TDS Rate Chart for FY 2025-26 (AY 2026-27) - Summary

TDS means Tax Deducted at Source. It is a system where tax is cut at the time of making certain payments like salary, interest, rent, or professional fees. The person who pays is responsible for deducting this tax and giving it to the government. The rate of TDS depends on the type of payment, the person receiving it, and whether they are a resident or non-resident. To avoid penalties, TDS must be deducted correctly, deposited on time, and returns should be filed before the due date.

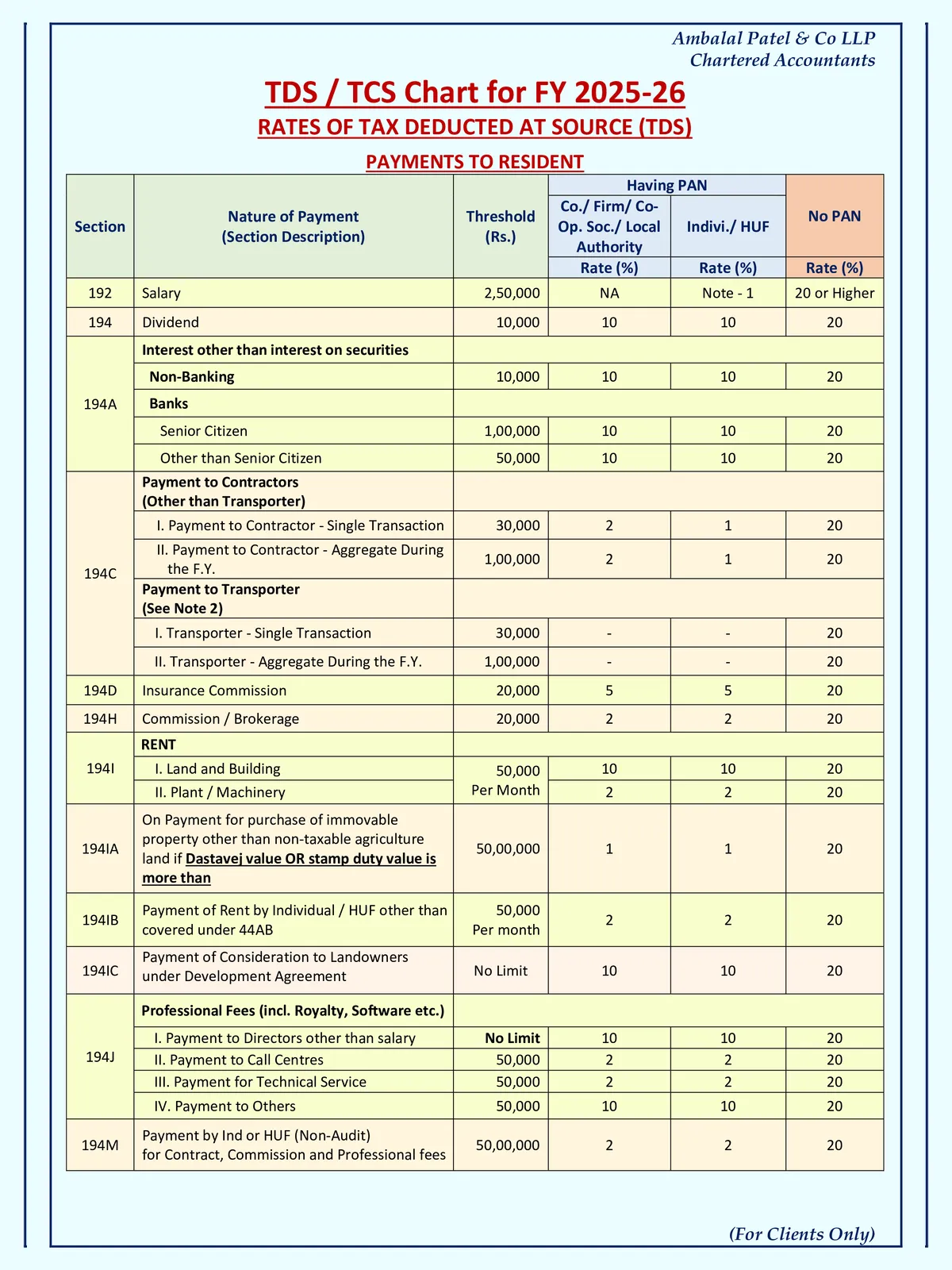

A TDS rate chart is a table that shows the tax rates for different types of payments along with the related sections and exemption limits. These rates change based on the nature of the payment, the person receiving it, and the total amount in a financial year. This chart helps people know how much TDS to deduct for each payment so that they follow the rules and avoid penalties. The chart below is updated as per Budget 2025 for FY 2025-26.

