House Rent Reciept - Summary

Understanding the Importance of a House Rent Receipt

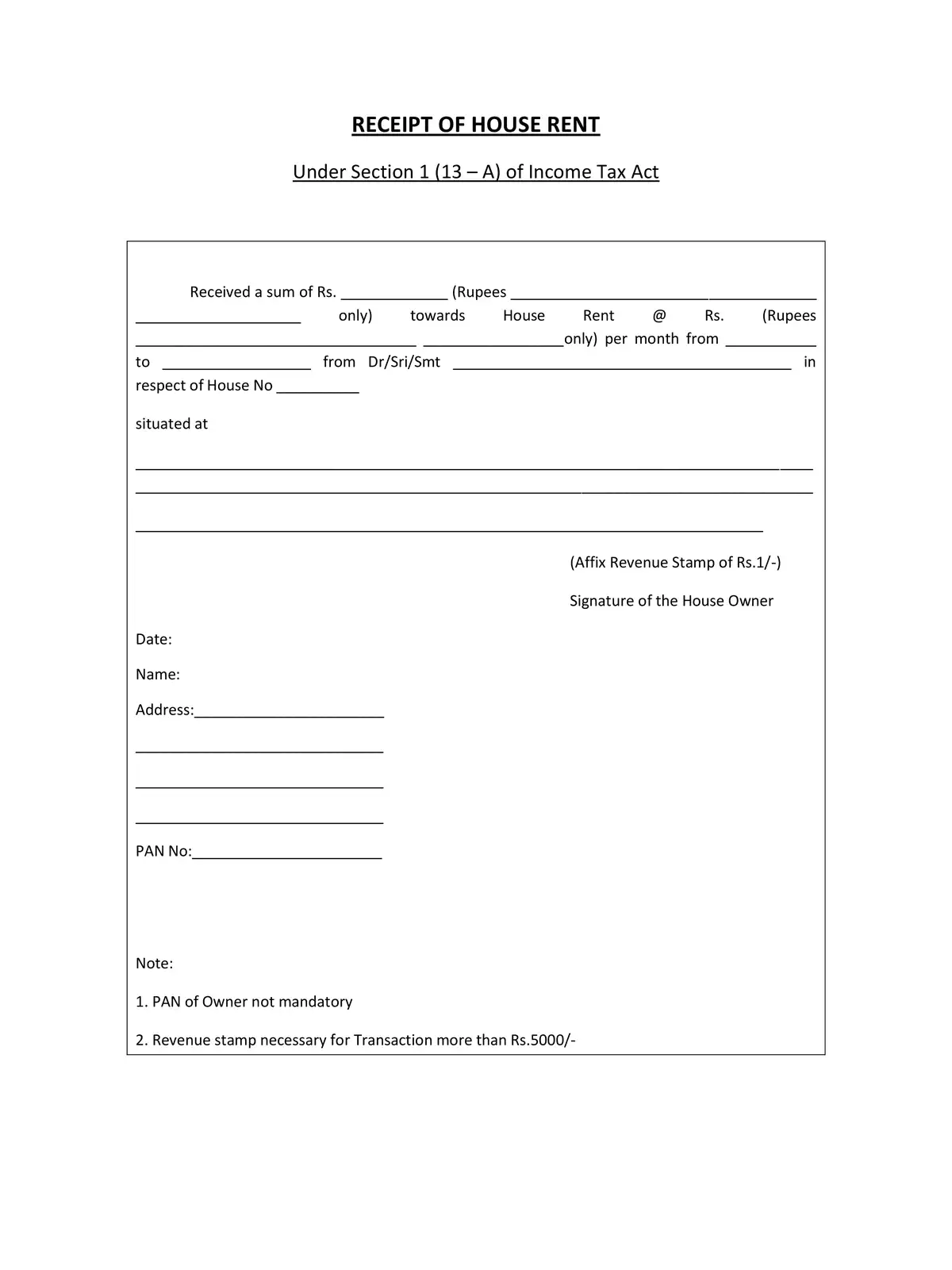

A house rent receipt is essential for employees receiving HRA above Rs 3,000. This document serves as proof of rent paid and is crucial for tax deductions. Most employers request these receipts on a quarterly basis; however, employees also have the option to submit them monthly.

It is important to note that if the rent payment exceeds Rs 5,000 in cash, then affixing a revenue stamp on the rent receipt is mandatory. This ensures that the transaction is recorded officially and can be referenced in future tax assessments.

Employers and employees alike should understand the significance of having accurate and timely house rent receipts. Not only do they facilitate the proper claiming of deductions, but they also help in maintaining clarity and transparency in financial transactions.

For ease of access and improved understanding, individuals looking to manage their housing finances can download the relevant documents in PDF format. This will help streamline processes around house rent receipts and ensure compliance with tax regulations. 📄💰

For those who want to avoid last-minute hurdles, it’s advisable to keep a systematic record of these receipts throughout the year. This way, when tax season arrives, everything is organized and readily available for review.

Maintaining these records can save employees significant amounts of money in HRA exemptions, so consider prioritizing them. With the appropriate documentation, employees can feel assured that their financial rights are protected. 🌟

In summary, a house rent receipt is not merely a piece of paper but a fundamental part of any employee’s financial toolkit. Proper adherence to these receipt requirements can lead to greater financial well-being. 🏠