Form 60 - Summary

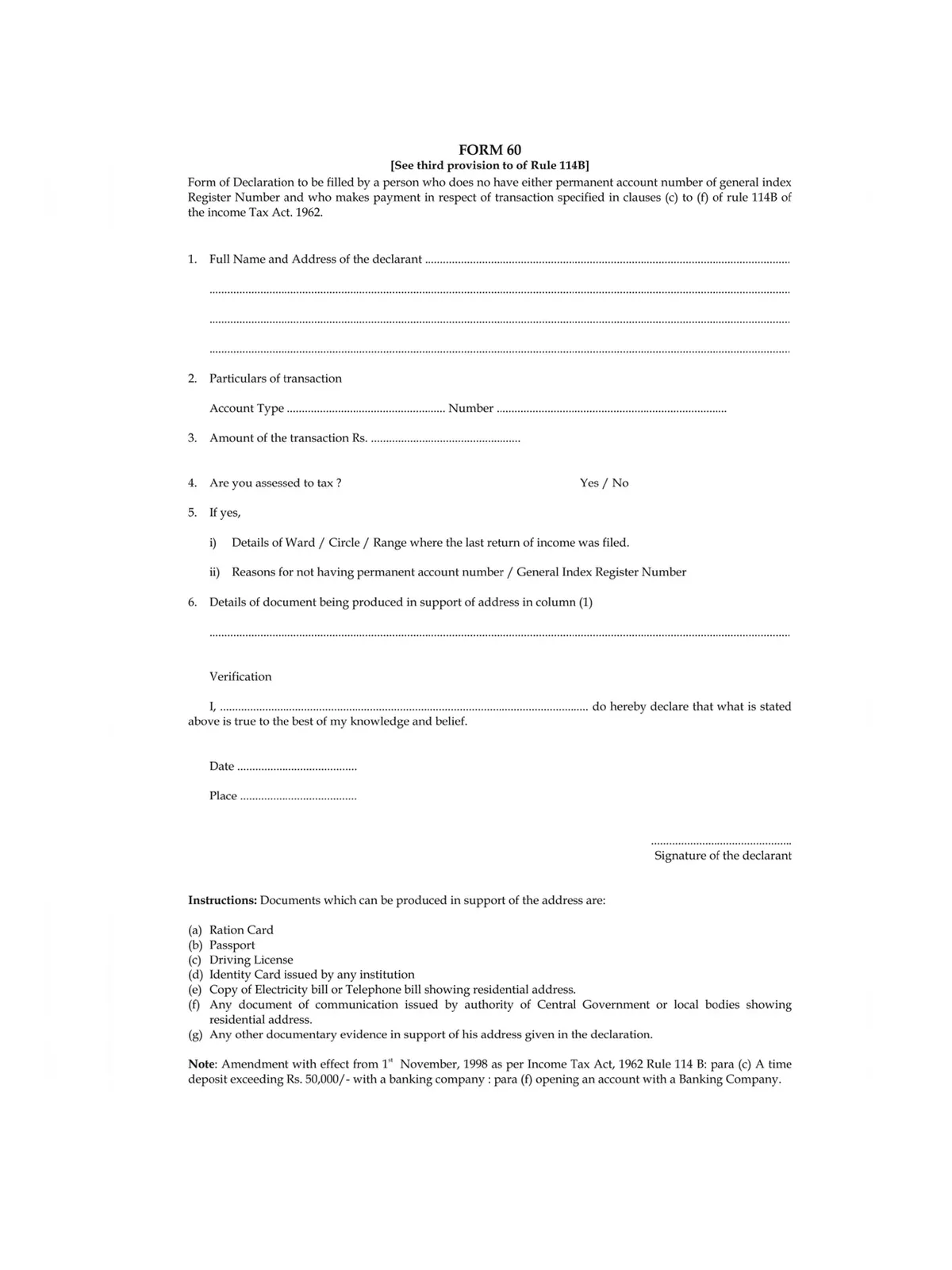

Form 60 is a document used by people in India who do not have a Permanent Account Number (PAN) but still need to carry out certain financial transactions. It is mainly used when someone wants to make payments, deposits, or purchases where quoting a PAN is normally required. By filling out Form 60, the person declares that they do not have a PAN and provides their personal details like name, address, and reason for not having one.

This form is accepted by banks, financial institutions, and government offices to keep a record of such transactions. It helps the government track financial activities and prevent misuse of money. Form 60 is especially useful for individuals who have not yet applied for a PAN card but still need to perform essential financial actions like opening a bank account or buying property.

When You Need to Use Form 60: Common Transactions

| Type of Transaction | Transaction Value |

|---|---|

| Sale or purchase of Motor Vehicle [except two-wheelers] | Any value |

| Opening a Bank account | Any value |

| Getting a new Debit or Credit card | Any value |

| Opening D-MAT account | Any value |

| Payment to hotel or restaurant at one time | Cash payments above Rs 50,000 |

| Travel expenses to a foreign country or buying foreign currency at one time | Cash payments above Rs 50,000 |

| Buying Mutual funds | Above Rs 50,000 |

| Purchasing bonds or debentures | Above Rs 50,000 |

| Getting bonds issued by RBI | Above Rs 50,000 |

| Depositing cash with (a) Bank (b) Post Office | Over Rs 50,000 in one day |

| Buying Bank Draft / Pay order / Bankers cheque | Over Rs 50,000 in one day |

| Time Deposit (FD) with (a) Bank (b) Post Office (c) NBFC (d) Nidhi company | More than Rs 50,000 at a time or Rs 5,00,000 in a financial year |

| Life Insurance Premium | Exceeding Rs 50,000 in a financial year |

| Trading in Securities | More than Rs 1,00,000 per transaction |

| Trading in Shares of unlisted company | More than Rs 1,00,000 per transaction |

| Sale or purchase of immovable property | Registered value above Rs 10,00,000 |

| Buying and selling goods and services | Rs 2,00,000 per transaction |

More About Form 60

| Form Type | Government Document |

| Form Name | Form 60 |

| Format | |

| Issued By | Central Government of India |

| Purpose | To provide a declaration when PAN is not available |

| Form 60 PDF | Download PDF |

Remember, you can easily get the official Form 60 download PDF 2025 so you have the latest version for your transactions. This helps you follow the rules even if you don’t have a PAN.

You can easily download Form 60 in PDF format through the link below and fill it out following the instructions.