NPS Vatsalya Form - Summary

NPS Vatsalya is a new initiative under the National Pension System designed for long-term investments by parents and guardians on behalf of their minor children.

The Pension Fund Regulatory and Development Authority (PFRDA) manages the scheme, which aims to assist families in planning for their children’s financial future as early as possible.

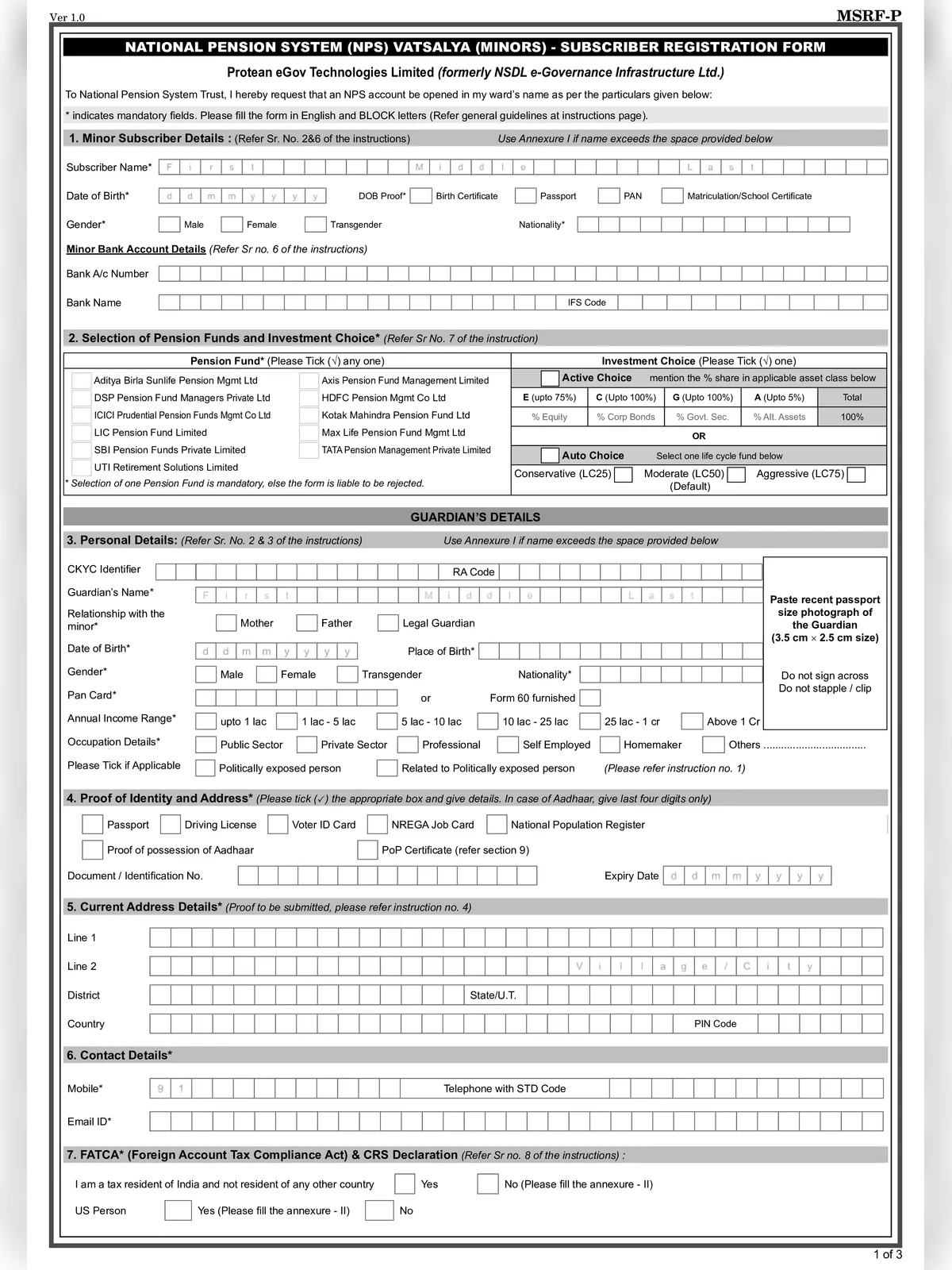

How to open NPS Vatsalya’s online platform (eNPS)?

To open an NPS Vatsalya account online, follow these steps:

- Visit the eNPS Portal: Go to the official eNPS website, which will host the NPS Vatsalya scheme.

- Select the NPS Vatsalya Option: Look for the option to apply for the NPS Vatsalya scheme specifically designed for minors.

- Complete Registration: Fill out the necessary details, including the minor’s information and guardian’s KYC details.

- Upload Documents: Provide required documents such as proof of identity and address for the guardian and proof of age for the minor.

- Make Initial Contribution: Ensure a minimum annual contribution of ₹1,000 is made during registration.

- Receive PRAN Card: After successful registration, a Permanent Retirement Account Number (PRAN) card will be issued for the minor subscriber.

Required Documents for NPS Vatsalya Scheme

- Proof of Identity for Guardian: This can include an Aadhaar Card, PAN Card, Passport, or Driving Licence.

- