Axis Bank Re-KYC Form for Non-Individual Current & Savings Account - Summary

This Axis Bank Re-KYC Form is essential for non-individuals to complete the KYC process for their Current and Savings accounts. Account holders can conveniently obtain this form at their nearest Axis branch or download it using the provided link below.

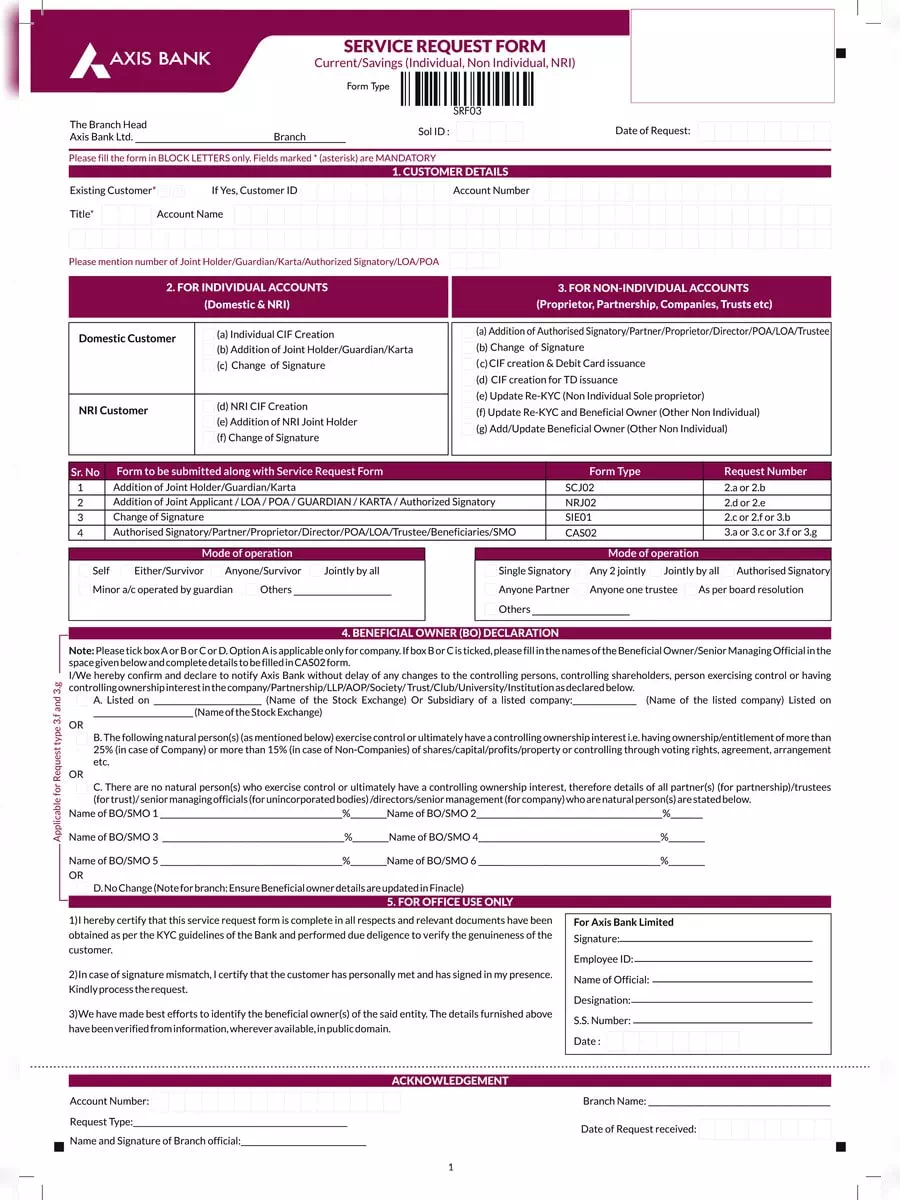

How to Fill Out the Axis Bank Re-KYC Form

In this form, you need to fill in important details like the Name of the account holder, Customer ID, Account Number, Address, and other necessary information. Once you have carefully completed the form, submit it to the Axis Bank branch where your account is held.

Documents Required for Re-KYC Form (Axis Bank)

- Registration certificate (for registered concerns).

- Certificate/license from Municipal authorities under the Shop & Establishment Act.

- Sales, GST returns, and income tax returns.

- GST/CST/VAT certificate.

- Certificate/registration document from Sales Tax/Service Tax/Professional Tax authorities.

- PAN Card of the entity.

- The complete Income Tax return (not just the acknowledgment) in the name of the sole proprietor, showing the firm’s income and duly authenticated/acknowledged by Income Tax Authorities.

KYC stands for Know Your Customer. Investors wishing to invest in market securities must complete the KYC process. This involves filling out the KYC form and submitting it to a SEBI-registered intermediary like Asset Management Companies or banks, along with the necessary KYC documents to become KYC compliant.

Download the Axis Bank Re-KYC Form for Non-Individual Current & Savings Account in PDF format using the link provided below. This PDF makes it easy for you to access and fill out the form required for the KYC process.