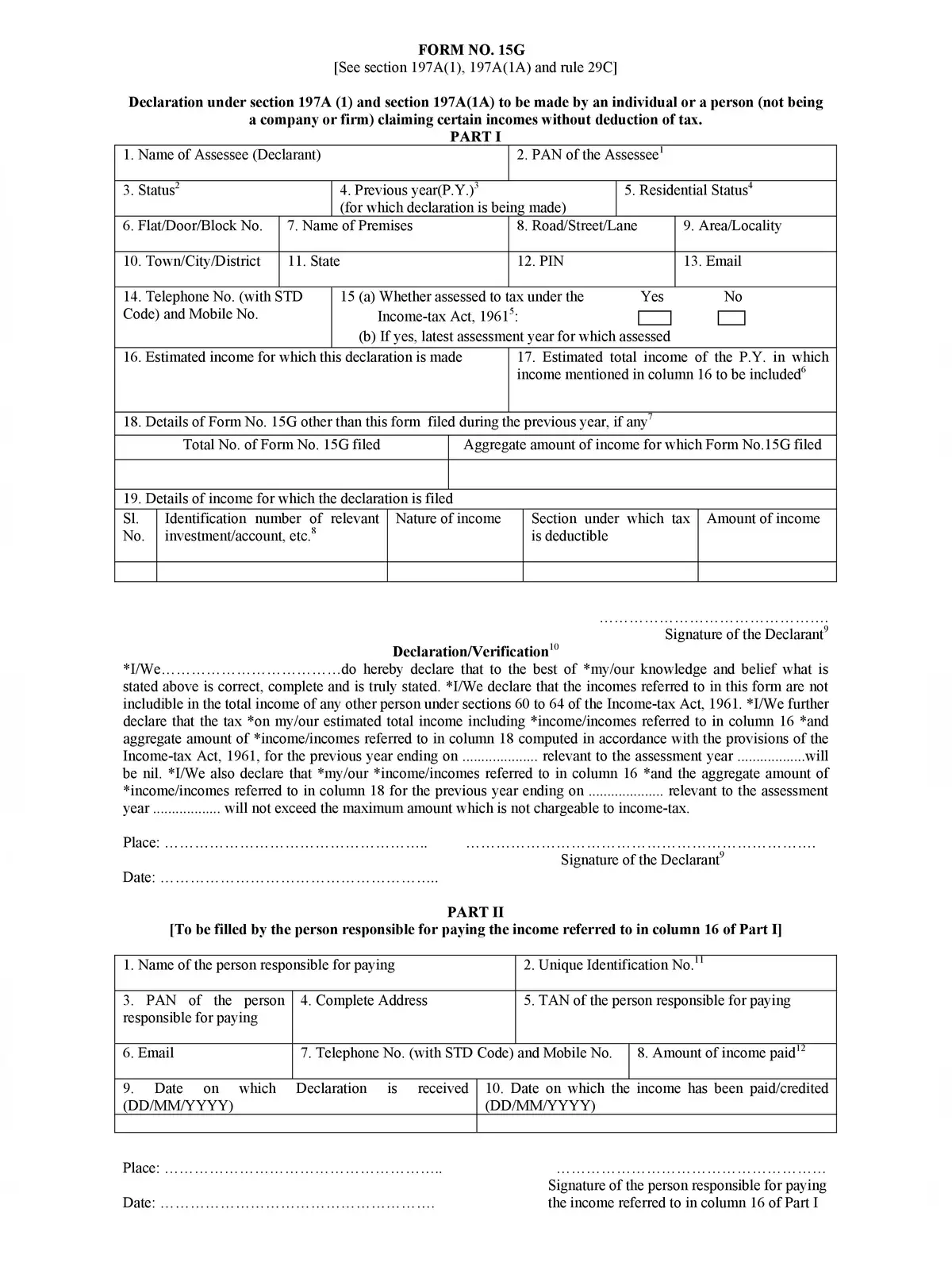

The Canara Bank 15G Form is a vital declaration that individuals under 60 years old and HUF can fill out to prevent TDS (tax deduction at source) on their interest income for the fiscal year. This form is crucial for anyone looking to save tax on their interest earnings and ensure they receive the full amount without deductions.

Understanding TDS and EPF Withdrawals

When it comes to EPF (Employee Provident Fund) withdrawals, it’s important to know that if your contribution period is less than 5 years and the withdrawal amount exceeds ₹50,000, TDS will be deducted at a rate of 10%. Remember, withdrawing from EPF before the completion of 5 years makes it taxable, which can impact your financial planning.

How to Download the Canara Bank 15G Form

You can easily download the Canara Bank 15G Form in PDF format using the link below. Having this form ready will help you avoid TDS deductions on your interest income. Just click the link and follow the steps to download it!