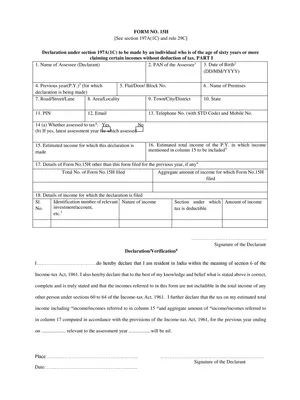

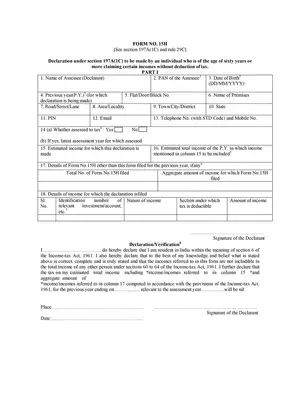

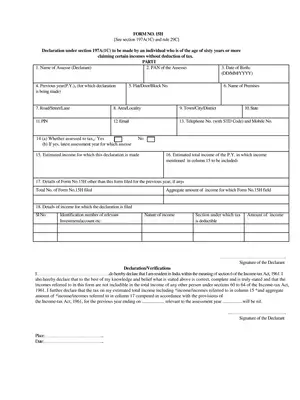

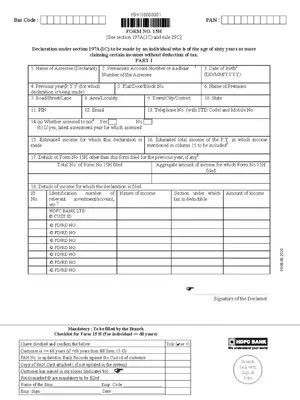

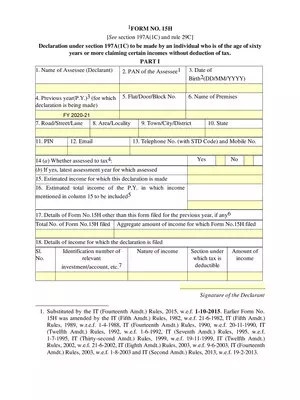

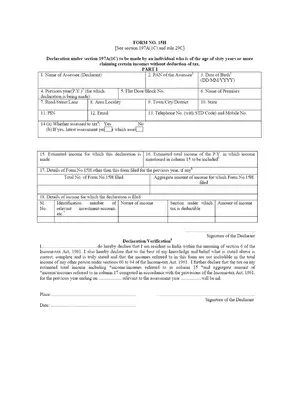

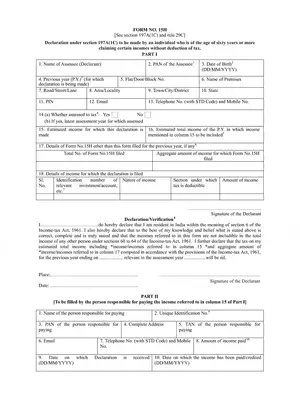

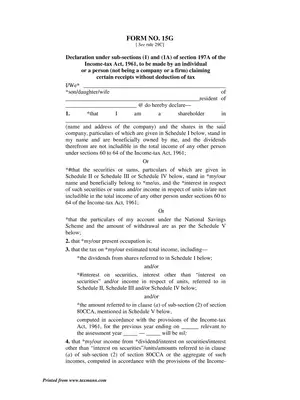

Form 15H

Form 15H aims to enable individuals to claim relief from TDS deductions on income generated from interest on Fixed Deposits in Banks made during a specific financial year, provided the individuals to meet certain eligibility criteria. Individuals must have a PAN card for being to claim TDS relief.

Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else. Form 15G and Form 15H are valid for one financial year. So, please submit these forms every year at the beginning of the financial year. This will ensure the bank does not deduct any TDS on your interest income.

Download here all the Bank Form 15H in PDF format using the link given below.