Yes Bank KYC Form - Summary

Understanding the Yes Bank KYC Form

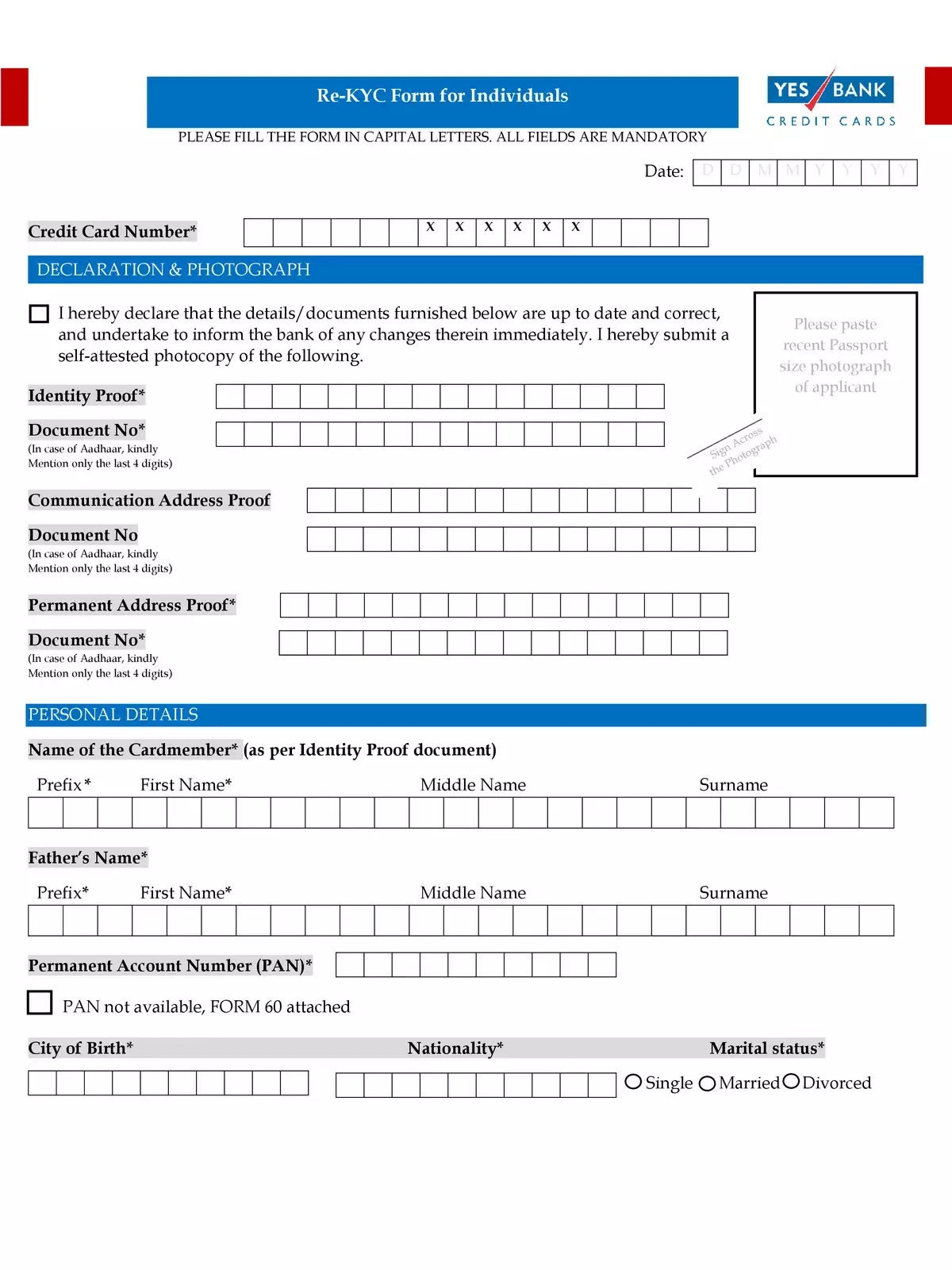

The Yes Bank KYC Form is important for identifying and verifying customers in the banking system. When you visit the bank, you will need to provide specific documents. These documents assist the bank in recognizing who you are and where you live. The KYC documents include two types: proof of identity and proof of address.

Types of KYC Documents Required

To complete your KYC process, you will need to submit particular documents. For proof of identity, acceptable options include your Aadhaar card, passport, or voter ID. It is essential to ensure that the document you present is valid and current. This helps the bank confirm your identity accurately.

For proof of address, you have various choices as well. You could show documents like your utility bill, rental agreement, or bank statement. These documents should clearly display your name and address, which aids the bank in processing your KYC form efficiently.

Importance of KYC

KYC, or Know Your Customer, is vital for banking security. It protects banks from fraud and ensures safer banking for everyone. By completing your KYC process, you help guarantee that the bank knows its customers. This not only protects you but also supports a secure banking environment.

To ease your banking experience, the Yes Bank KYC Form is quite handy. You can download the PDF of the KYC Form from the bank’s website, where it is easily accessible for you. This allows you to fill it out at your convenience. Regularly updating your KYC information is a good practice as it helps keep your banking records accurate and current.

Completing the Yes Bank KYC Form is a quick and essential step to accessing various banking services smoothly. Make sure to gather all required documents beforehand, so your KYC completion process goes as seamlessly as possible. Don’t forget to download the PDF and make your banking journey easier! 😊