Bank of Maharashtra RTGS From - Summary

Understanding RTGS and NEFT

RTGS (real time gross settlement) and NEFT (national electronic funds transfer) are important electronic payment systems that enable individuals to transfer funds between banks. The fund transfer under NEFT is settled in batches, unlike the real-time settlement process in RTGS.

What is RTGS?

RTGS is a system that allows you to transfer large amounts of money from one bank to another instantly. This means that when you use RTGS, the money is transferred at that very moment. It’s perfect for urgent transactions, especially when you need to send money for things like business deals or property purchases.

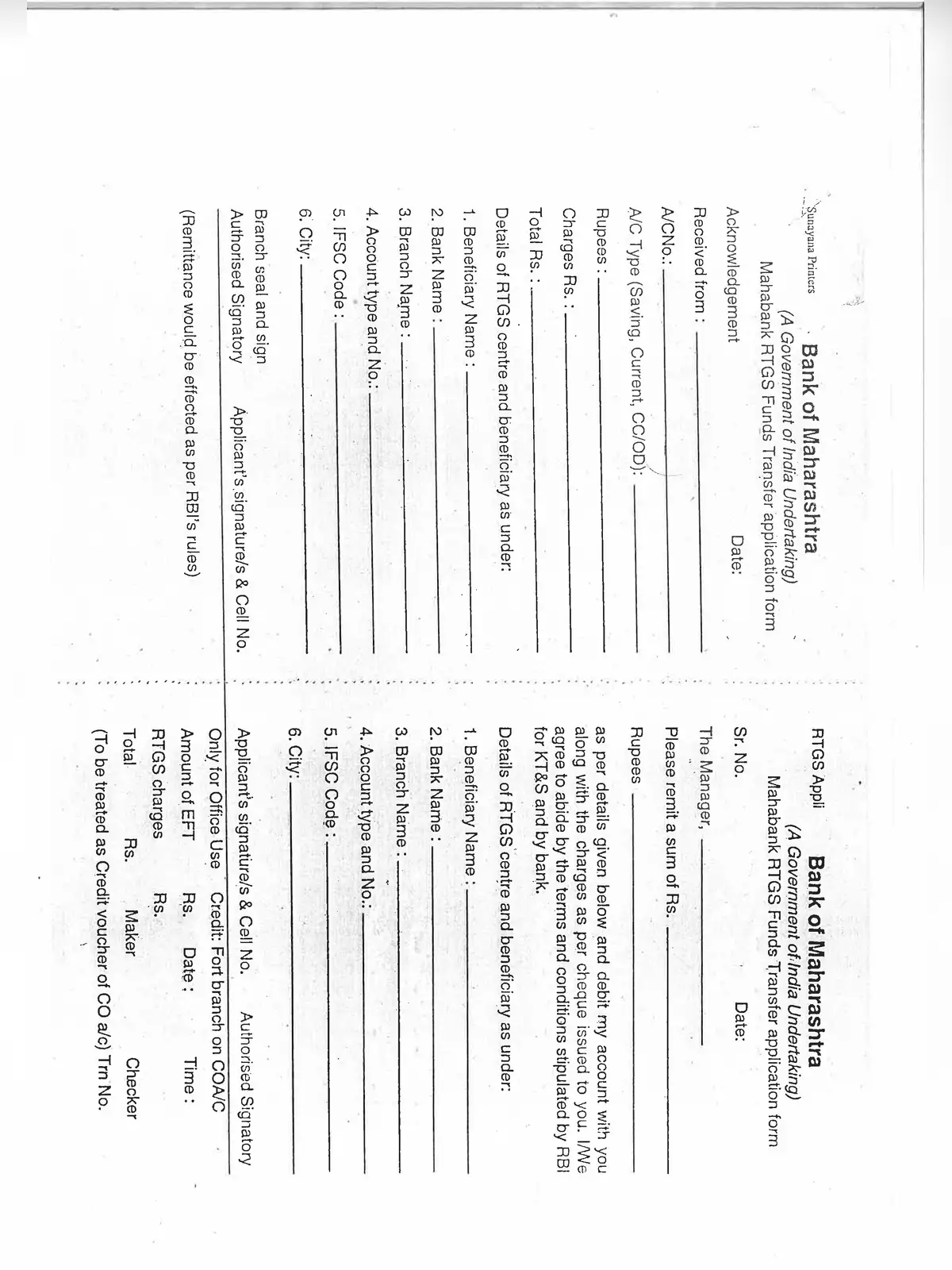

RTGS transactions have a minimum limit, so it is mainly used for high-value transfers. It is crucial to ensure that you have all the details right, such as the beneficiary’s bank account number, IFSC code, and other necessary information.

The Difference Between RTGS and NEFT

While both RTGS and NEFT are designed for fund transfers, they work differently. As mentioned earlier, RTGS deals with real-time transfers, providing immediate credit to the receiver’s account. On the other hand, NEFT processes transactions in batches, and this means there can be a delay before the money reaches the recipient.

Both systems are safe and reliable. They are used widely across India for making payments, whether for personal or business needs.

You can learn more about the procedures and benefits of using these systems in the detailed PDF. With the convenience of modern banking, sending money has never been easier. Whether you need to make a quick payment or settle a bill, understanding RTGS and NEFT is essential.

Don’t forget to check out our PDF for a comprehensive guide on Bank of Maharashtra RTGS and make your transactions smooth and efficient.