SBI General’s Top Up Policy Brochure - Summary

Medical bills are among the most unpredictably variable expenses a person might face throughout his or her life. A medical insurance policy’s coverage for a specific illness or accident may be insufficient at times.

An extra policy coverage may be useful during these unpredictably uncertain periods. One such policy is the SBI General Arogya Top-up Policy, which gives additional protection against escalating medical costs.

Eligibility

The Policy has the following eligibility criteria:

- This coverage can be purchased by anyone aged 3 months to 65 years old.

- The maximum entrance age can be extended to 70 years by selecting a deductible of Rs.5 lakh.

- Anyone under the age of 55 does not need a pre-insurance medical examination if they have no past medical history.

- This policy can cover the insured’s family members.

Sum Insured and Premium Charges

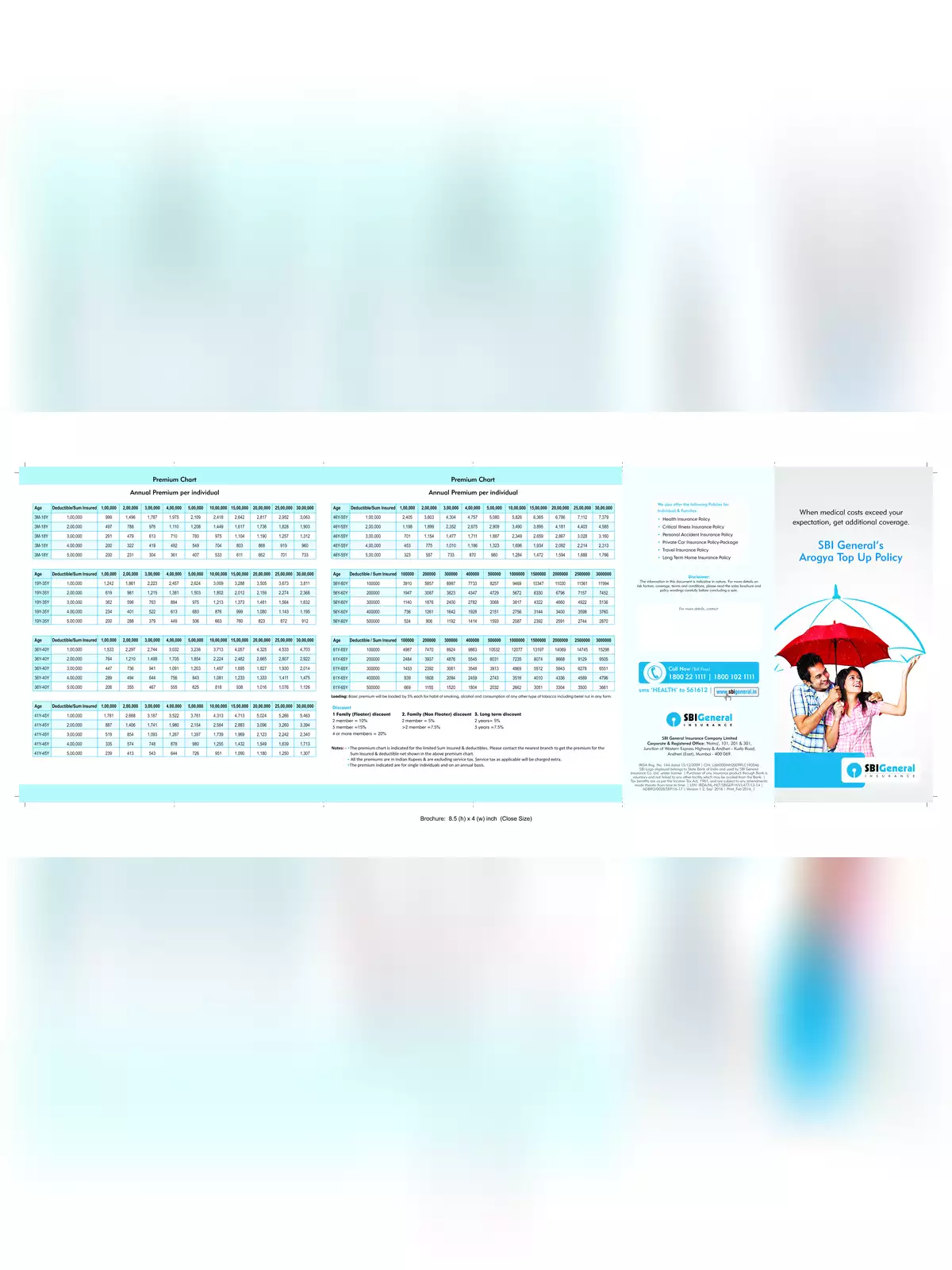

The SBI top up Policy’s sum insured ranges from Rs.1 lakh to Rs.50 lakh. This policy’s deductible options range from Rs.1 lakh to Rs.10 lakh. With such broad coverage, premiums vary greatly depending on the insured’s age group, the amount insured, and the deductible selected.

To collect more information about the policy, download the SBI General’s Top Up Policy Brochure in PDF format following the link given below.