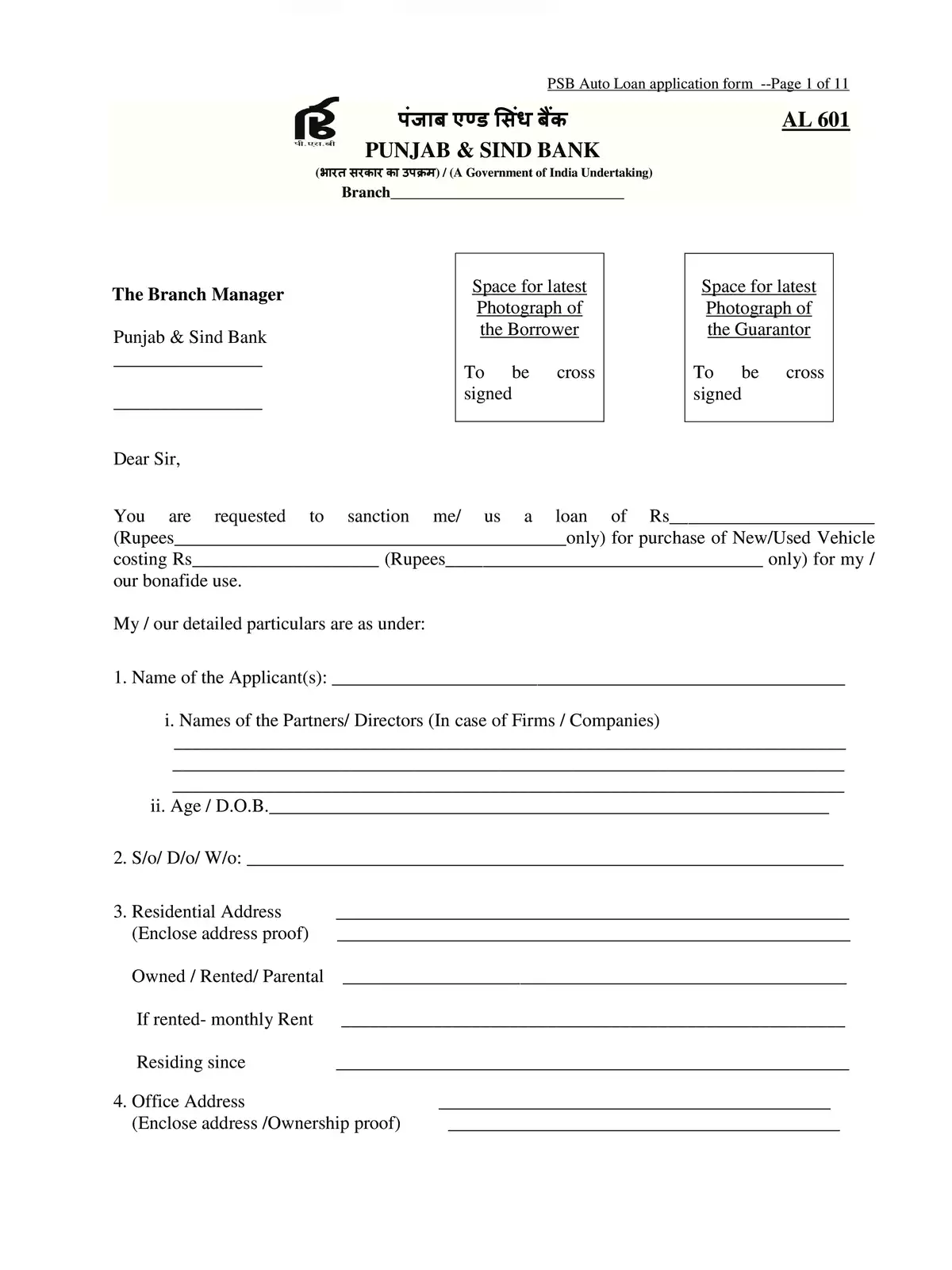

PSB Auto (Vehicle) loan Application Form - Summary

DOCUMENTS REQUIRED FOR PSB AUTO LOAN

If you’re planning to apply for a PSB auto loan, it’s important to collect the necessary documents for a hassle-free application process. The following is a comprehensive list of the documents required for your vehicle loan application. This guide will help you prepare everything you need to ensure your loan is approved successfully.

Essential Documents for Your PSB Auto Loan Application

- For New Vehicle – Proforma Invoice of the Vehicle.

- For Old Vehicle – Offer letter from the seller, valuation from authorized workshop, copy of old RC, and running insurance copy.

- ID Proof of the applicant(s) and guarantor(s), including partners/directors for corporate applicants.

- Two photographs each of the applicant(s) and guarantor(s).

- Address proof of the applicant(s) and guarantor(s).

- The latest copy of the telephone bill (landline or postpaid connection at residence and business place).

- Copy of PAN/TAN number.

- Copy of Aadhaar card.

- Copy of driving license.

- Copy of IT assessment order/IT returns along with computation (Form no. 16 for salaried class) for the last three years.

- Last two months’ salary certificates for salaried class, including deductions, joining date, date of superannuation, and permanency of employment. For pensioners, provide copy of PPO.

- For businessmen or professionals, latest ITR for assessment of repayment capacity. For other cases, any authentic document that satisfies the branch manager’s requirement justifying the repayment capacity.

- Bank statement for the last three months, where salary income is credited for individual applicants and bank statement for the last six months for applicants other than individuals, where business income is credited along with account details (account number and nature of account, date of opening the account).

- Assets and liabilities statement on the prescribed format for individual applicants. Last three years’ financial statements for applicants other than individual applicants.

- Partnership deed for partnership firms, Memorandum of Association, Article of Association, and board resolution for joint stock companies.

- A cheque for the processing fee and one cancelled cheque of the account from which the EMI (Post Dated Cheques) will be given (for signature verification). PDC/ECS instructions for required EMIs should be obtained from an account where salary/business income is credited in all cases. In case of ECS instructions, one undated cross cheque favoring PSB loan account number and name (of the borrower) should be taken. A stamped undertaking from the borrower that they will not revoke the ECS instructions till the currency of the bank loan must also be obtained.

- For take-over cases, a statement of the loan account since inception needs to be submitted.

- Charges & fees: The current charges can be obtained from the branch in charge or the bank’s website.

Get Ready to Download Your PSB Auto Loan PDF

By gathering these documents, you are one step closer to applying for your PSB auto loan. Make sure to download the PDF version of this document list for easy reference. Visit the link below for your PDF download and keep all your paperwork ready for a smooth application experience! 🚗