Pashu Kisan Credit Card (PKCC) Scheme Guidelines - Summary

The Pashu Kisan Credit Card (PKCC) Scheme is designed to double farmers’ income through livestock, and the Haryana Government is committed to reaching 1 lakh farmers by Independence Day. Amid the corona crisis, the government is putting in great efforts for the upliftment and welfare of farmers.

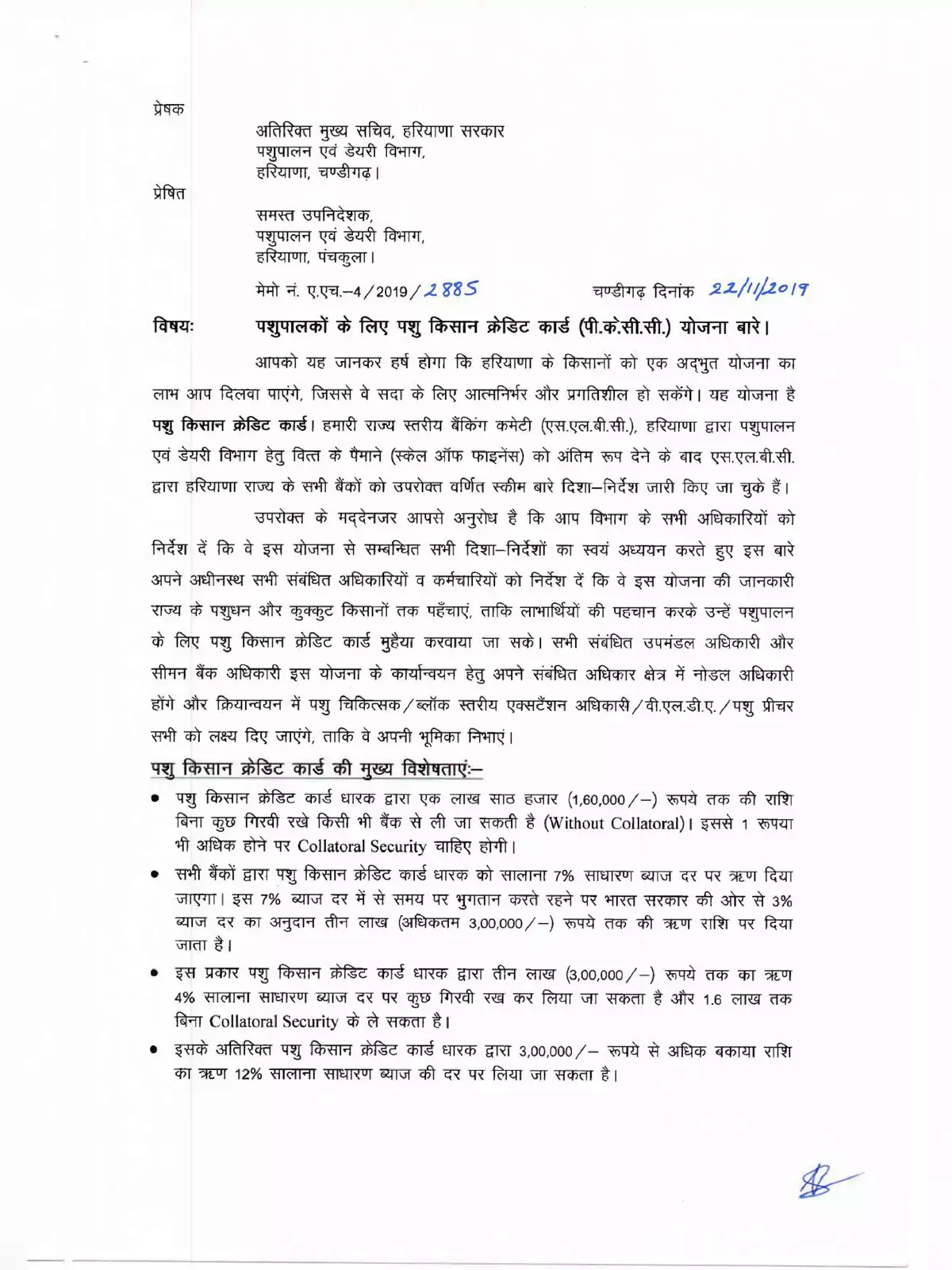

Loan Benefits Under the PKCC Scheme

This scheme offers loans to farmers for purchasing animals. Farmers can receive a loan of Rs 40,783 for cows and up to Rs 60,249 for buffaloes.

The Rs 40,783 loan is issued through credit cards in 6 equal installments of Rs 6,797 per month. This amount needs to be repaid at a 4% annual interest rate within one year. The repayment period starts from the day the first installment is received.

Interest Rate and Subsidies

Farmers can access loans under the PKCC Scheme at an interest rate of 7%. The central government provides a subsidy of 3%, while the Haryana government gives rebates on the remaining 4% interest. A maximum loan amount of Rs 3 lakh is available to eligible farmers.

Farmers holding an animal credit card can avail up to Rs 1.60 lakh without needing any collateral security. This means there is no requirement for a guarantee!

For additional information, you can easily download the Pashu Kisan Credit Card (PKCC) Scheme Guidelines in PDF format using the link provided below. Don’t miss this chance to get all the details you need to benefit from this wonderful scheme!