Bank of India RTGS Form - Summary

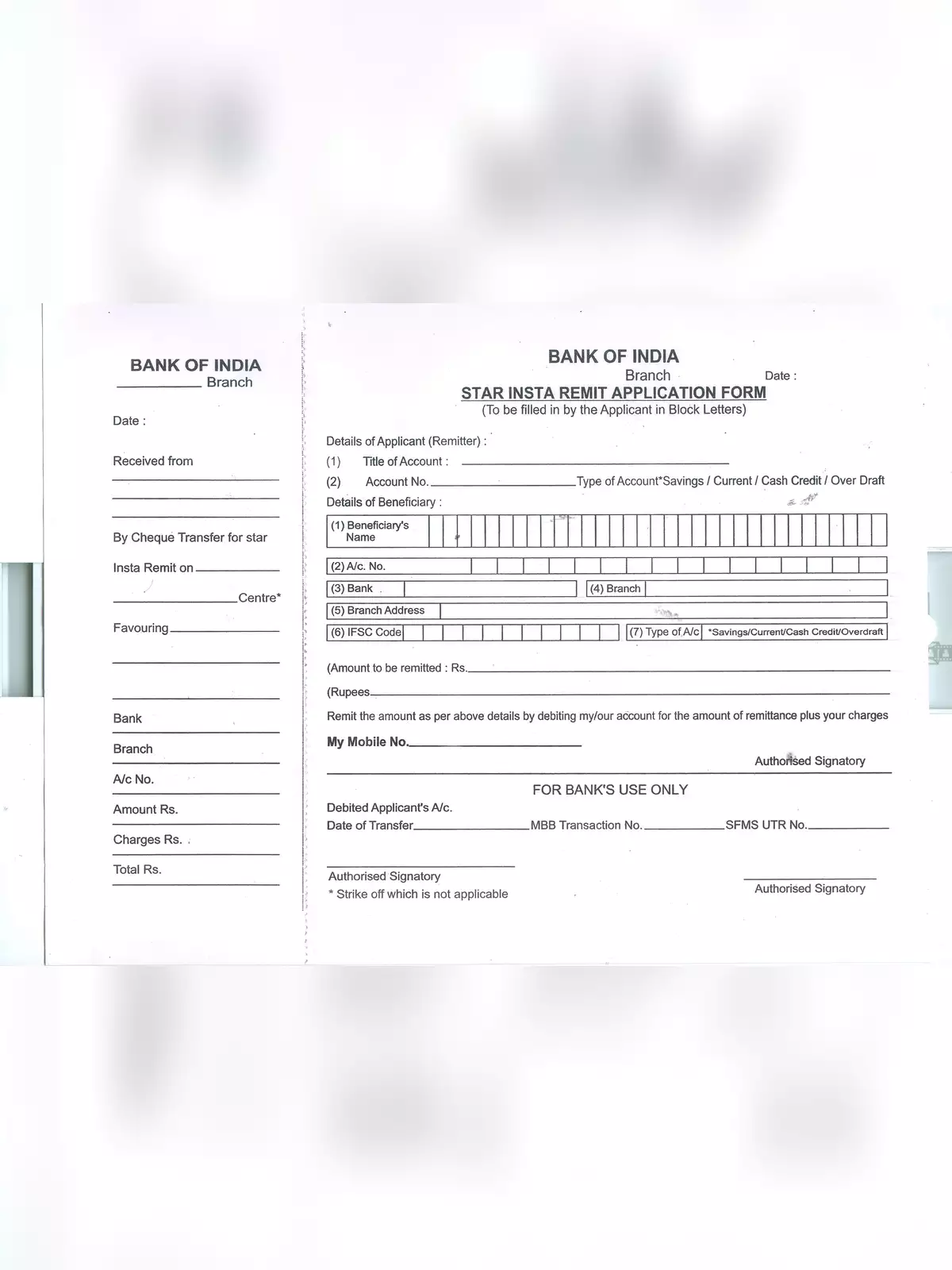

Bank of India RTGS Form is used to transfer a large amount of money from one bank account to another quickly and safely. RTGS stands for Real Time Gross Settlement, which means the money is transferred immediately without any delay. This service is mainly used for transactions above ₹2 lakh and is available during bank working hours.

By filling out the RTGS form, customers need to provide details such as their name, account number, amount to be transferred, and the receiver’s bank details. It ensures secure and direct fund transfers between banks anywhere in India. This form can be submitted at any Bank of India branch or filled online through internet banking.

Main Details for the Bank of India RTGS Form

| Type of Form | RTGS / NEFT Form |

| Bank Name | Bank of India |

| Official Website | www.bankofindia.co.in |

| Language | English |

| Purpose | Online Funds Transfer |

| Minimum RTGS Transfer Limit | ₹2 Lakhs |

| Maximum Transfer Limit | No Limit (Depends on bank’s policies) |

| Eligible Beneficiary | Bank Customers with accounts in India |

Details Needed to Fill the Bank of India RTGS/NEFT Form

To fill out your Bank of India RTGS/NEFT transaction form successfully, you will need to provide these details carefully:

- Sender Information (Details of the person sending the money):

- Your Name

- Your Account Number

- Your Bank Branch IFSC Code

- Your Bank Branch Address

- Your Account Type (Savings, Current, etc.)

- Receiver Information (Details of the person getting the money):

- Receiver’s Name

- Receiver’s Account Number

- Receiver’s Bank Branch IFSC Code

- Receiver’s Bank Branch Address

- Receiver’s Account Type

- Details of the Cheque used (if any)

- The exact Amount you want to Transfer

- Any other details the bank asks for the transaction

After filling in all the details on the Bank of India RTGS/NEFT Form, you can submit it at your nearest Bank of India branch. RTGS sends payments immediately, so the money moves almost instantly. NEFT processes transactions in batches during the day. Both are safe and common ways to transfer money electronically across India.

Before submitting the form, check all the details carefully, especially account numbers and IFSC codes, to avoid delays or errors. Using the downloadable Bank of India RTGS/NEFT Form PDF makes sure you have the right format for your offline transaction.

You can easily download the Bank of India RTGS/NEFT Form PDF using the link below to start your transaction.