Atal Pension Yojana (APY) Closure Form - Summary

Atal Pension Yojana (APY) Closure Form is used when a subscriber wants to close or exit their APY account. This form is submitted to the bank or post office where the APY account was opened. Closing the account may happen due to reasons like reaching the age of 60 years, voluntary exit before 60, or the death of the subscriber

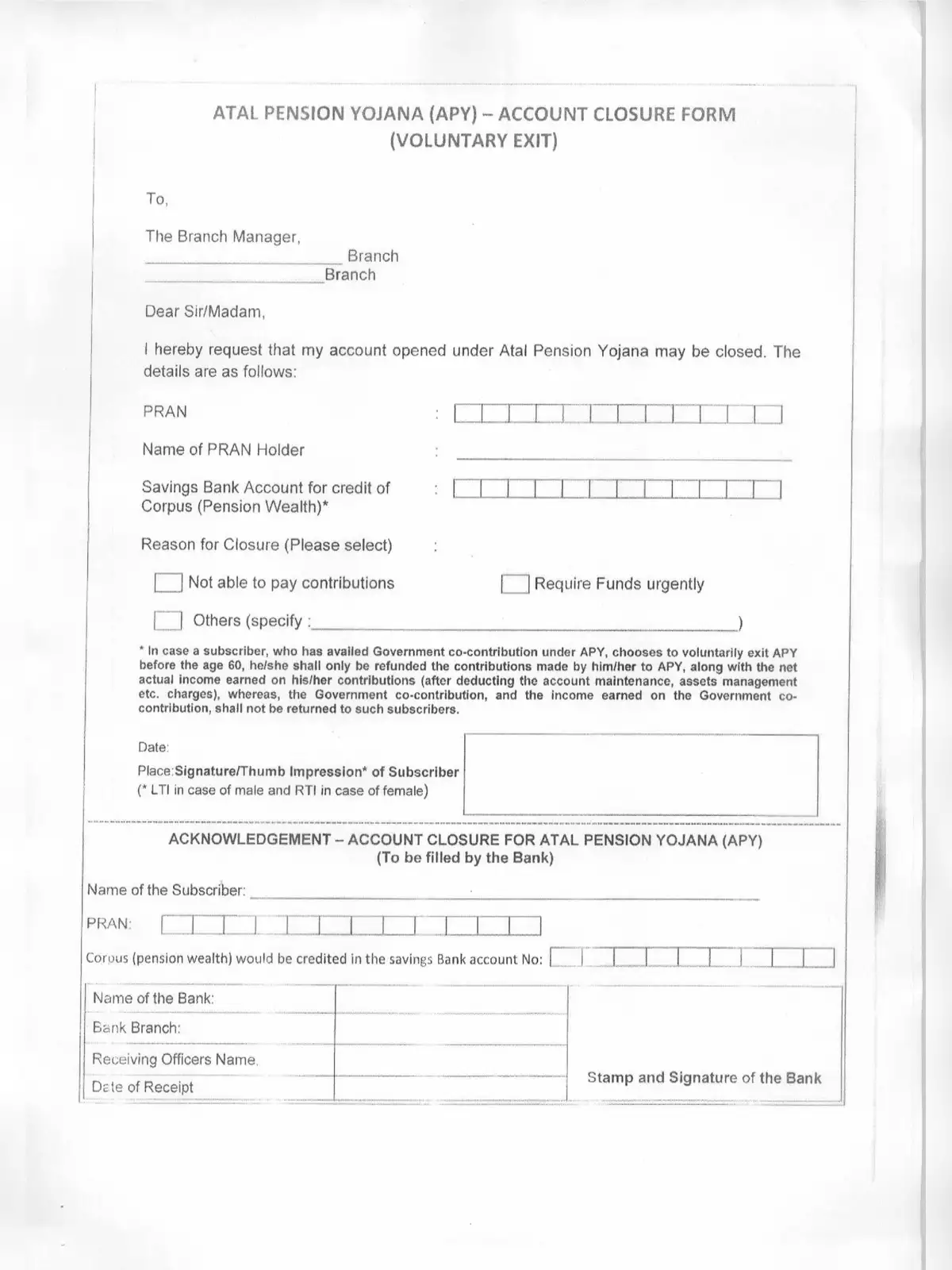

Through this form, the subscriber or nominee can request the settlement of the pension or refund of the balance amount. The form includes personal details such as the APY account number, bank details, and reason for closure. It ensures a smooth process for account closure and helps the authorities transfer the eligible amount properly.

Rules for Exit from Atal Pension Yojana (APY)

- Exit after 60 years of age:

- The subscriber can exit after turning 60 years.

- The pension amount (₹1000 to ₹5000 per month) will start as per the chosen plan.

- Voluntary exit before 60 years:

- Allowed only in exceptional cases like serious illness or financial emergency.

- The subscriber will get only the contribution amount plus interest, but not the government co-contribution.

- Exit in case of death:

- If the subscriber dies, the spouse will get the same pension amount.

- After the spouse’s death, the nominee will receive the accumulated corpus.

- Premature closure (other than death):

- Allowed only if the scheme rules are followed.

- The exit request must be submitted using the APY Closure Form at the bank or post office.

Steps to Close Your Atal Pension Yojana Account

Closing your Atal Pension Yojana account is easy if you follow the right steps:

- Go to the bank branch where your APY account is linked.

- Ask for the Atal Pension Yojana Account Closure Form.

- Fill out the form carefully with all required details and submit it to the bank staff.

- Wait for the bank to process your application; the time may vary based on the bank.

- After approval, the money along with any accumulated interest will be transferred to your bank account, and you will get confirmation from the bank.

How to Withdraw Your Pension After Age 60

Once you turn 60 years old, you can start withdrawing your pension amount from the Atal Pension Yojana scheme. You have the option to receive the guaranteed minimum monthly pension or get a higher pension if your investment yields more. This ensures you get the best benefit possible.

In case of the subscriber’s death, the spouse who is the legal nominee will receive the monthly pension without any change. If both the member and spouse pass away, the pension will go to the nominee chosen by the subscriber.

If you want to officially close your APY account today, just download the Atal Pension Yojana Account Closure Form PDF available on the website and follow the instructions carefully. 😊