SBI Mudra Loan Application Form - Summary

Pradhan Mantri MUDRA Yojana (PMMY) is a scheme launched by the Hon’ble Prime Minister on April 8, 2015, for providing loans up to 10 lakh to the non-corporate, non-farm small/micro-enterprises. These loans are classified as MUDRA loans under PMMY. These loans are given by Commercial Banks, RRBs, Small Finance Banks, MFIs, and NBFCs. The borrower can approach any of the lending institutions mentioned above or can apply online through this portal www.udyamimitra.in.

Features of SBI Mudra Loan

| Nature of facility | The term loan and working capital |

| Purpose | Modernization, business capital, expansion |

| Target group | People belonging to the trading sector, part of business enterprises, and those who carry out agricultural activities |

| Quantum of loan |

|

| Repayment period | 3 –5 years |

| Processing fee |

|

| Margin |

|

| Pricing | Pricing linked to MCLR |

| Collateral security | No collateral required. However, as Primary Security, hypothecation of P&M for TL and hypothecation of stocks and receivables for CC to be done. |

| Eligibility criteria | New and existing units |

| Other conditions you must be aware of |

|

SBI e-Mudra

Existing SBI savings and current account holding customers can now apply for the SBI Mudra loan online. Loan applications for up to Rs.50,000 can be submitted on the SBI e-Mudra portal – https://emudra.sbi.co.in:8044/emudra.

Eligibility criteria for SBI e-Mudra Loan

- The borrower should be between 18 and 60 years of age.

- The deposit account should have been active for a minimum of 6 months.

Documents Required

It is important to keep the following documents in hand when applying online for the e-Mudra loan. The documents should be in the JPEG, PNG, or PDF format and should not exceed 2MB in size. The documents should be a photocopy or a scanned copy of any of the following:

- GST registration certificate

- Shop & Establishment certificate

- Udyog Aadhaar

- Any other document of business registration

Details Required

To ensure that the application process is smooth, make sure you have the following details ready:

- Your SBI savings/current account number

- Aadhaar number: This is voluntary and is required to complete the e-KYC process instantly through the mobile app. However, if you do not wish to provide your Aadhaar number online, your application will be manually processed at the SBI branch.

- Business details: This includes the name and address of your business and its start date and is used to verify your business location.

- Religion and community: This is a part of SBI’s credit policy.

- Sales figures: Sales turnover figures.

- Business account: Account number, bank, and branch name where your business’ sales proceeds gets credited.

Online Application Process

- Visit the SBI e-Mudra portal.

- Click on the button ‘Proceed’ on the homepage.

- Read the instructions given in Hindi or English and click on ‘’Ok’’ to proceed to the next page.

- Fill in your mobile number, SBI savings/current account number, and required loan amount.

- Click on ‘Proceed’.

- Fill in the details required in the online application form. You can also select the relevant data through the dropdown menu.

- Upload the necessary documents.

- Accept the SBI e-Mudra Terms and Conditions with an e-Sign. To do this:

- Input your Aadhaar number.

- Tick on the consent check box for using your Aadhaar for purposes of the e-Sign.

- You will receive an OTP to your mobile number registered with your Aadhaar.

- Enter the OTP in the required field to complete your application.

SBI’s e-Mudra facility makes it easier to get your loan sanctioned with minimal documentation and faster approvals.

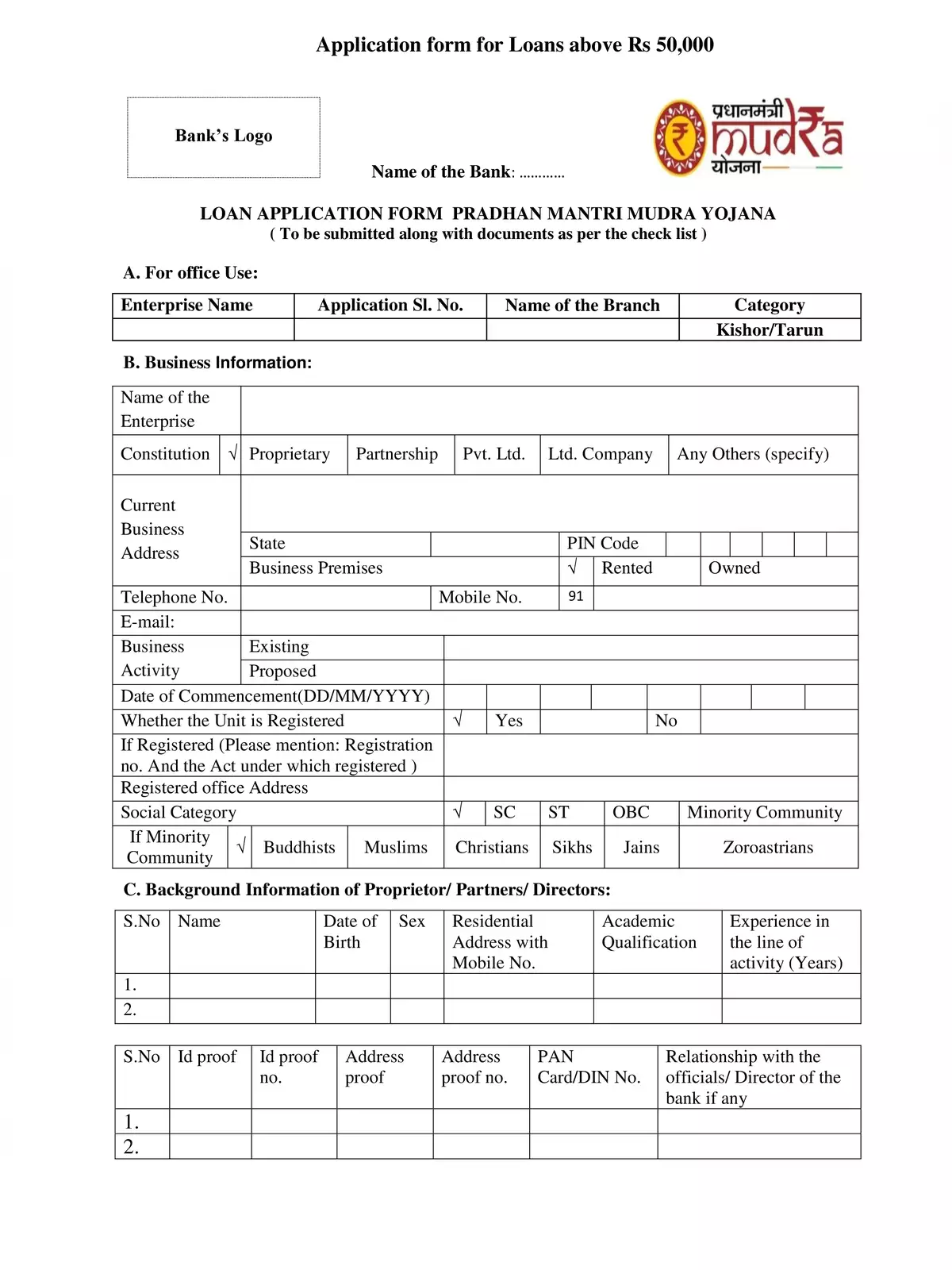

You can download the SBI Mudra Loan Application Form in PDF format using the link given below.