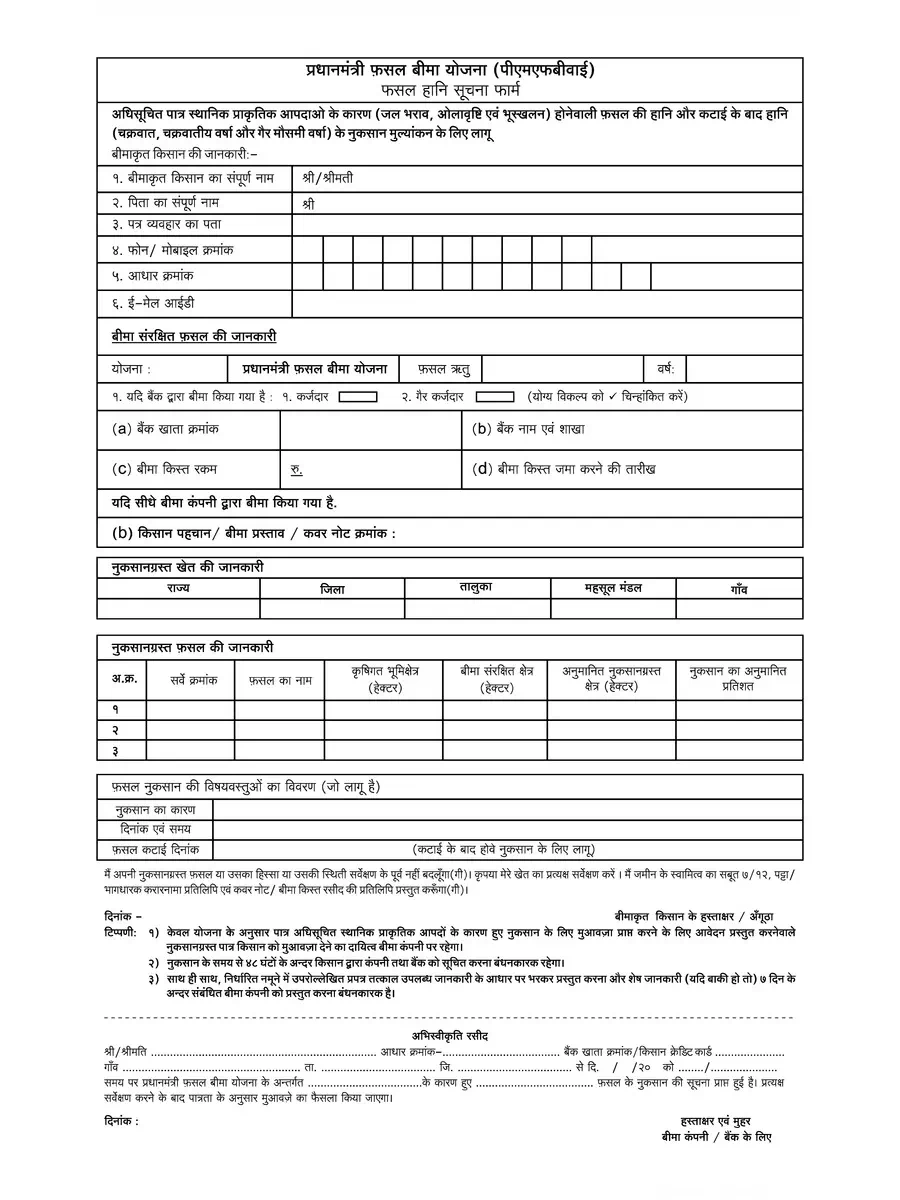

PMFBY Claim Form ICICI Lombard - Summary

Download the PMFBY Claim Form ICICI Lombard in PDF format today! The PMFBY (Pradhan Mantri Fasal Bima Yojana) provides essential insurance cover for farmers, offering immediate financial relief during adverse seasonal conditions that can affect crops, such as floods, long dry spells, severe drought, and more. If the expected yield during the season is likely to be less than 50% of the Normal Yield, farmers can easily claim support.

Key Features of the PMFBY Claim Form ICICI Lombard

This insurance scheme is crafted to protect farmers, ensuring they can bounce back from unexpected losses. The PMFBY Claim Form ICICI Lombard is vital for farmers who want to receive their entitled benefits and support without hassle.

Eligibility Criteria for PMFBY Claim Form ICICI Lombard

Eligibility Criteria: All notified Insurance Units (IUs) will be eligible for the “ON ACCOUNT” payment only if the expected yield of the affected crop during the season is less than 50% of the Normal Yield.

The assessment of possible losses and the amount of ‘on-account’ payment is determined through a joint survey by the Insurance Company and State Government officials. To qualify for financial support under this scheme, farmers must ensure that they have paid their premium or that it has been debited from their account before the State Government issues the damage notification. This notification is crucial for invoking compensation provisions.

Moreover, banks must ensure that farmers’ premiums are debited within 15 days from the sanction or renewal of their Kisan Credit Card (KCC) or crop loan. If banks fail to do this, they will be responsible for meeting the claim liabilities of eligible farmers who are not covered. The payable amount will be 25% of likely claims, subject to adjustments against final claims.

Don’t wait any longer! Download the PMFBY Claim Form ICICI Lombard in PDF format using the link provided below to secure your claims and protect your farm’s future. 📄