Income Tax Form 15CA - Summary

Understanding Income Tax Form 15CA

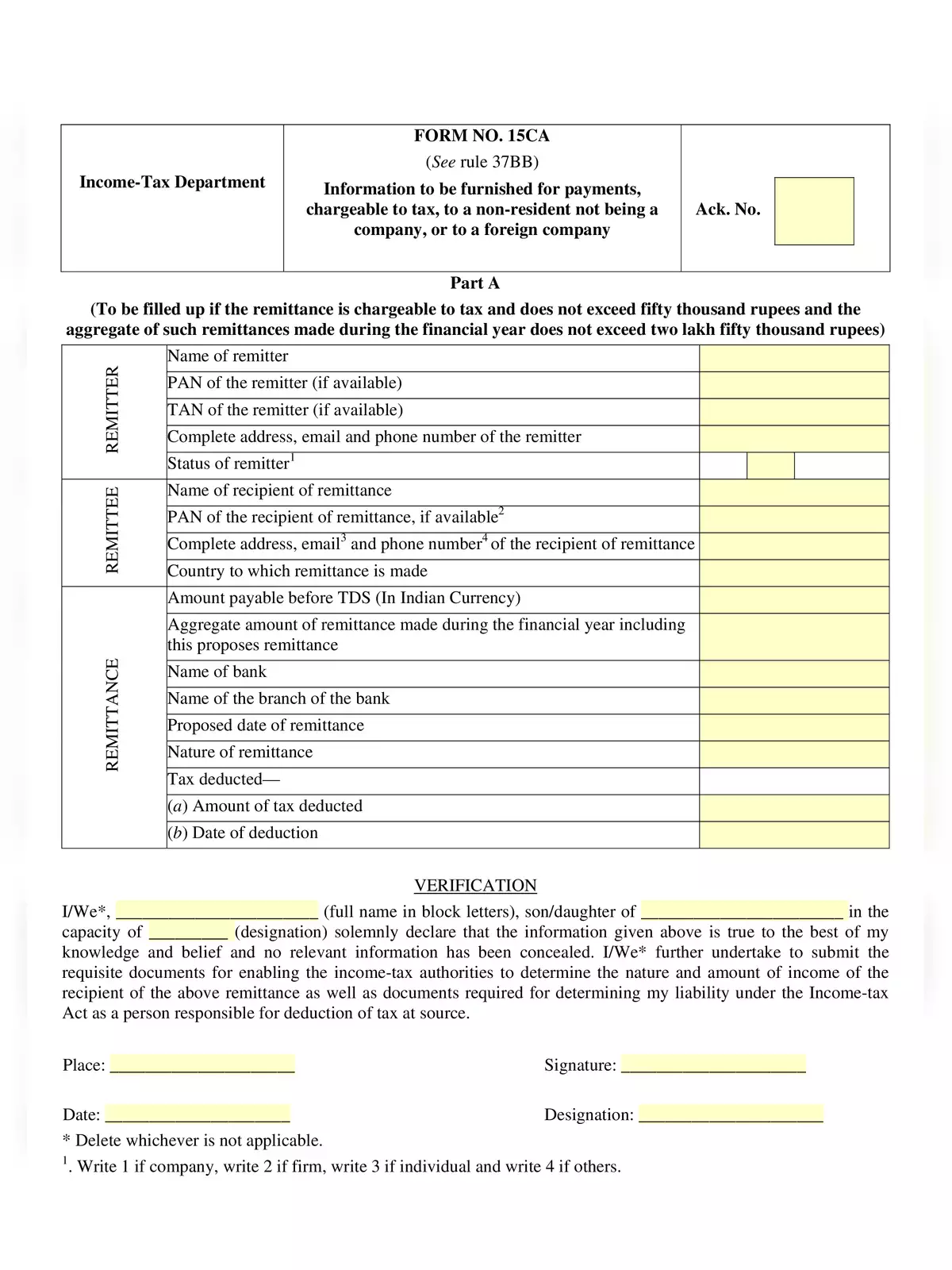

Income Tax Form 15CA is an important declaration made by a remitter. This essential document helps gather key information about payments that have tax implications for a recipient who is a non-resident. By accurately filling out this Form, the Income Tax Department can effectively track foreign remittances and understand their tax consequences.

Why Form 15CA is Important

Filing Income Tax Form 15CA is crucial because it ensures that all international payments are reported correctly. This diligence supports both the payer and the recipient in adhering to the rules and regulations laid down by the Income Tax Department.

Whenever individuals or businesses plan to send money to non-residents, they must complete this Form. It acts as a protective measure against tax evasion and guarantees that the correct amount of tax is collected on such payments. This is especially vital for transactions concerning services, royalties, or interest that may be earned overseas.

It is also important to understand that not submitting Form 15CA correctly or on time can result in penalties or legal hassles. Thus, being thorough in this process can save both time and potential difficulties in the future.

As part of this declaration process, the individual making the payment must also submit Form 15CB. This certificate is issued by a Chartered Accountant and verifies the details provided in Form 15CA.

In conclusion, understanding and submitting Income Tax Form 15CA is essential for everyone making payments to a non-resident. This Form facilitates smooth processing and transparency in tax-related matters, ensuring compliance with the law.

For more detailed guidance, you can download the PDF available below. It contains all the necessary information you need to complete and file Income Tax Form 15CA accurately.