GST Rate List in India 2026 - Summary

GST is a single tax that replaced many old taxes like VAT, service tax, and excise duty. The rate list helps people understand how much tax they need to pay when they buy or sell goods and services.

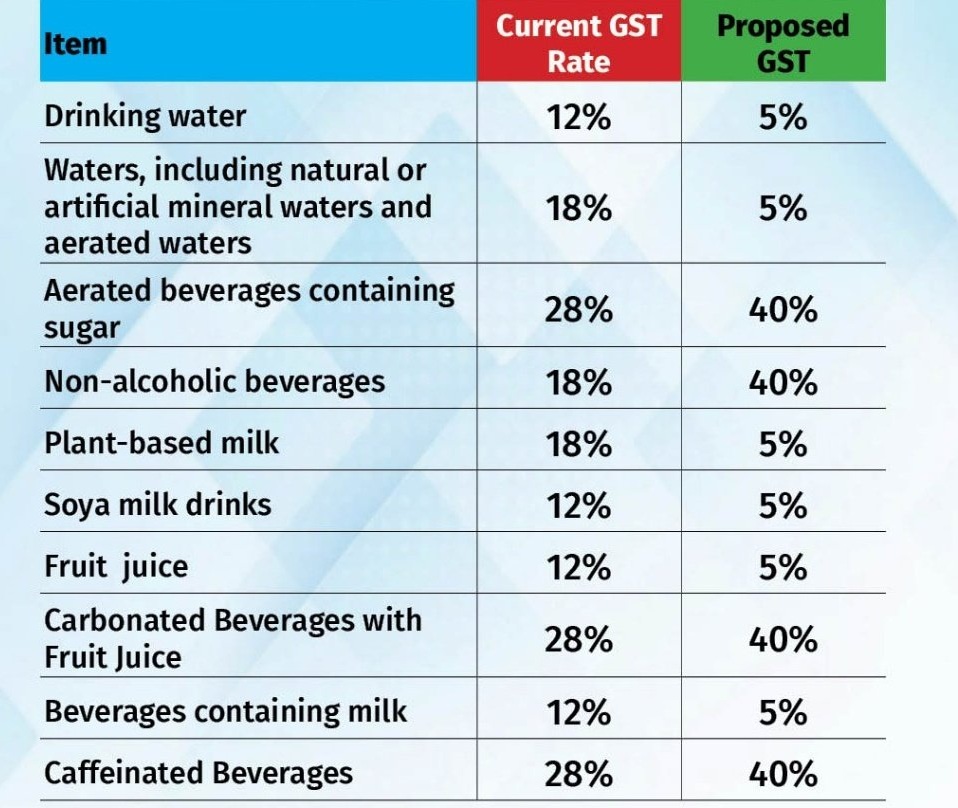

Earlier, GST had four tax rates: 5%, 12%, 18%, and 28%. These have now been simplified into just two rates: 5% and 18%. This makes the system easier to understand and fairer for consumers. However, some luxury and harmful items such as expensive cars, tobacco, and cigarettes will continue to be taxed at a much higher special rate of 40%. This ensures that essential items remain affordable, while luxury and non-essential products contribute more in taxes.

