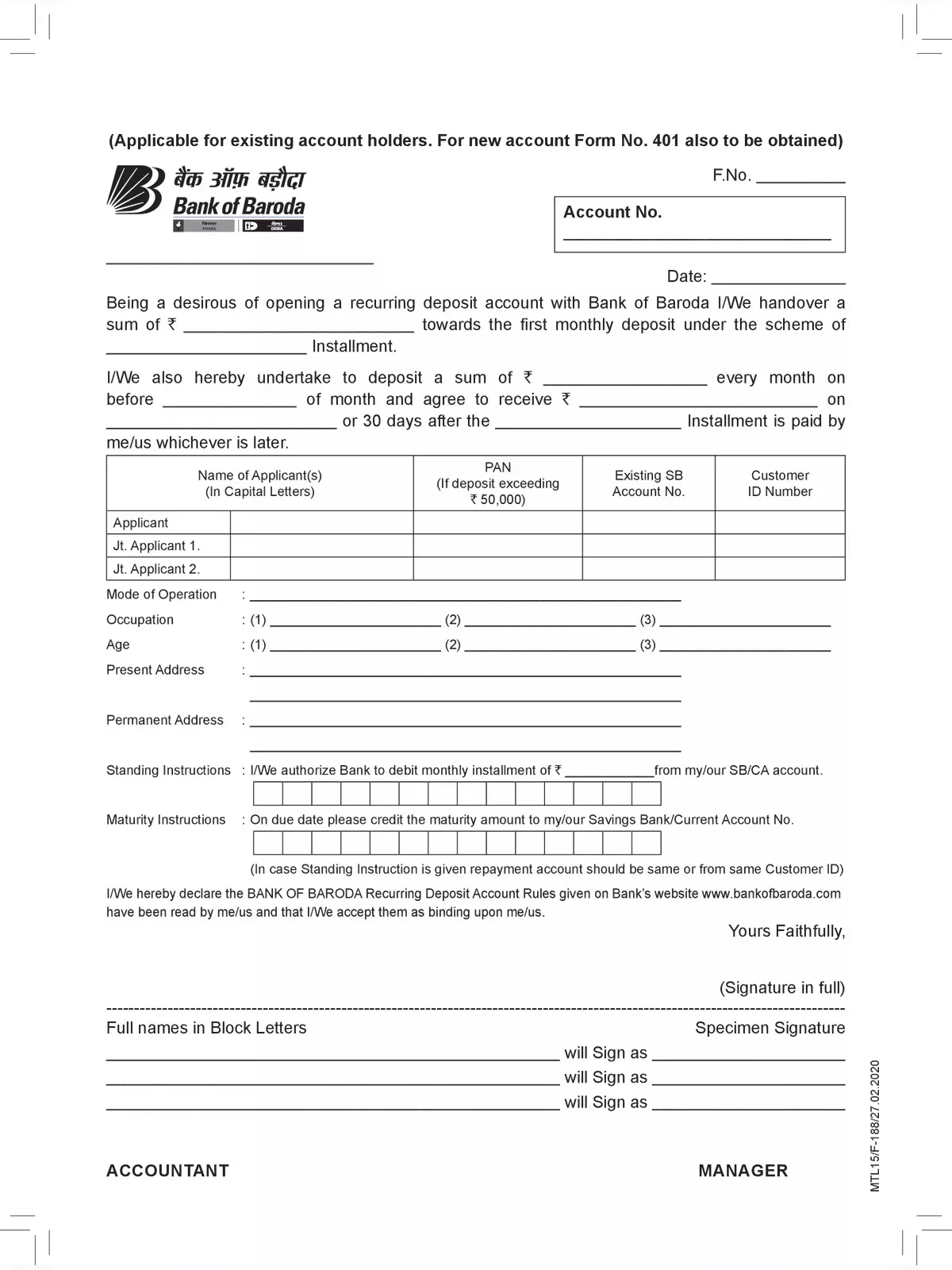

Bank of Baroda Recurring Deposit Form - Summary

This is an application form for opening a Recurring Deposit (RD) account at the Bank of Baroda. You can easily download this form in PDF format from the bank’s official website at Bank of Baroda, or you can download it directly from the link provided below.

Understanding the Benefits of the Bank of Baroda Recurring Deposit Form

Benefits of Opening a Recurring Deposit Account

- By choosing to open a recurring deposit account with Bank of Baroda, you can build a habit of saving regularly. The monthly installments on your RD account encourage you to set aside money throughout the year. One of the main advantages of recurring deposit accounts is that they typically offer higher returns on your investments compared to other financial options. This is due to the attractive interest rates associated with these schemes, which are generally better than those of regular savings accounts.

- Bank of Baroda provides a variety of recurring deposit accounts to meet your financial needs and investment goals. You can select from different recurring deposit schemes that feature varying principal amounts, monthly installments, and time frames. Our RD accounts can have tenures ranging from 6 months to 120 months, and there’s no upper limit on the amount you can invest.

- Furthermore, Bank of Baroda allows you to access a loan and overdraft facility up to 95% of your recurring deposit amount, offering assistance during times of urgent financial need.

Key Features of the Bank of Baroda Recurring Deposit Form

- Anyone can open a recurring deposit account at Bank of Baroda. The minimum monthly deposit for RD accounts is Rs.50 in rural and semi-urban branches, while in urban and metro branches, it is Rs.100. There are no limits on how much you can deposit monthly in these accounts.

- The tenure for recurring deposit accounts ranges from 6 months to 120 months and is fixed when you open your RD account. If you require funds urgently, you can also opt for premature withdrawal. However, be aware that closing your recurring deposit early might come with a penalty.

- We offer attractive interest rates on recurring deposits, which are based on the maturity period of the deposit. The interest on these accounts is compounded quarterly and paid out when the RD matures.

- Bank of Baroda provides a nomination facility for recurring deposit accounts to ensure your loved ones are protected.

Maturity proceeds will be credited to the savings or current account of the customer. If there are no operational accounts, maturity proceeds below Rs.20,000 can be given in cash, while amounts above this will be issued through a Demand Draft or Pay Order. Minor accounts can be opened for individuals aged 10 and above, subject to a maximum limit of Rs.1,00,000/-.

Download the Bank of Baroda Recurring Deposit Form in PDF format using the link below or explore alternative links for more details.