HDFC Loan Application Form - Summary

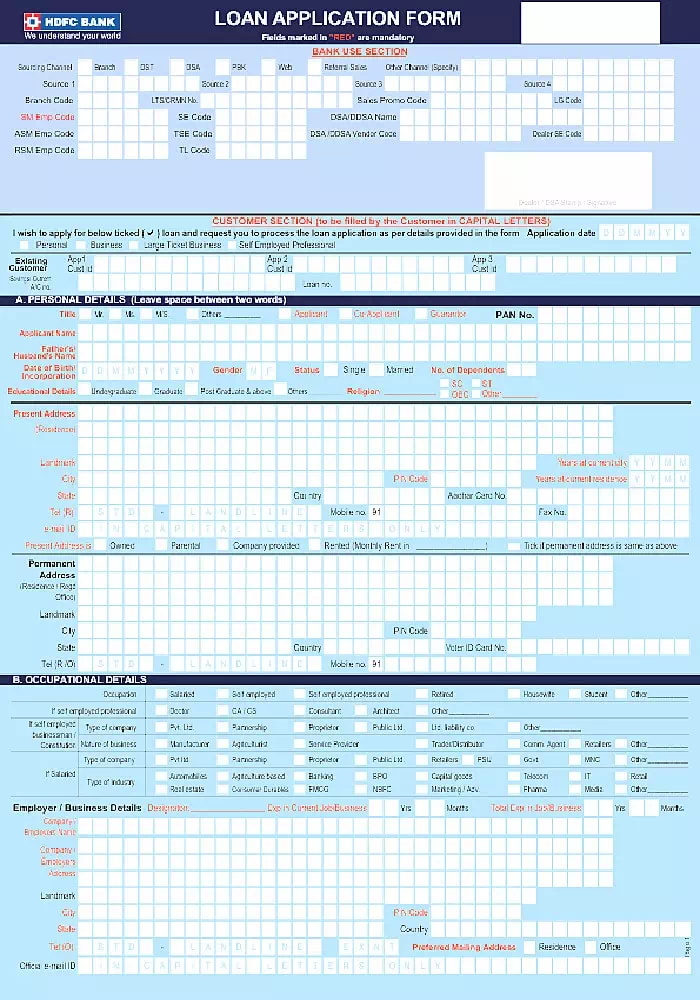

HDFC Loan Application Form

The HDFC Loan Application Form is essential for those looking to apply for an HDFC Bank Personal Loan, which is an excellent choice for tackling financial needs due to its promise of quick approval and disbursement. With an HDFC Personal Loan, you can get financial support up to Rs. 25 lakh without the need for collateral. This money can be used for many exciting purposes, such as paying medical bills, improving your home, planning a holiday, financing a wedding, and much more.

You can easily repay the loan amount over a flexible tenure of up to 60 months, allowing you to manage your payments in a way that suits your budget.

Eligibility

To apply for an HDFC Personal Loan, there are a few eligibility criteria that you need to meet. Firstly, you must be at least 21 years old and not older than 60 years.

Additionally, you should be employed in either a private limited company or a public sector job, including positions within federal, state, or local government. It’s also important that you have been with your current employer for at least one year and have a total work experience of at least two years.

Moreover, having a minimum monthly income of Rs. 25,000 is crucial for your loan application to be accepted.

More Info

Obtaining a personal loan is a practical financial solution for those in need of funds for specific purposes. Since personal loans are unsecured, you won’t have to provide any collateral or security. The process to apply for personal loans is quite straightforward and quick, with approvals and disbursements often completed in just a few hours. This fast service ensures that you get the financial assistance you need without delay.

People commonly use personal loans for a variety of needs, such as covering wedding expenses, planning vacations, conducting home repairs, renovating spaces, and much more. If you’re looking for financial support, consider downloading our detailed PDF guide on the HDFC Loan Application Form and its many benefits. An HDFC Personal Loan could be the perfect solution to meet your immediate financial requirements. 😊