List of Items Taxed at 0% GST Rate

| Products | GST Rate |

| Milk | 0% |

| Kajal | 0% |

| Eggs | 0% |

| Educational Services | 0% |

| Curd | 0% |

| Lassi | 0% |

| Health Services | 0% |

| Children’s Drawing & Colouring Books | 0% |

| Unpacked Foodgrains | 0% |

| Unbranded Atta/Maida | 0% |

| Unpacked Paneer | 0% |

| Gur | 0% |

| Besan | 0% |

| Unbranded Natural Honey | 0% |

| Fresh Vegetables | 0% |

| Salt | 0% |

| Prasad | 0% |

| Palmyra Jaggery | 0% |

| Phool Bhari Jhadoo | 0% |

List of Items Taxed at 5% GST Rate

List of Items Taxed at 12% GST Rate

| Products | GST Rate |

| Butter | 12% |

| Ghee | 12% |

| Processed food | 12% |

| Almonds | 12% |

| Mobiles | 12% |

| Fruit Juice | 12% |

| Preparations of Vegetables | 12% |

| Fruits | 12% |

| Nuts or other parts of Plants, including Pickle Murabba | 12% |

| Chutney | 12% |

| Jam | 12% |

| Jelly | 12% |

| Packed Coconut Water | 12% |

| Umbrella | 12% |

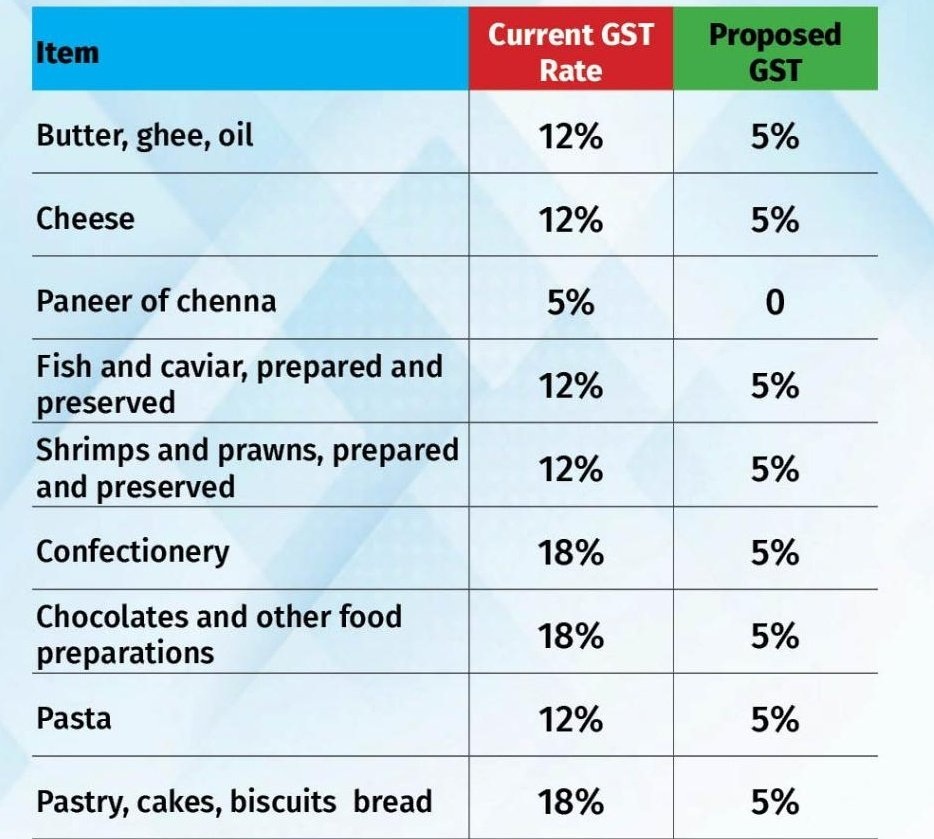

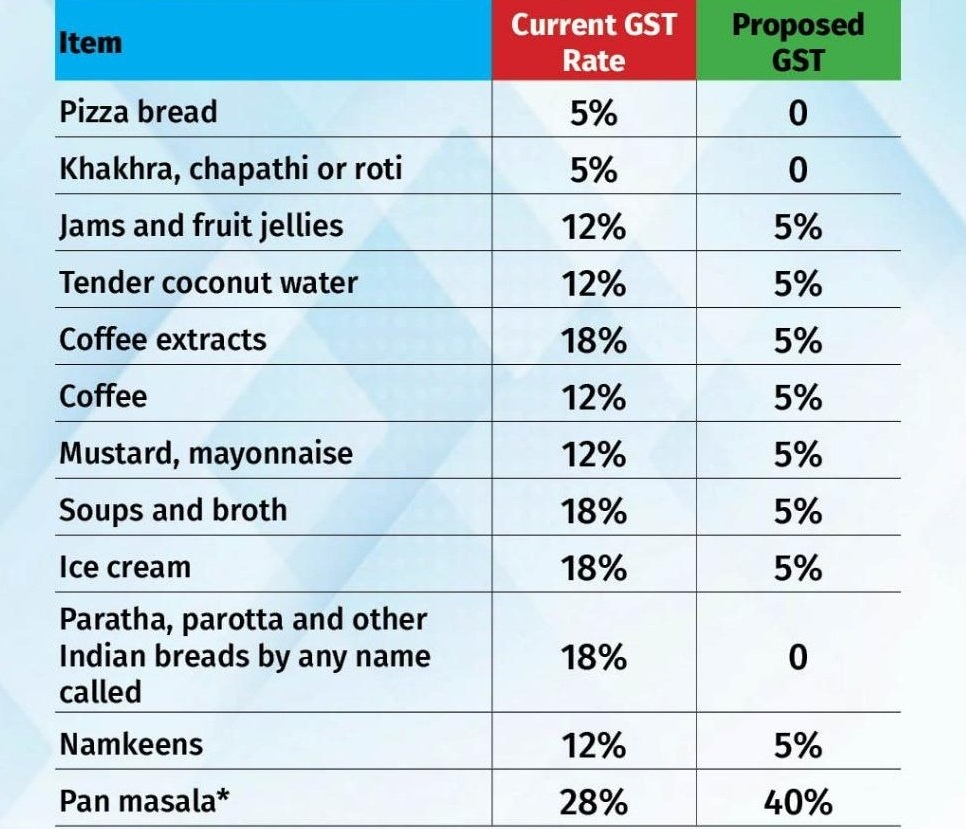

GST New Rate List

| Category | Items | Old GST Rate | New GST Rate |

|---|---|---|---|

| Food & Beverage | Chapati, paranthas, UHT milk, paneer, pizza bread, khakra | 5% | Nil |

