PF Declaration Form 11 - Summary

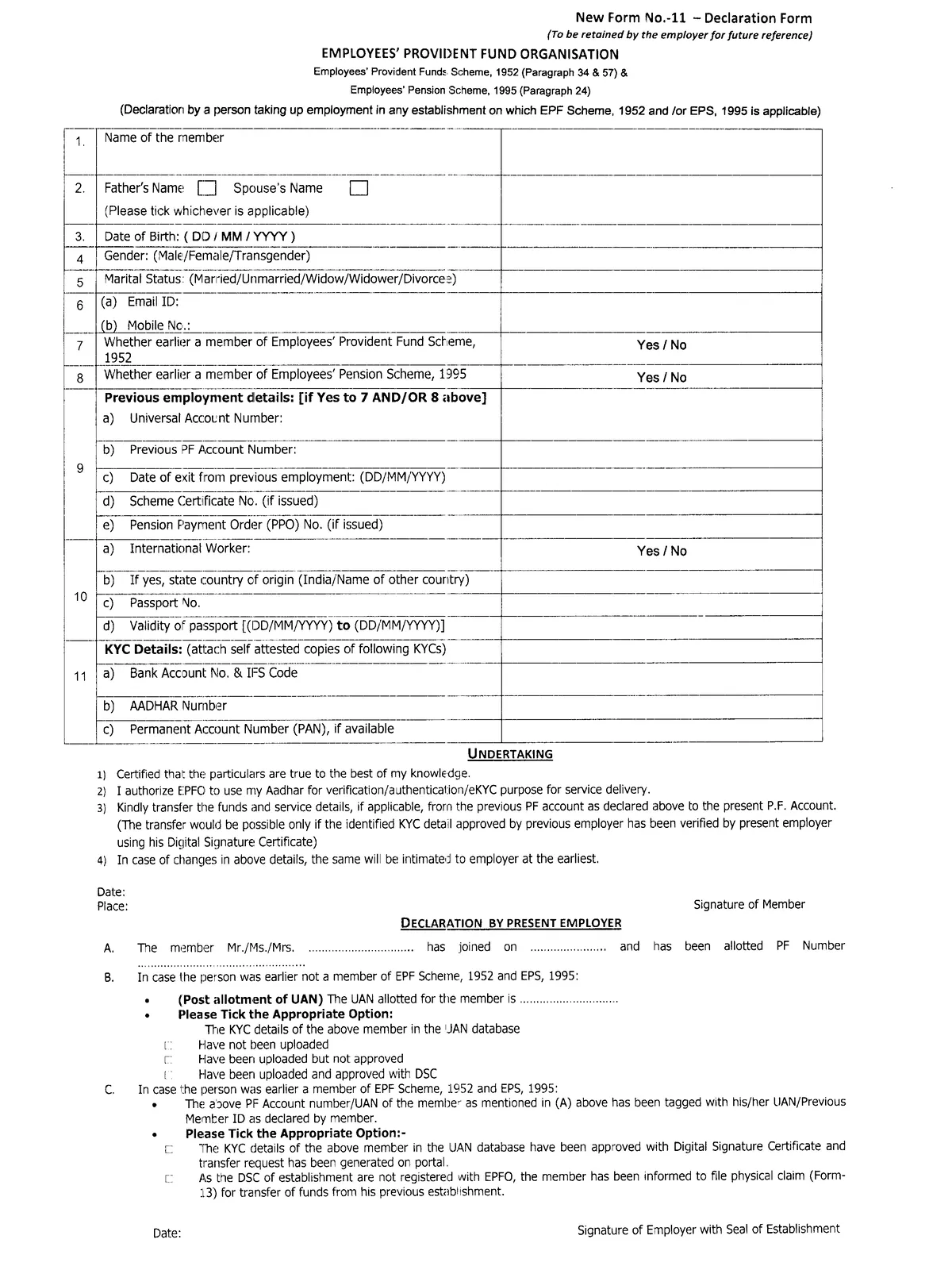

PF Declaration Form 11 is a document used by employees when they join a new job. It is mainly related to the Provident Fund (PF) account, which is a savings scheme for employees to secure their future. This form collects details like the employee’s PF account number, Universal Account Number (UAN), previous employment details, and whether they were part of the PF scheme earlier. Submitting Form 11 helps the new employer link the employee’s PF account with the new job.

The purpose of PF Declaration Form 11 is to make sure that all PF details of an employee are properly recorded and transferred without any problem. It also helps in avoiding the creation of multiple PF accounts for one person. Filling and submitting this form is compulsory for employees who are eligible for PF benefits. By using Form 11, both the employer and employee can ensure smooth management of PF contributions and savings.

Uses of PF Form 11:

- To declare previous PF membership details

- To transfer old PF balance to the new employer

- To help EPFO link the UAN correctly

- To ensure employee is covered under PF and pension scheme

- To avoid multiple UANs for one employee