Union Bank of India RTGS Form 2026 - Summary

Union Bank of India (UBI) RTGS form is used to transfer large amounts of money from one bank account to another in a quick and safe way. RTGS stands for Real Time Gross Settlement, which means the money is sent immediately to the receiver’s account without any delay. It is mainly used for transactions above ₹2 lakh and is perfect for urgent or business payments.

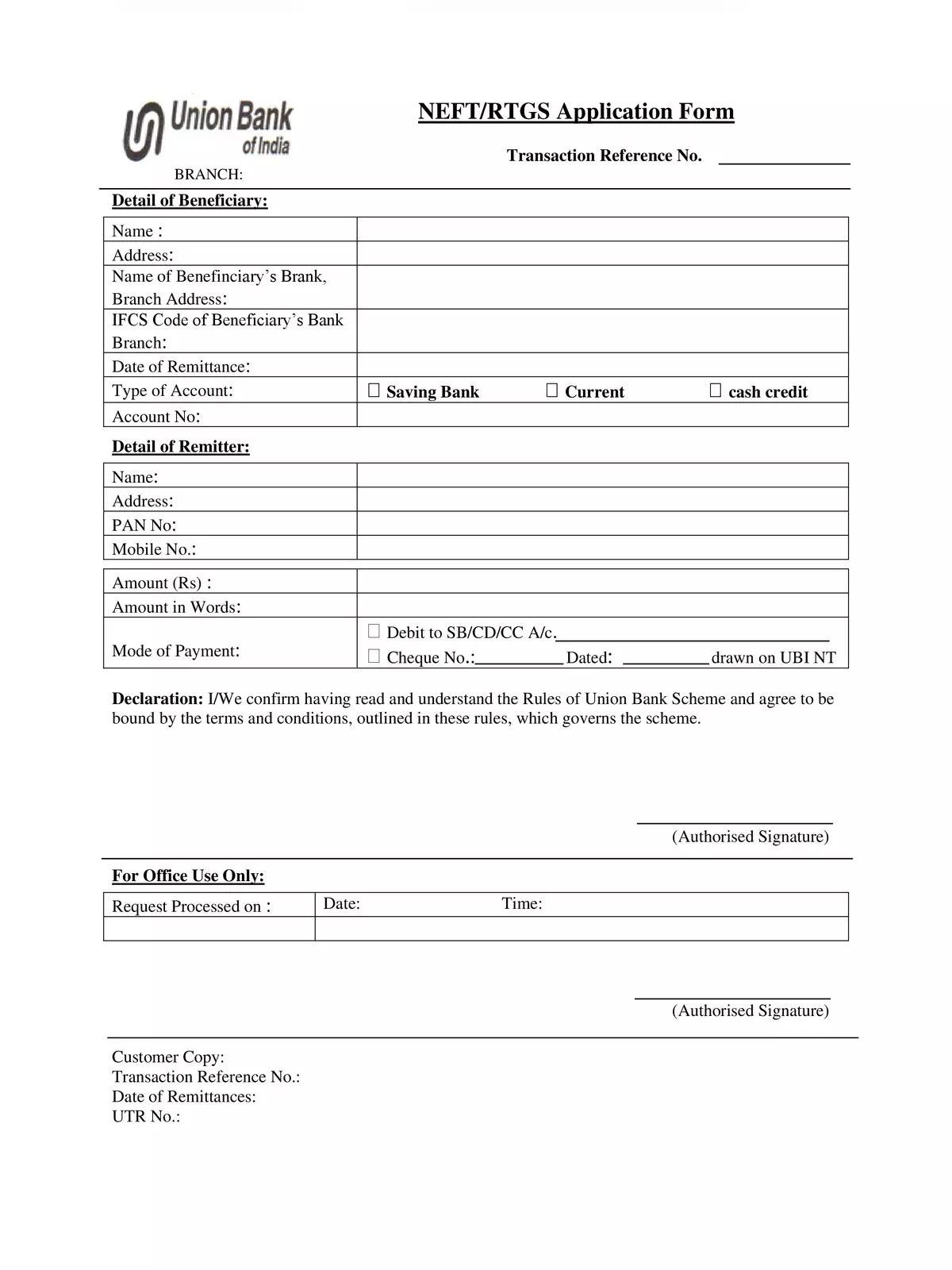

In the UBI RTGS form, you need to fill in details like your name, account number, branch name, and the receiver’s account number, bank name, IFSC code, and amount to be transferred. After you submit the form at the bank, the money is processed and credited to the receiver’s account in real time, ensuring a fast and secure transfer.

Union Bank of India RTGS (NEFT) Form

To use the Union Bank RTGS/NEFT form, you will need to provide key details such as the account number, IFSC code, and the amounts for both the payer and the payee. You must also attach a cheque leaf with this form when submitting it to your bank branch.

The RTGS payment system is overseen by the Reserve Bank of India (RBI), ensuring it is a safe and dependable way to send and receive money across India, anytime you need it. In fact, RTGS stands out as one of the quickest options available for funds transfer. Compared to NEFT, which can take some time for settlement, RTGS offers a very rapid method. The fees for RTGS transactions are quite reasonable, typically ranging from Rs. 25 to Rs. 55.

Essential Information Needed for an RTGS Transaction:

- The amount to be transferred in rupees

- Name of the payee/beneficiary as it appears in the bank account

- IFSC code of the payee/beneficiary’s bank

- Account number of the payee/beneficiary

- Name of the beneficiary bank and its branch