Form 3CA Rule 6G(1)(a) - Summary

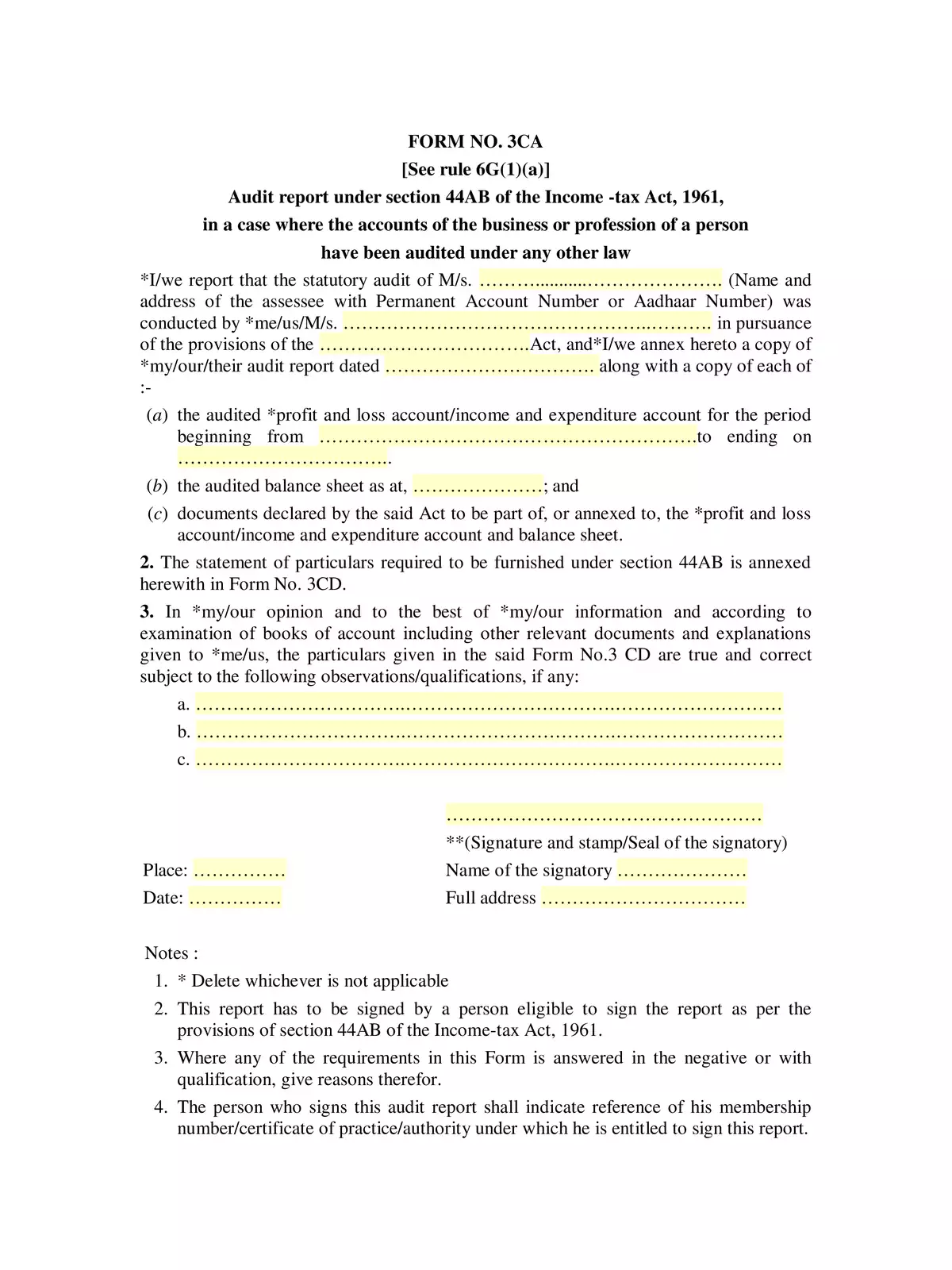

This is an important Audit report Form, known as Form 3CA Rule 6G(1)(a), which is required under section 44AB of the Income-tax Act, 1961. It applies in situations where a person’s business or professional accounts have already been audited under any other law. In such cases, a Chartered Accountant (CA) must furnish this report. This ensures compliance with tax regulations and provides clarity about the financial state of the business.

Understanding Form 3CA

Form 3CA serves as proof that the audit has been carried out and confirms the honesty of the financial records. It is necessary for those who want to complete their tax obligations and avoid any penalties. Filling out this form correctly is crucial for smooth processing.

Why You Need This Form

Having Form 3CA helps verify that your accounting practices are transparent and trustworthy. It also aids in providing essential documentation if required by tax authorities. Remember, if you want to have a good standing with tax officials, timely submitting this form can save you from issues later on.

To help you further with this information, we have a detailed PDF available for download. Make sure to check it out for a complete understanding of Form 3CA and its requirements!