CAMS KYC Form - Summary

CAMS KYC is a simple and paperless Aadhaar-based process designed to make fulfilling KYC requirements easy for anyone starting their journey in Mutual Fund investments. Recently, the Securities and Exchange Board of India (SEBI) has allowed Aadhaar-based KYC for mutual fund investments, which greatly helps investors like you. KYC, which means “Know Your Customer,” typically requires identity proof with a photograph and address proof as the two main mandatory documents.

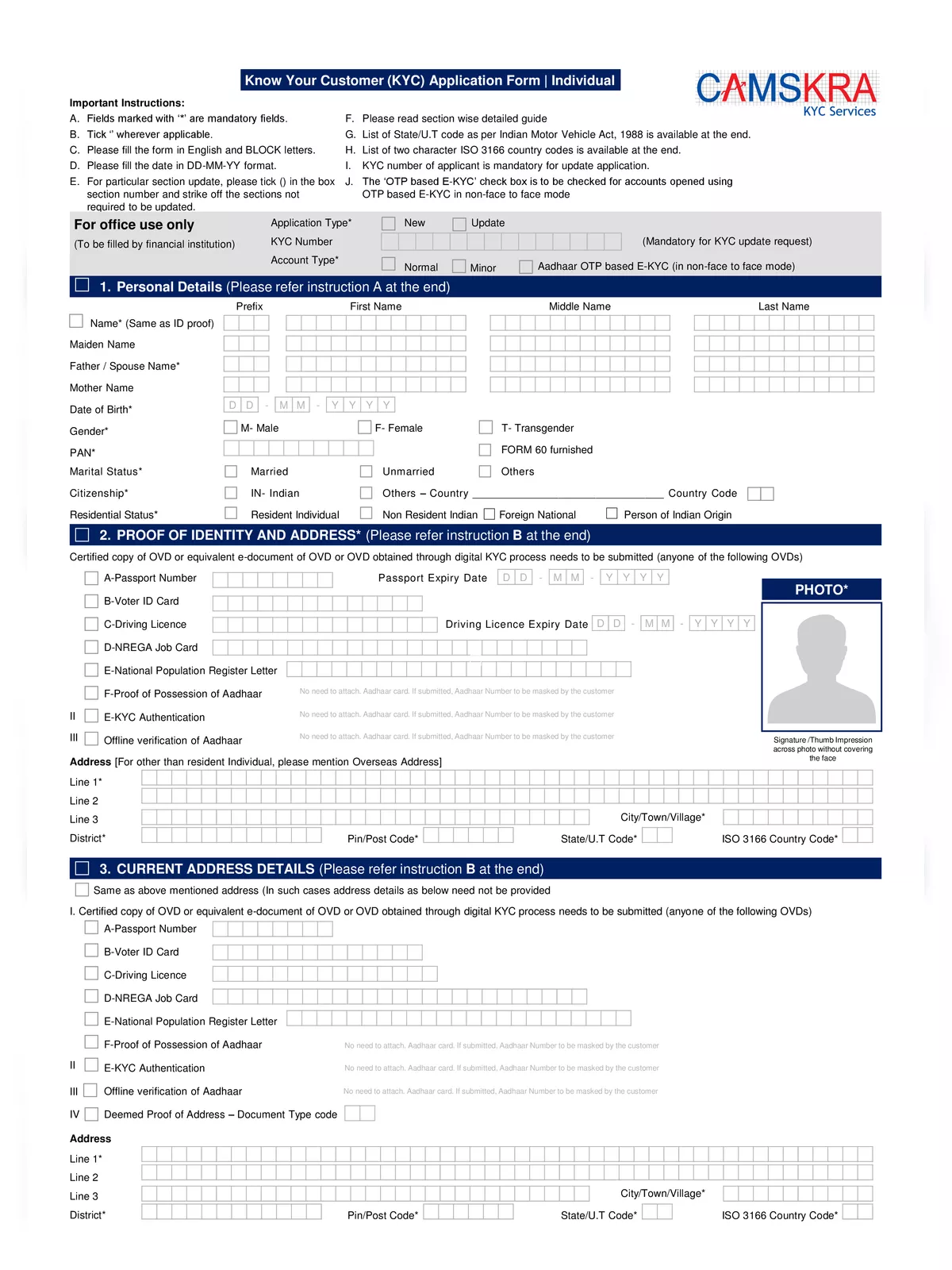

The traditional KYC process involves filling out a KYC form, signing it, and submitting additional documents for verifying your identity and address. It also requires in-person verification (IPV) and checking of original documents by an authorized person. However, CAMS eKYC completely changes this process by removing the need for paperwork and IPV. As a recognized KYC User Agency (KUA), CAMS is authorized by UIDAI to collect UIDA numbers from investors and perform KYC verification using a One Time Password (OTP).

Why Choose CAMS eKYC?

CAMS eKYC simplifies your life by saving you time and effort. The streamlined KYC process makes it quicker and easier for anyone looking to invest in mutual funds. With just a few clicks, you can complete your KYC requirements digitally without any hassle.

CAMS KYC Form Documents Required

- Copy of PAN Card of applicant.

- KYC Acknowledgment OR KYC form of applicant.

- Cancelled cheque with applicant’s name pre-printed OR Applicant’s Bank Statement/Passbook.

- Annexure-I – Bankers Attestation of Signature of the applicant Nomination Form.

You can easily download the CAMS KYC Form PDF using the link provided below. Don’t miss out on this simple way to get your KYC done!