NPS Contribution Instruction Slip - Summary

Instructions for NPS Contribution Slip (PDF Download)

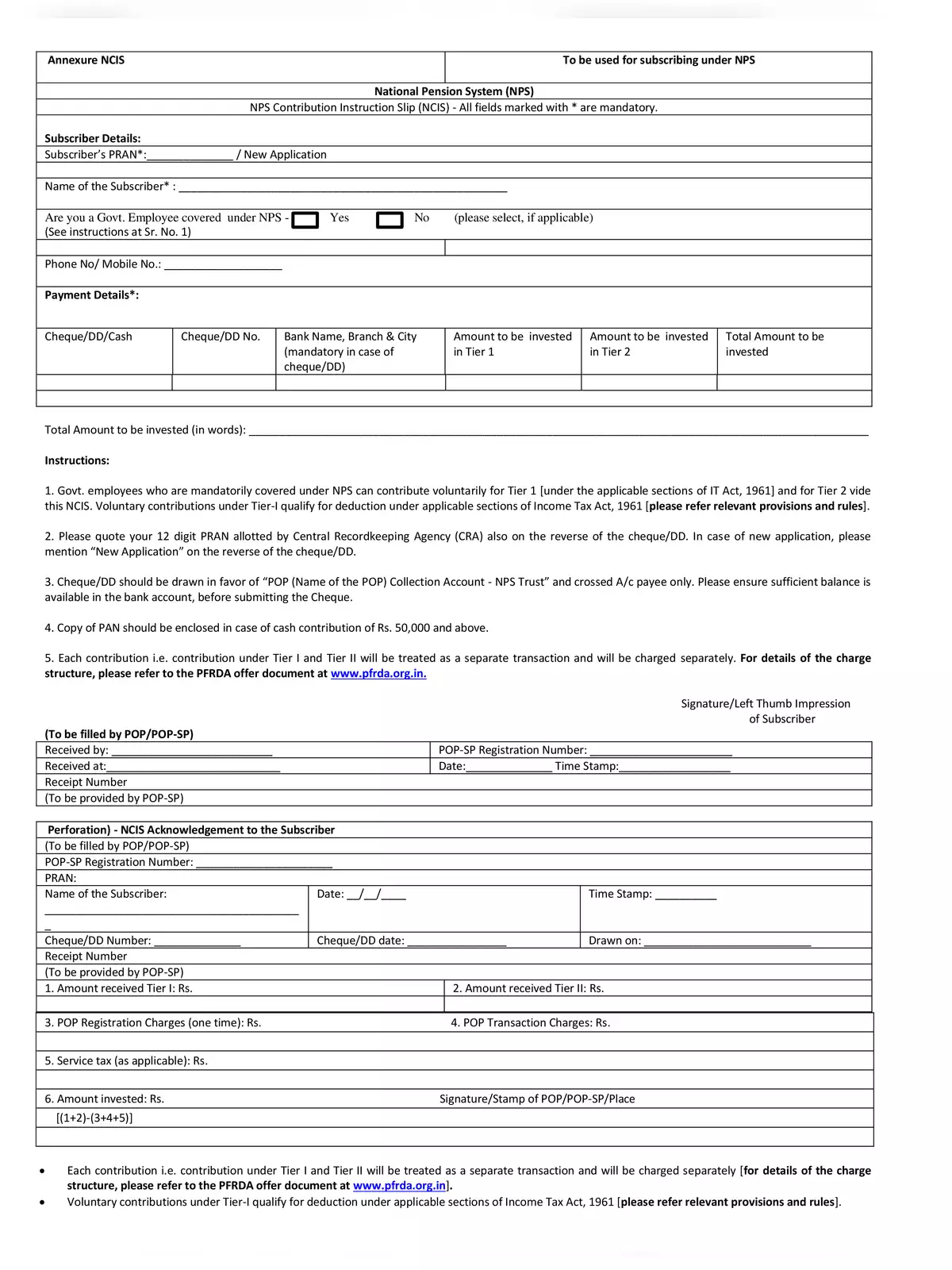

NPS Contribution Instruction Slip provides essential guidance for making contributions under the National Pension System (NPS). It’s important for government employees, as they are mandatorily covered under NPS, to know that they can make voluntary contributions for Tier 1 and Tier 2 as outlined in this document. Voluntary contributions made under Tier-I are eligible for deductions under the Income Tax Act, 1961 [please refer relevant provisions and rules]. You can download the PDF for more insights.

Guidelines for Contributors

- Please quote your 12-digit PRAN allotted by the Central Recordkeeping Agency (CRA) on the reverse of the cheque or Demand Draft (DD). If you are submitting a new application, kindly mention “New Application” on the reverse of your cheque/DD.

- Ensure that your Cheque/DD is drawn in favour of “POP (Name of the POP) Collection Account – NPS Trust” and it must be crossed as A/c payee only. Always check that there is sufficient balance in your bank account before you submit the Cheque.

- If you are making a cash contribution of Rs. 50,000 or above, it is necessary to enclose a copy of your PAN.

- Each contribution, whether it is under Tier I or Tier II, is treated as a separate transaction and will incur charges accordingly. For detailed information on the charge structure, please refer to the PFRDA offer document at www.pfrda.org.in.

Your Next Steps

Understanding these instructions is crucial for a smooth contribution process. Feel free to download the PDF for an easy reference whenever you need it! 😊