IDBI Accounts Opening Form - Summary

IDBI Accounts Opening Form: A Complete Guide

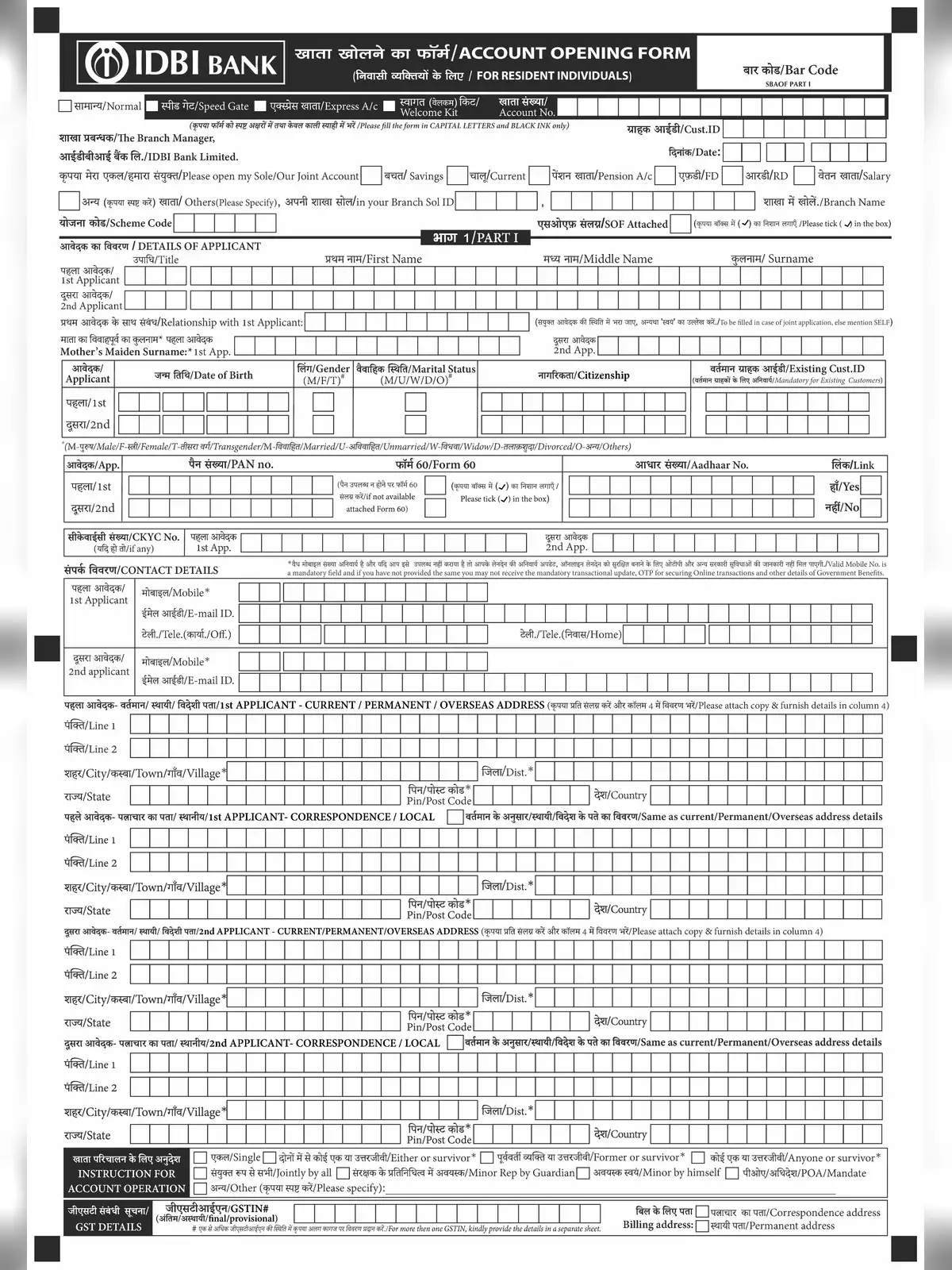

IDBI Accounts Opening Form is essential for anyone looking to open a Saving, Current, Pension, Fixed Deposit, Recurring Deposit, or Salary account. This form is specifically designed for resident individual persons in India, making it easier to manage your finances wisely.

When you decide to open an account with IDBI Bank, you will need to fill out this form accurately. It is straightforward and user-friendly, suitable even for beginners. Knowing how to complete the form correctly ensures a smooth and hassle-free banking experience.

Types of IDBI Accounts

IDBI Bank offers various account types to cater to your specific needs. Each account type serves different purposes and comes with its own benefits. Here are some of the accounts you can open:

1. **Saving Account**: Ideal for daily transactions while earning interest on your savings.

2. **Current Account**: Best suited for businesses that require frequent transactions without any limit.

3. **Pension Account**: Specifically designed for retired individuals to manage their pension funds conveniently.

4. **Fixed Deposit Account**: A safe investment option to grow your savings at a fixed interest rate over a term.

5. **Recurring Deposit Account**: Encourages regular saving habits with fixed monthly deposits.

6. **Salary Account**: Tailored for employees to receive their salaries with added benefits.

Filling out the IDBI Accounts Opening Form requires some personal details such as your name, address, and contact information. Be sure to have all necessary documents ready for better convenience.

By downloading the PDF version of the IDBI Accounts Opening Form, you can fill it out at your own pace. This feature allows you to keep the form handy and ensures that you do not miss any crucial details.

In conclusion, the IDBI Accounts Opening Form is your first step towards managing your financial future effectively. Get started today and open the account that suits you best! 🌟