TDS Rate Changes FY 2025-26

The following are the changes made in TDS provisions with effect from 1st April, 2025.

- The government has changed threshold limit for TDS deduction for various sections. The relaxed threshold limits are as follows

| Section | Previous Threshold Limits | Modified Threshold Limits |

| 193 – Interest on securities | NIL | 10,000 |

| 194A – Interest other than Interest on securities | (i) 50,000/- for senior citizen; (ii) 40,000/- in case of others when payer is bank, cooperative society and post office (iii) 5,000/- in other cases | (i) 1,00,000/- for senior citizen (ii) 50,000/- in case of others when payer is bank, cooperative society and post office (iii) 10,000/- in other cases |

| 194 – Dividend, for an individual shareholder | 5,000 | 10,000 |

| 194K – Income in respect of units of a mutual fund | 5,000 | 10,000 |

| 194B – Winnings from lottery, crossword puzzle Etc. & 194BB – Winnings from horse race | Aggregate of amounts exceeding 10,000/- during the financial year | 10,000/- in respect of a single transaction |

| 194D – Insurance commission | 15,000 | 20,000 |

| 194G – Income by way of commission, prize etc. on lottery tickets | 15,000 | 20,000 |

| 194H – Commission or brokerage | 15,000 | 20,000 |

| 194-I – Rent | 2,40,000 (in a financial year) | 6,00,000 (in a financial year) |

| 194J – Fee for professional or technical services | 30,000 | 50,000 |

| 194LA – Income by way of enhanced compensation | 2,50,000 | 5,00,000 |

| 206C(1G) – Remittance under LRS and overseas tour program package | 7,00,000 | 10,00,000 |

- Section 206AB which added compliance burden for TDS deductors has been removed.

- The TDS rate for section 194LBC – Income received from investment in securitization trusts for residents has been reduced to 10%.

- With effect from 1st April, 2025, a new section 194T is inserted, wherein TDS has to be deducted on partner’s remuneration at 10%.

TDS Rate Chart for FY 2025–26

| Section | Nature of Payment | Threshold Limit (₹) | TDS Rate |

|---|---|---|---|

| 192 | Salary | As per income tax slab | As per slab rate |

| 192A | Premature withdrawal from EPF | ₹50,000 | 10% |

| 193 | Interest on securities | ₹10,000 | 10% |

| 194 | Dividend | ₹5,000 | 10% |

| 194A | Interest (other than securities) | ₹5,000 (₹40,000 for banks/post office, ₹50,000 for senior citizens) | 10% |

| 194B | Lottery, crossword, game winnings | ₹10,000 | 30% |

| 194BB | Horse race winnings | ₹10,000 | 30% |

| 194C | Payment to contractors/sub-contractors | ₹30,000 (single) or ₹1,00,000 (annual) | 1% (individual/HUF), 2% (others) |

| 194D | Insurance commission | ₹15,000 | 10% |

| 194DA | Life insurance policy proceeds | ₹1,00,000 | 5% (on income part only) |

| 194H | Commission/Brokerage | ₹15,000 | 5% |

| 194I | Rent of land/building/furniture | ₹2,40,000 | 10% |

| 194IA | Transfer of immovable property | ₹50,00,000 | 1% |

| 194IB | Rent paid by individuals/HUF (not liable to audit) | ₹50,000 per month | 5% |

| 194J | Professional/technical fees, royalty, etc. | ₹30,000 | 10% (2% for technical fees) |

| 194M | Payment by individual/HUF to contractor or professional (not liable to audit) | ₹50,00,000 | 5% |

| 194N | Cash withdrawal from bank/post office | ₹20 lakh (for non-filers), ₹1 crore (others) | 2%/5% |

| 194O | Payment by e-commerce operator to participant | ₹5,00,000 | 1% |

| 195 | Payment to Non-Resident | Any amount | Rates as per Income Tax Act/DTAA |