Post Office NPS Contribution Slip - Summary

Govt. employees looking to make Post Office NPS contributions can do so for Tier 1 and Tier 2. This helps them save on taxes under the Income Tax Act, 1961. By contributing voluntarily, NPS account holders can maximize their retirement savings while enjoying tax benefits.

Understanding NPS Contributions

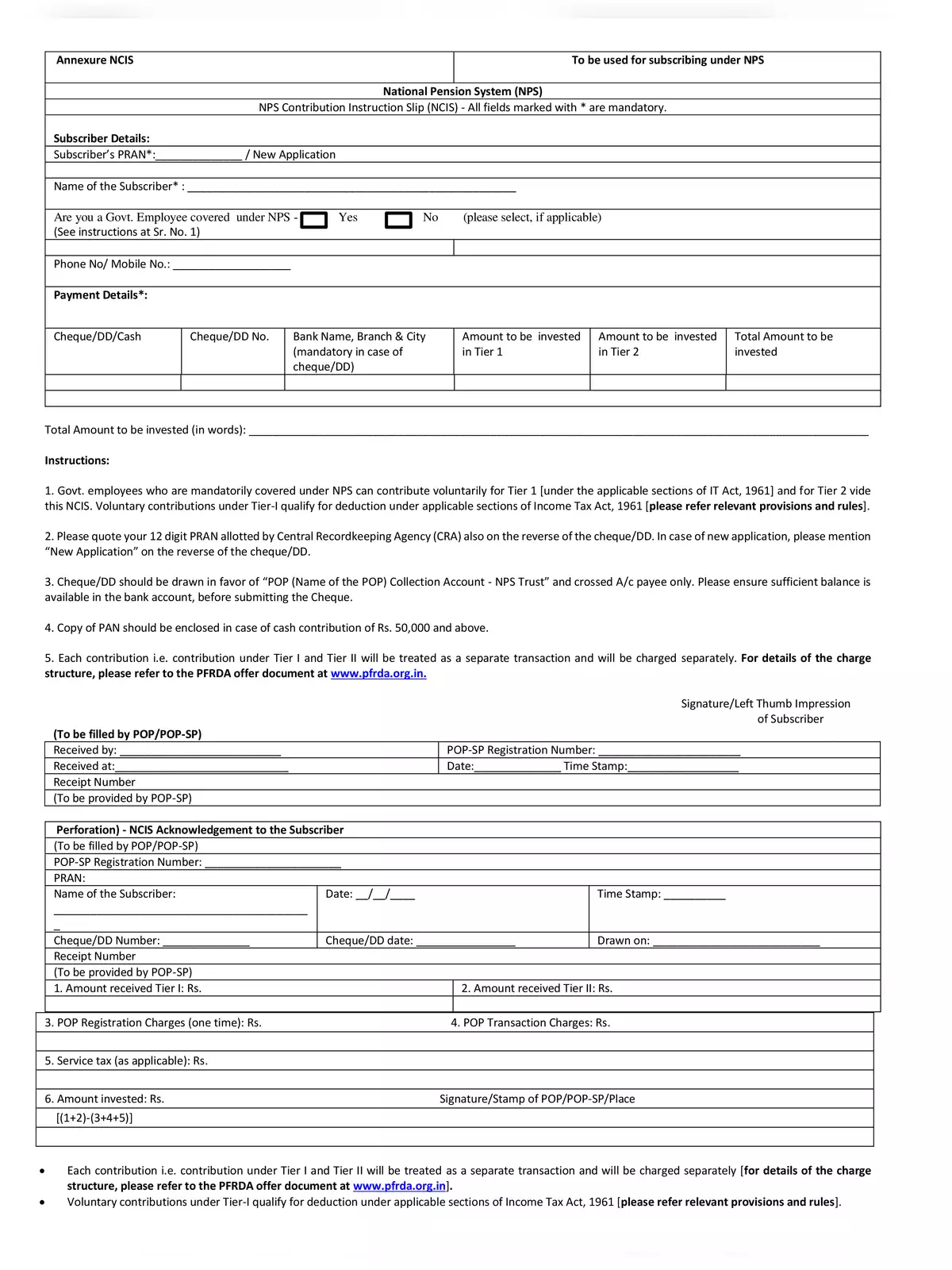

1. Govt. employees who are mandatorily covered under NPS can contribute voluntarily for Tier 1 [under the applicable sections of IT Act, 1961] and for Tier 2 vide this NCIS. Voluntary contributions under Tier-I qualify for deduction under applicable sections of Income Tax Act, 1961.

2. Please quote your 12 digit PRAN allotted by Central Recordkeeping Agency (CRA) also on the reverse of the cheque/DD. In case of a new application, please mention “New Application” on the reverse of the cheque/DD.

3. Cheque/DD should be drawn in favor of “POP (Name of the POP) Collection Account – NPS Trust” and crossed A/c payee only. Please ensure sufficient balance is available in the bank account before submitting the Cheque.

4. Copy of PAN should be enclosed in case of a cash contribution of Rs. 50,000 and above.

Download the Contribution Slip

You can easily download the Post Office NPS Contribution Slip in PDF format online from the link given below. This will make your contribution process smooth and simple.