| Butter, ghee, dry nuts, condensed milk, sausages, jam, confectionery, ice cream, biscuits, cereals, juices, namkeen, packed water, pastries | 18% | 5% | |

| Other fats & cheese | 12% | 5% | |

| Plant-based & soya milk drinks | 18% / 12% | 5% | |

| Household Items | Tooth powder, feeding bottles, tableware, kitchenware, umbrellas, bicycles, bamboo furniture, combs | 12% | 5% |

| Shampoo, talc, toothpaste, toothbrush, soap, hair oil | 18% | 5% | |

| Household Appliances | ACs, dishwashers, TVs | 28% | 18% |

| Stationery | Maps, charts, globes, pencils, sharpeners, crayons, notebooks | 12% | Nil |

| Erasers | 5% | Nil | |

| Footwear & Textiles | All | 12% | 5% |

| Healthcare | Life-saving drugs, devices, thermometers, oxygen, kits, glucometers, spectacles | 12% / 18% | 5% / Nil |

| Insurance & Policies | Life & health insurance | Taxable | Nil |

| Goods carriage insurance | 12% | 5% (with ITC) | |

| Hotels & Flights | Rooms up to ₹7,500 | 12% | 5% (no ITC) |

| Economy air tickets | – | 5% | |

| Vehicles & Auto Parts | Motorcycles ≤350cc, small hybrids | 28% | 18% |

| EVs | 5% | 5% | |

| Auto components | 28% | 18% | |

| Small petrol/diesel/CNG vehicles | 28% | 18% | |

| Construction | Cement | 28% | 18% |

| Sewing Machines | Machines & parts | 12% | 5% |

| Agricultural Machinery | Diesel engines ≤15HP, hand pumps, irrigation equipment, harvesters, composting machines, tractors, trailers, carts | 12% | 5% |

| Fertiliser inputs (acids, ammonia), biopesticides, neem-based pesticides, micro-nutrients | 12% / 18% | 5% | |

| Tractor components (tyres, tubes, pumps, gearboxes, radiators, etc.) | 18% | 5% | |

| Beauty & Fitness Services | Salons, gyms, yoga, barbers, health clubs | 18% | 5% (no ITC) |

List of Items Taxed at 3% GST Rate

| Products | GST Rate |

| Imitation jewellery | 3% |

| Articles of precious metal or of metal clad with precious metal | 3% |

| Natural pearls or cultured pearls, whether or not worked or graded but not strung, mounted or set; or temporarily strung for convenience of transport | 3% |

| Diamonds, whether or not worked, but not mounted or set (Excludes non-industrial) | 3% |

| Precious stones (other than diamonds) and semi-precious stones | 3% |

| Silver | 3% |

| Gold | 3% |

| Waste and scrap of precious metal or of metal clad with precious metal | 3% |

List of Items Taxed at 0.25% GST Rate

| Products | GST Rate |

| Non-industrial diamonds | 0.25% |

| unworked precious/semi-precious stones | 0.25% |

| Synthetic or reconstructed precious or semi-precious stones | 0.25% |

GST Rate Changes at 54th GST Council Meeting

| Goods/Service | HSN/SAC Code | Earlier GST Rate | New GST Rate |

| Cancer drugs such as Trastuzumab Deruxtecan, Osimertinib and Durvalumab | 9804 | 12% | 5% |

| Namkeens and Extruded/Expanded Savoury food products | 19059030 | 18% | 12% (prospective) |

| Car and Motor cycle seats | 9401 | 18% | 28% (prospective) |

| Transport of passengers by helicopters | 9964 | 18% | 5% on seat-share basis; 18% on charter |

| Import of services by branch office of foreign airlines | Taxable | Exempted |

GST Rate Changes at 53rd GST Council Meeting

The folowing table summarises the GST rate revisions:

| Particulars | New GST Rate/Exemption |

| Extra Neutral Alcohol used for the manufacture of alcoholic liquor for human consumption | Exempt |

