ICICI Bank KYC Form - Summary

Understanding the ICICI Bank KYC Form

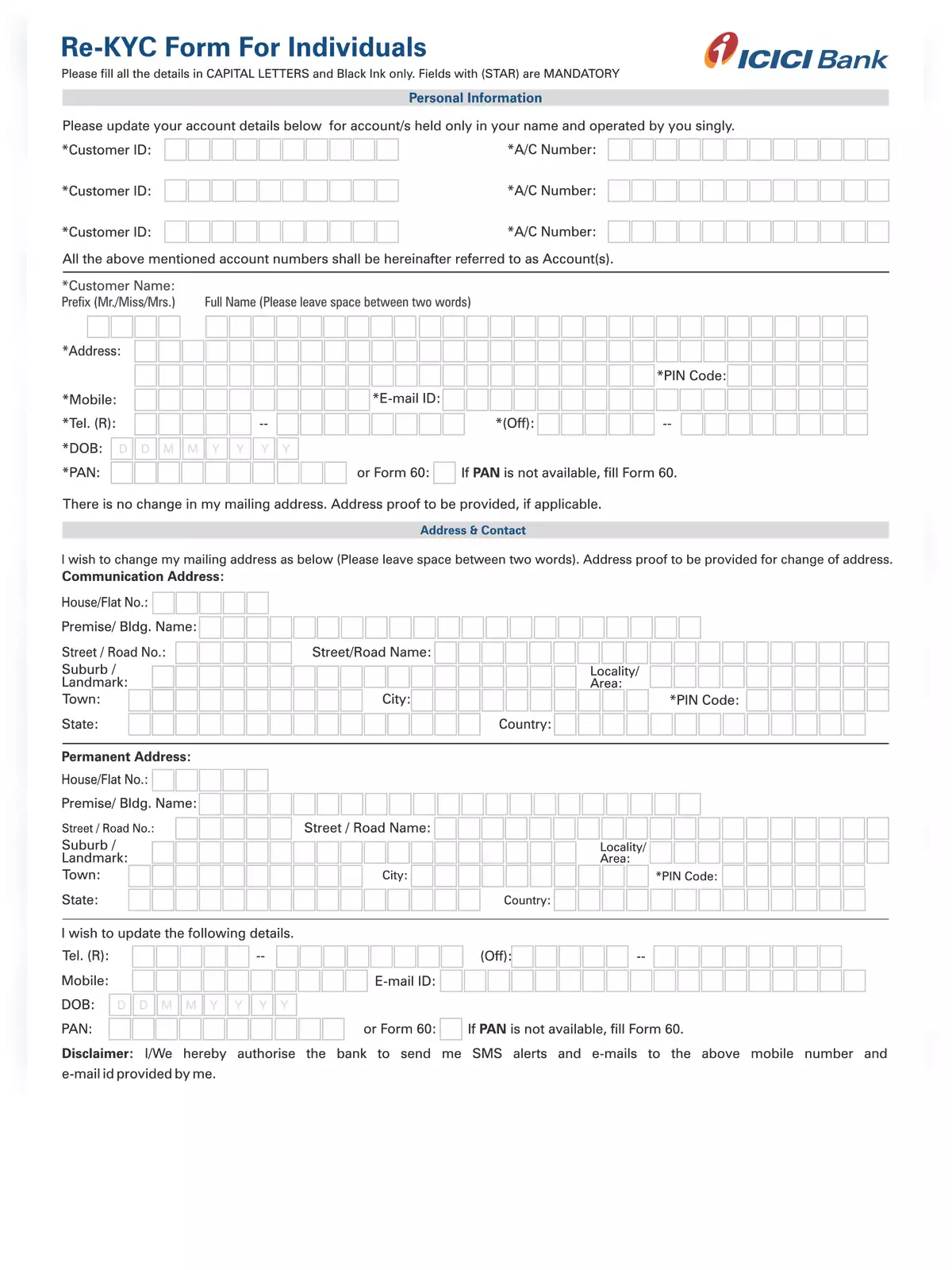

The ICICI Bank KYC Form is an essential document that ensures the bank knows its customers properly. KYC stands for “Know Your Customer,” which is the process of verifying the identity of clients. The KYC documents include two types: proof of identity and proof of address. Having the correct KYC details helps in making banking transactions secure.

Importance of KYC in Banking

For any bank, including ICICI Bank, having proper KYC documents is crucial for many reasons. This process helps prevent fraudulent activities and ensures compliance with government regulations. A complete KYC process enhances the safety and integrity of banking transactions, providing peace of mind to both the bank and its customers.

When filling out the ICICI Bank KYC Form, you need to provide relevant documents that serve as proof of your identity and address. Typically accepted identity proof documents include items like an Aadhaar card, passport, or voter ID. For proof of address, documents such as a utility bill or rental agreement can be used. Ensuring you have the right documents is important for a smooth KYC process.

It is also important to ensure that the copies of these documents are clear and readable. If your document is not legible, the bank may ask you to submit new copies, which could delay the KYC process. Therefore, always check the quality of the documents you provide before submission.

After submitting the KYC Form and related documents, the bank will process your application. You can also track the status of your KYC application through the ICICI Bank mobile app or website, making it easy to stay updated.

By completing the KYC process, you will have access to all banking services that ICICI Bank offers, including online banking, loans, and investments. Remember, it’s important to keep your KYC information updated, especially if you change your address or name. Regularly check your documents and details to ensure they remain current.

For more detailed information and to get the ICICI Bank KYC Form, don’t forget to check the PDF provided below. Download the PDF for easy access to all necessary instructions and forms you may need. This way, you can simplify your KYC process and ensure everything is in order. 📄