PNB 15G Form - Summary

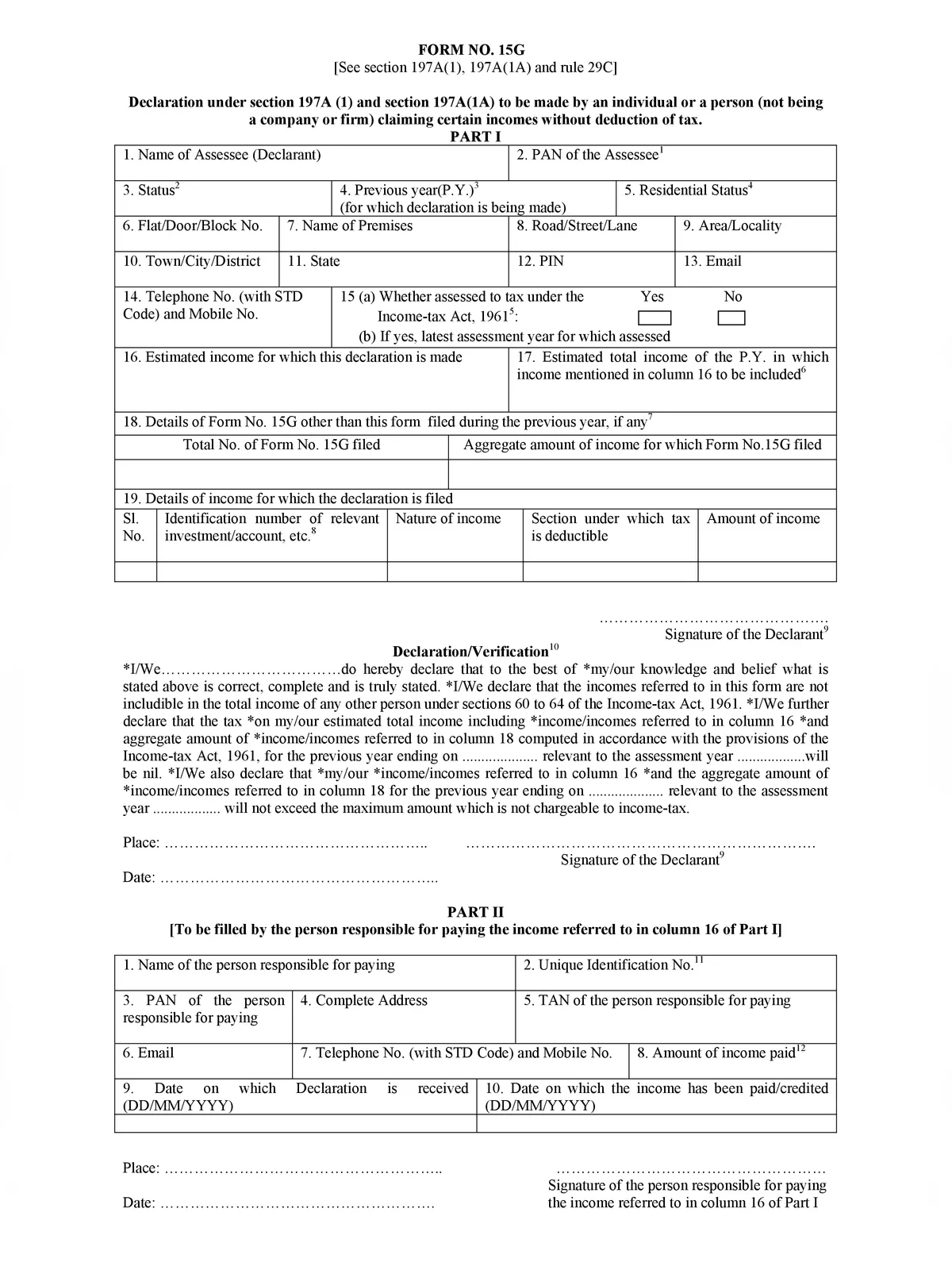

Hello, Friends today we are sharing with you PNB 15G Form PDF to help all of you. If you are searching PNB 15G Form in PDF form then you can download it from the official website www.pnbindia.in or it can be directly downloaded from the link given at the bottom of this page. Form 15G and Form 15H are self-declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit.

Form 15G is a self-declaration form for seeking non-deduction of TDS on specific income as an annual income of the tax assessee is less than the exemption limit. The rules for this specific self-declaration form are mentioned under the provisions of Section 197A of the Income Tax Act, 1961. Form 15g PNB PDF must be filled by the Individual or a person other than a company for the applicable Financial Year. Your age should be 60 years or less. Tax liability calculated on the total taxable income for the Financial year is zero.

PNB 15G Form Highlights

| Type of Form | Form 15G |

| Name of Bank | Punjab National Bank |

| Official Website | https://www.pnbindia.in |

| Uses of Form | Non-Deduction of TDS on Fixed Deposit |

| Beneficiary | Bank Customers |

| Form Language | English, Hindi |

| Form Download Link | Download PDF |