| Imports of parts, components, testing equipment, tools, and tool-kits of aircraft, irrespective of their HS classification, are used to boost the MRO activities subject to specified conditions. | 5% IGST |

| Parts of Poultry keeping Machinery | 12% |

| All milk cans (different materials), irrespective of use | 12% |

| All carton boxes and cases of both corrugated and non-corrugated paper board | 12% |

| All types of sprinklers, including fire water sprinklers | 12% |

| All solar cookers, whether or not single or dual energy source | 12% |

| Services provided by Indian Railways to common man for sale of platform tickets, cloak rooms, and battery operated car services are exempted, including intra railway supplies | Exempt |

| Service by way of hostel accommodation is currently not exempted if outside educational institution upon satisfying the conditions that the rent limit is up to Rs. 20,000 per person per month, and the service is rendered for a continuous period of 90 days | Exempt |

| Corporate guarantee if in case it is for services or goods where whole ITC is available | Exempt |

| Services provided by Special Purpose Vehicles (SPV) to Indian Railway by way of allowing Indian Railway to use infrastructure built & owned by SPV during the concession period and maintenance services supplied by Indian Railways to SPV | Exempt |

| Imports of specified items for defence forces | IGST is exempt for five years till 30th June 2029 |

| Imports of research equipment/buoys imported under the Research Moored Array for African-Asian-Australian Monsoon Analysis and Prediction (RAMA) programme subject to specified conditions | IGST is exempt |

| Imports in SEZ by SEZ Unit/developers for authorised operations with effect from 1st July 2017 | Compensation Cess is exempt |

| Supply of aerated beverages and energy drinks to authorised customers by Unit Run Canteens under the Ministry of Defence | Compensation Cess is exempt |

| Import of technical documentation for AK-203 rifle kits imported for the Indian Defence forces. | Ad hoc IGST exemption provided |

GST Rate List Change at 49th GST Council Meeting

| Item description | Before | After |

| Rab/Liquid jaggery* | 18% | Nil (sold lose) / 5% (sold labelled/pre-packaged) |

| Pencil sharpeners* | 18% | 12% |

| Certain tracking devices fixed on durable containers^ | Applicable rate | Nil |

| Coal rejects supplied to the washeries* | Applicable cess rate | Exempted from cess |

| Authority, board or a body set up by the Central Government or State Government including National Testing Agency (NTA) for conduct of entrance examination* | Applicable rate | Exempted |

GST 45th GST Council Meeting – GST Rate List

| Items | Before | After |

|---|---|---|

| Import of expensive life-saving medicines such as Zolgensma, Viltepso or as recommended by a relevant government department for personal use | 12% | Nil |

| Waste unintentionally generated during the fish meal production, except for Fish Oil | Applicable rate | Nil from 1st July 2017 to 30th September 2019 |

| IGST on the goods sold at the Indo-Bangladesh border haats | Applicable rate | Nil |

| Transport of goods by vessel and air from India to outside India extended up to 30th September 2022 | Nil | Nil |

| Granting of National Permit to goods carriages on a fee payment | 18% | Nil |

| Skill training programmes where the state/central government funds expenditure equal to or more than 75% | 18% | Nil |

| Services on AFC Women’s Asia Cup to be held in 2022 | 18% | Nil |

| ‘Keytruda’ drug for the treatment of cancer | 12% | 5% |

| Biodiesel, sold to the oil marketing companies for blending it with diesel | 12% | 5% |

| Fortified Rice Kernels for the Integrated Child Development Services Scheme, etc | 18% | 5% |

| Retro fitment kits in vehicles for the disabled | Applicable rate | 5% |

| Railway goods, locomotives, and parts under Chapter 86 | 12% | 18% |

| Pens | 12% or 18% | 18% |

| Metal concentrates and ores | 5% | 18% |

| Certain Renewable Energy Devices | 5% | 12% |

GST 44th GST Council Meeting – GST Rate List

| S. No. | Description | Present GST Rate | GST Rate recommended by GST Council |

|---|---|---|---|

| Medicines | |||

| 1. | Tocilizumab | 5% | Nil |

| 2. | Amphotericin B | 5% | Nil |

| 3. | Anti-Coagulants like Heparin | 12% | 5% |

| 4. | Remdesivir | 12% | 5% |

| 5. | Any other drug recommended by the Ministry of Health and Family Welfare (MoHFW) and Dept. of Pharma (DoP) for Covid treatment | Applicable Rate | 5% |

| Oxygen, Oxygen generation equipment and related medical devices | |||

| 1. | Medical Grade Oxygen | 12% | 5% |

| 2. | Oxygen Concentrator/ Generator, including personal imports thereof | 12% | 5% |

