Citibank Loan Application Form - Summary

Suppose you are a Citibank of Suvidha customer. Getting a Citibank Loan Application Form for a Personal Loan is very easy. You can simply log into your Citibank Online account to start the process. After sending us an online application, you can have a conversation with a Citi Phone officer for assistance.

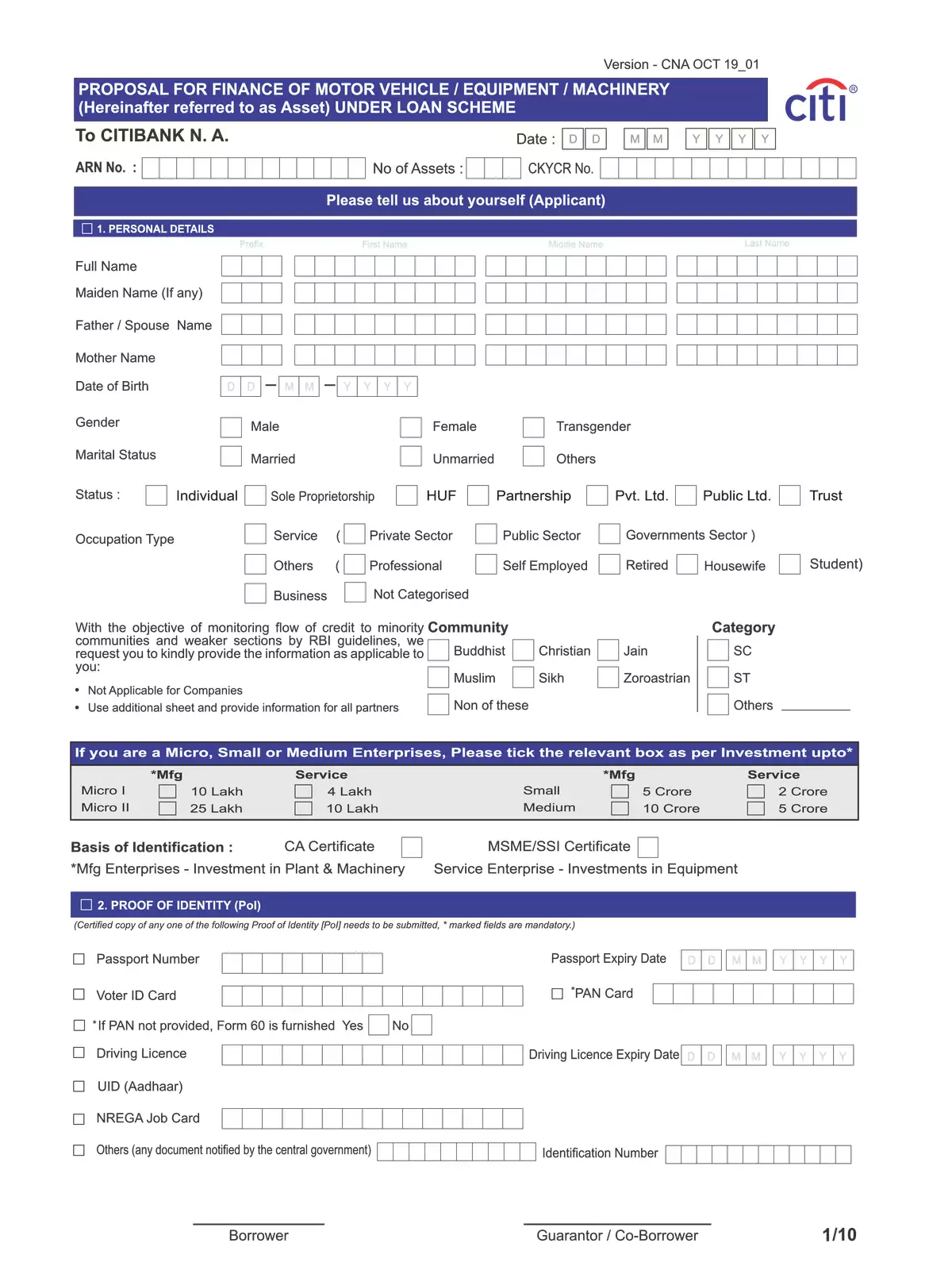

The process for securing a Citibank personal loan is made simpler with minimal documentation and fast-track application processing.

Documents Required for Citibank Personal Loan

To apply for a Citibank personal loan, you need some important documents. If you are a salaried individual, required ID proofs include your PAN Card, Aadhaar Card, Driving License, Voter’s ID, and Passport photographs. For self-employed individuals, you will need a PAN Card, Trade License, Driving License, Voter’s ID, Passport, and photographs.

Why Choose Citibank Personal Loan?

Citibank personal loans are a great option for many reasons. Let us highlight some key features and benefits of Citibank personal loans:

- Loan amounts available up to Rs.30 lakh.

- Quick disbursal in just 48 hours.

- Option for part pre-payment facility.

- Attractive interest rates starting from only 10.50% p.a.

- Minimal documentation required for existing Citibank customers.

- Flexible repayment options available, ranging from six months to 60 months.

To download the Citibank Loan Application Form PDF, you can follow the link provided below.