PMSBY Form - Summary

PMSBY Form PDF is an accidental insurance scheme that provides accidental death and disability coverage for one year, with an annual renewal. Pradhan Mantri Suraksha Bima Yojana provides life coverage of Rs. 2 lahks for accidental demise and permanent total disability and Rs. 1 lakh for permanent partial disability.

Pradhan Mantri Suraksha Bima Yojana is available to people in the age group 18 to 70 years with a bank account who give their consent to join/enable auto-debit on or before 31st May for the coverage period 1st June to 31st May on an annual renewal basis. Aadhar would be the primary KYC for the bank account.

PMSBY Form – Eligibility

The eligibility criteria for subscribing to Pradhan Mantri Suraksha Bima Yojana (PMSBY) are as follows:

- The minimum age requirement is 18 years.

- The maximum age requirement is 70 years.

- Those having a savings bank account and falling under the age group of 18 – 70 years are eligible to subscribe to the policy.

Pradhan Mantri Suraksha Bima Yojana (PMSBY) – PMSBY Form

The risk coverage under the scheme is Rs. 2 lakh for accidental death and full disability and Rs. 1 lakh for partial disability. The premium of Rs. 12 per annum is to be deducted from the account holder’s bank account through ‘auto-debit facility in one installment.

The scheme is being offered by Public Sector General Insurance Companies or any other General Insurance Company who are willing to offer the product on similar terms with necessary approvals and tie-up with banks for this purpose.

How to Enroll Pradhan Mantri Suraksha Bima Yojana (PMSBY)

- The subscriber can approach either one of the participating banks or insurance companies to subscribe to Pradhan Mantri Suraksha Bima Yojana.

- Most of the reputed banks allow subscribers to take the policy through internet banking. The subscriber will have to log in to the Internet banking account and enroll in the scheme.

- Subscribers can also send a message through their registered mobile numbers to the toll-free numbers of banks and insurance companies.

Termination of Suraksha Bima Yojana

There are certain situations when the policy account of the holder will be discontinued/terminated and no benefits would be paid thereafter. Following are those conditions:

- On attaining the age of 70 years.

- Due to insufficiency of balance in the saving account at the time of policy renewal in subsequent years.

- In case the subscriber is found to be covered by more than one saving bank account and the premium is being paid intentionally. Only one policy cover will remain active and other will be terminated and premium paid will be forfeited.

- If the cover is terminated in cases such as technical or administrative reasons, or due date, the cover can be reinstated on receipt of full annual premium.

How to Claim PMSBY Accident Insurance Scheme Benefits

PMSBY Scheme aims to cover death caused by accident and disability as confirmed by documentary evidence. This includes road, rail and vehicular accidents, drowning, death involving any crime (accident reported to police), snakebite, fall from a tree and other causes supported by immediate hospital record.

Download PMSBY Form in different languages from the following:–

| PMSBY Form in Different Languages | PDF Link |

| Hindi | PMSBY Form Hindi PDF |

| Telugu | PMSBY Form Telugu PDF |

| Tamil | PMSBY Form Tamil PDF |

| Odia | PMSBY Form Odia PDF |

| Bengali | PMSBY Form Bengali PDF |

| Gujarati | PMSBY Form Gujarati PDF |

Pradhan Mantri Suraksha Bima Yojana (PMSBY) Form

- Download PMSBY Certificate

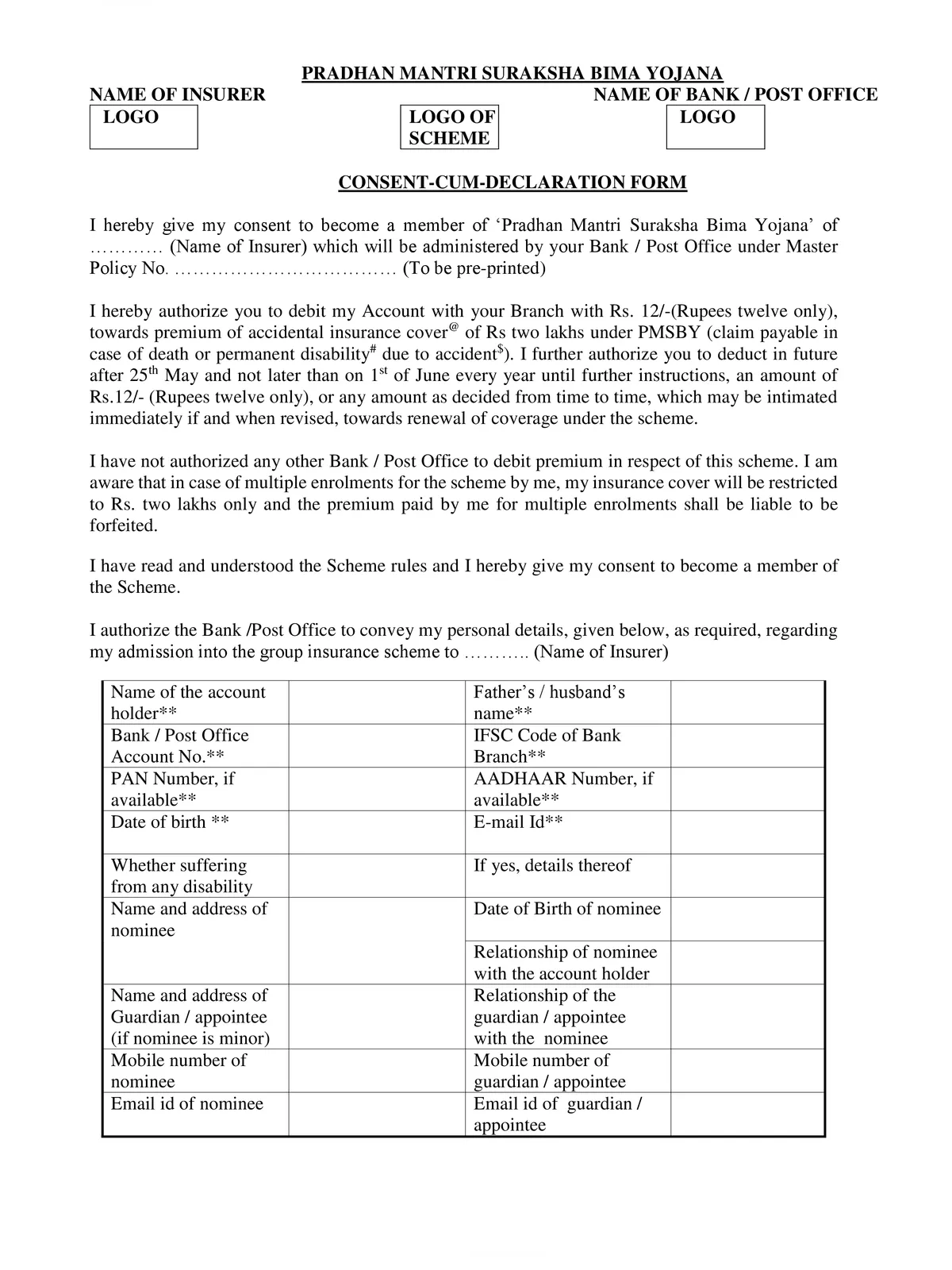

PMSBY Consent-Cum-Declaration

PMSBY Consent-Cum-Declaration  PMSBY Claim procedure

PMSBY Claim procedure PMSBY Claim-cum-discharge Form

PMSBY Claim-cum-discharge Form  Rules for PMSBY-Hindi

Rules for PMSBY-Hindi Rules for PMSBY – English

Rules for PMSBY – English

You can download the PMSBY Form in PDF format online from the link given below.