Form 60 - Summary

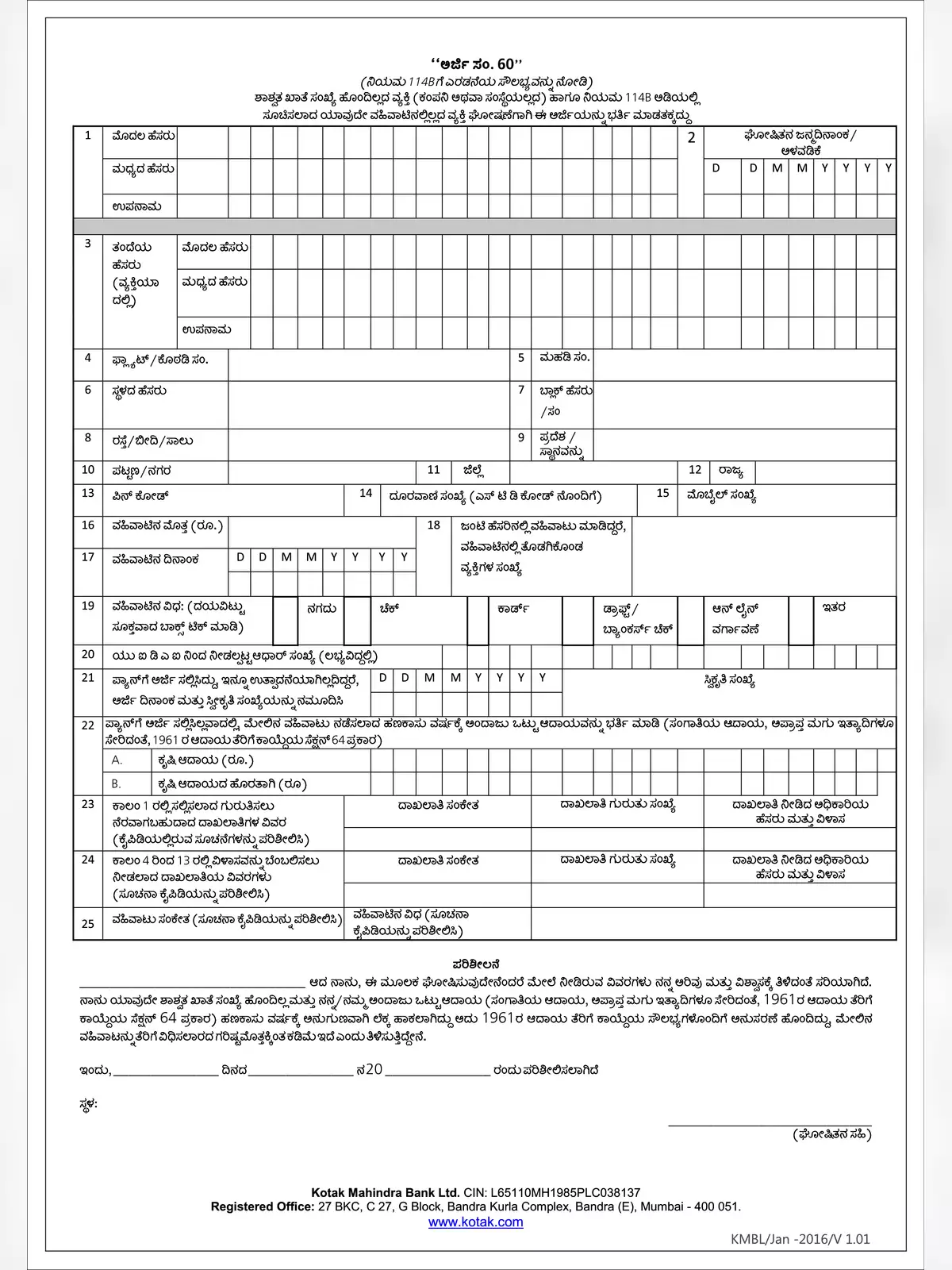

Form 60 is an important document for individuals who need to carry out financial transactions that require quoting a PAN but do not possess one. This form allows such individuals to proceed with their transactions without a PAN.

Understanding Form 60

Form 60 can be used instead of providing a PAN for various situations. It acts as a declaration that individuals or persons (excluding companies or firms) must file when they do not have a PAN and are engaging in any transactions specified under rule 114B.

How to Use Form 60

If you fall under the category of not having a PAN and need to conduct financial dealings, you can utilize Form 60 to ensure compliance with tax regulations. This form helps streamline the process and allows you to participate in financial activities that require PAN details.

You can download the Form 60 in PDF format online from the link provided below. Make sure to keep a copy for your records!