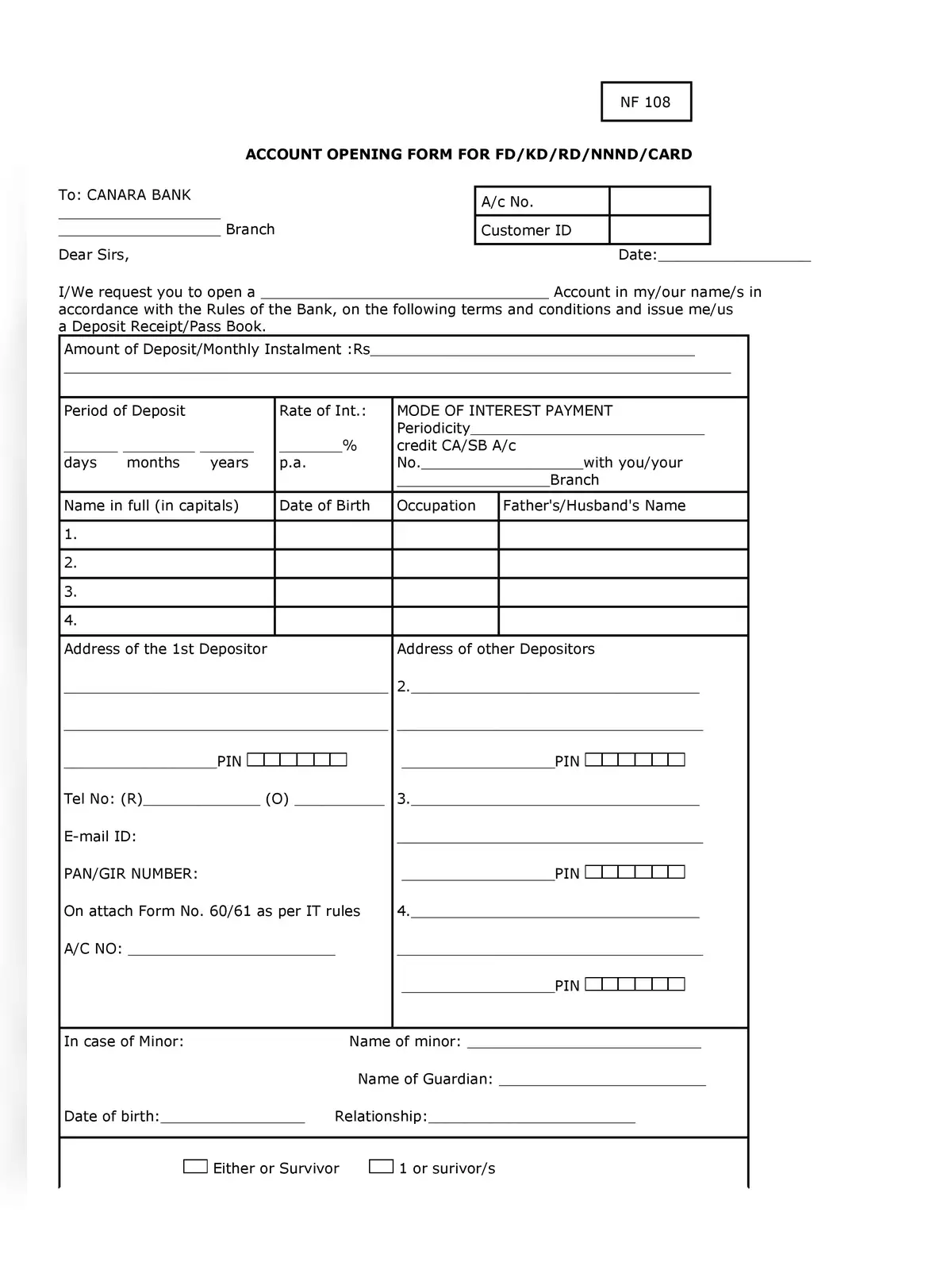

Canara Bank FD/KD/RD/NNND/CARD Form - Summary

This is an Application for open a Fixed Deposit/Recurring Deposit and form.

| 2. TERM DEPOSITS | ||||

| A. Domestic | Rate of Interest (%) p.a. | |||

| For Deposits less than Rs.2 Crore w.e.f. 07.05.2020 | ||||

| Term Deposits (All Maturities) | General Public | Senior Citizen | ||

| Rate of Interest (% p.a.) | Annualised Interest yield ** | Rate of Interest (% p.a.) # | Annualised Interest yield ** | |

| 7 days to 45 days* | 4.00 | 4.06% | 4.00 | 4.06% |

| 46 days to 90 days | 4.50 | 4.58% | 4.50 | 4.58% |

| 91 days to 179 days | 4.50 | 4.58% | 4.50 | 4.58% |

| 180 days to less than 1 Year | 5.10 | 5.20% | 5.60 | 5.72% |

| 1 year only | 5.75 | 5.88% | 6.25 | 6.40% |

| Above 1 year to less than 2 years | 5.75 | 5.88% | 6.25 | 6.40% |

| 2 years & above to less than 3 years | 5.75 | 5.88% | 6.25 | 6.40% |

| 3 years & above to less than 5 years | 5.70 | 5.82% | 6.20 | 6.35% |

| 5 years & above to 10 Years | 5.70 | 5.82% | 6.20 | 6.35% |

| * Rates are applicable only for single deposit of Rs.5 Lakh & above. Minimum period for renewal of domestic/NRO term deposits is 7 days irrespective of the size of deposit. Below Rs.5 Lakh, Minimum tenor of deposit is 15 Days. # Additional interest of 0.50% for Senior Citizens is to be made available for Deposits (Other than NRO/NRE and CGA Deposits) less than Rs. 2 Cr and with tenor of 180 Days and above. ** Approximate Annualized Yield in % terms at the beginning of the slab. Effective Annualized rate of return on Bank’s Re-investment Deposit Plan (Kamadhenu Deposit) is based on quarterly compounding of interest. Bank Offers 5.70 % p.a. for Canara Tax Saver Deposit scheme (General Public). Maximum deposit acceptable is Rs 1.50 Lakh. The above Rate of interest is applicable to Recurring deposits also. | ||||