| 3. | Ventilators | 12% | 5% |

| 4. | Ventilator masks / canula / helmet | 12% | 5% |

| 5. | BiPAP Machine | 12% | 5% |

| 6. | High flow nasal canula (HFNC) device | 12% | 5% |

| Testing Kits and Machines | |||

| 1. | Covid Testing Kits | 12% | 5% |

| 2. | Specified Inflammatory Diagnostic Kits, namely D-Dimer, IL-6, Ferritin, and LDH | 12% | 5% |

| Other Essentials Goods GST Rate Relief | |||

| 1. | Pulse Oximeters, incl personal imports thereof | 12% | 5% |

| 2. | Hand Sanitizer | 18% | 5% |

| 3. | Temperature check equipment | 18% | 5% |

| 4. | Gas/Electric/other furnaces for a crematorium, including their installation, etc. | 18% | 5% |

| 5. | Ambulances | 28% | 12% |

GST Tax Slab Rates List for Goods

| 5% GST Rate | Spices, Frozen vegetables, Rusk, Fish fillet, Pizza bread, Sabudana, Tea, Baby milk food, Plain Chapati & Khakhra, Floor covering, Fertilizers, Footwear under ₹ 1,000, Apparels under ₹ 1,000, Real zari, Agarbatti, Pizza bread, Edible Oils, Skimmed milk, Medicines, Paper waste, Revenue stamps, Stent, Ethanol, Mehndi Paste, Insulin, Scrap of Glass, Velvet Fabric, Plastic waste, Post stamps, Stamp, Postmarks, Tamarind Kernel Powder, Plastic waste, Coir mats, Matting, First Day Covers, Braille Watches, Sliced mango, Domestic LPG |

|---|---|

| 12% GST Rate | Cakes, Drip Irrigation System, Photographers, Pack water bottle of 20 litre, Butter, Mechanical sprayers, Ghee, Almonds, Pouches, purses and Handbags, Fruits, Art, ware of iron, Boiled sugar confectionery, Packaged coconut water, Pickle, Mirrors, framed with Ornaments, Nuts, Bamboo wood building, Chutney, Apparel above ₹ 1,000, Jam, Bhujia, Notebooks, Frozen meat, Animal fat sausage, Packaged dry fruits, Cake servers, Packed Dry Fruits, Ladles, Forks, Mobile, Toothpowder, Non-AC Restaurants, State-run Lotteries, Work Contracts, Tongs, Fish knives, Jelly, Brass Kerosene Pressure Stove, Fertilizer – grade Phosphoric Acid, Playing Cards, Carom board, Chessboard, Skimmers, Spoons, Manmade Yarn, Sewing Thread of Manmade Staple Fibres, Murabba, Biodiesel and select biopesticides, Ludo, Exercise Books, Preparation of vegetables |

| 18% GST Rate | Washing Machine, Vacuum Cleaner, Pasta, Tyres, Biscuits, Vanity case, Pastries, Soups, Preserved Vegetables, Camera, Curry paste, Instant food mixes, Shampoo, Printers, Mixed condiments, Computers, Mixed Seasonings, CCTV, Hair Dryers, Electric transformer, Tissues, Steel products, Electrical transformer, Stationery items, Paint, Sheets, Kajal pencil sticks, Pumps, Sanitaryware, Binoculars, Varnishes, Speakers, Water Heaters, Fans, Goggles, Safety Glass, Circuits, Optical fibre, Hair Shavers, Windows, Fridge, Foliage, Door, Compressors, Multifunctional Printers, Telescope, Modelling Paste for Children, Branded Garments, Musical instruments and their parts, Razor and razor blades, Light fitting, Some parts of pumps, Glassware, TV, Aluminium Foil Furniture, Paddling Pools, Cigarette Filter Rods, Headgear, Mayonnaise, Steel Products, Electrical boards, panels and wires, Juicer Mixer, Power Banks with Lithium ion batteries, video games, carriage accessories for the disabled, small sport related items, Salad dressings, Footwear priced above ₹ 500, Washing Powder, Toiletries, Poster Colours, Large and medium cars (Second hand). SUVs, Swimming pools and padding pools, Woven and Non-woven bags |

| 28% GST Rate | Personal Aircraft, Sunscreen, Tobacco, Hair clippers, Bidis, Weighing machine ,Waffles plus wafers which are coated with chocolate, Wallpaper, ATM Vending Machine, Yachts, Motorcycles, Ceramic tiles, Dishwasher, Aerated Water, Pan Masala |

You can download the GST Rates List PDF format using the link given below.