Pradhan Mantri Mudra Loan Application Form SBI - Summary

This is a Pradhan Mantri Mudra Loan application form SBI aimed at helping businesses expand their capabilities and modernize operations. You can easily download the PDF of this form from the link provided below. The State Bank of India (SBI) Mudra Loan is part of a special loan scheme designed for Micro, Small & Medium Enterprises (MSMEs), organized by the Micro-Units Development and Refinance Agency (MUDRA). This initiative plays a vital role in supporting small businesses and enabling their growth.

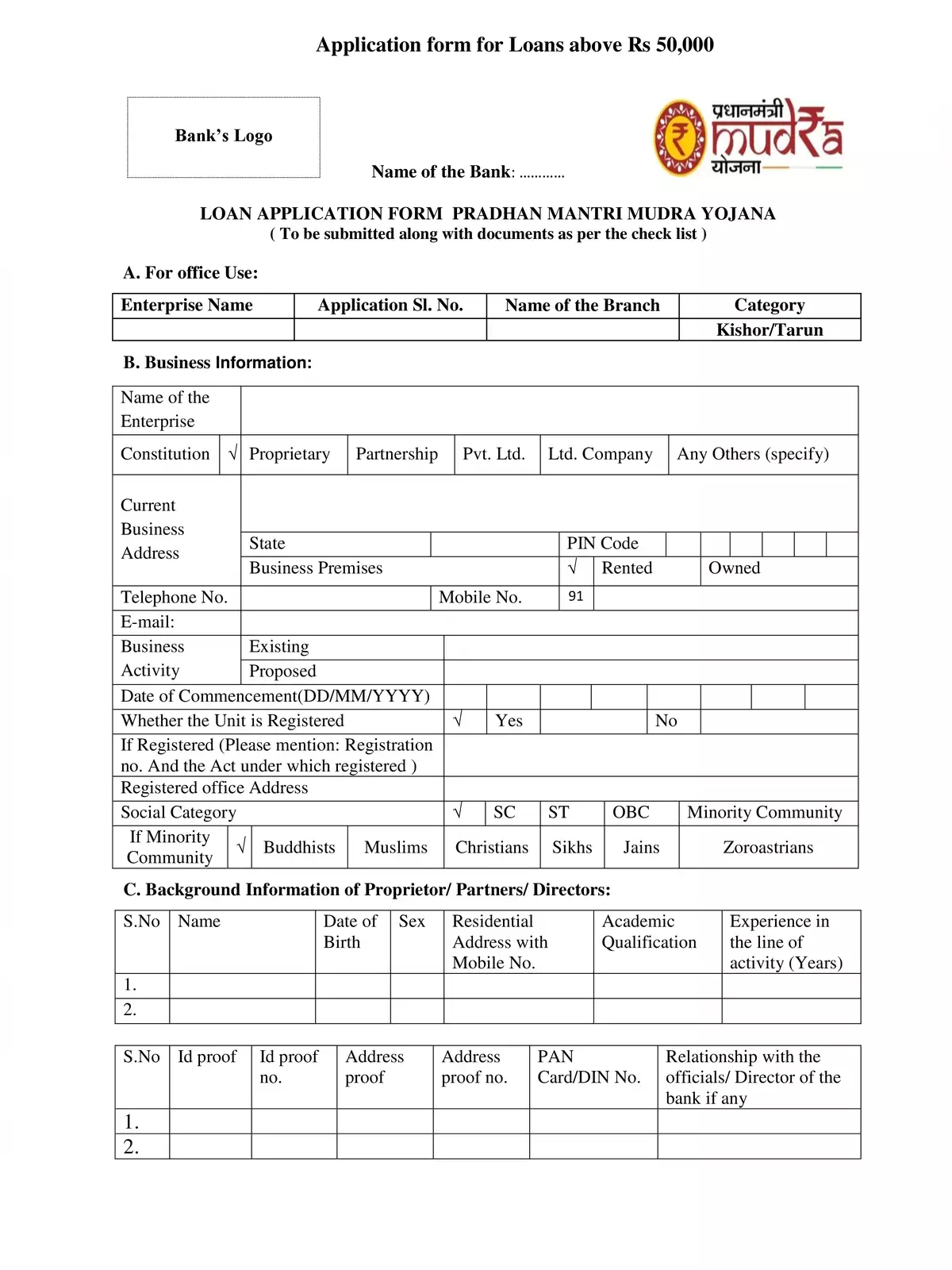

Loan Details and Categories

The Pradhan Mantri Mudra Loan comes in different categories and amounts to meet various business needs. Here are the important details:

Quantum of the loan (Min/Max)

- Maximum loan amount: Up to Rs 10 lacs

- Loans up to Rs.50,000 are categorized as SHISHU

- Loans from Rs.50,001 to Rs.500,000 are categorized as KISHORE

- Loans from Rs.500,001 to Rs.10,00,000 are categorized as TARUN

The loans under the MUDRA Scheme benefit from the Credit Guarantee for Micro Units (CGFMU), which is facilitated through the National Credit Guarantee Trustee Company (NCGTC). This guarantee cover is available for a period of five years, allowing for Mudra Scheme loans to have a maximum repayment term of up to 60 months.

To make applications easier, leads are now available on the Udyami Mitra Portal (www.udyamimitra.in). Branches can access this site using their Username and Password. Additionally, all branches will issue a MUDRA RuPay Card for all eligible CC accounts.

SBI Mudra Loan Apply Online

If you’re eager to apply for the SBI Mudra Loan online, follow these straightforward steps:

- Firstly, visit the official website of SBI bank at SBI Website.

- Next, fill in the personal details of the applicants.

- Make sure to provide the applicant’s Aadhaar card for e-KYC purposes through UIDAI. The e-KYC and e-sign must be completed using OTP authentication for smooth loan processing and disbursement.

- After finishing the loan formalities, the applicant will receive an SMS to start the next steps by returning to the e-MUDRA portal.

- This entire process should be completed within 30 days after receiving the loan sanction SMS. 📄

Always remember, accurately filling out your application and submitting the required documents can significantly speed up your loan approval process. For more information, don’t forget to download the PDF!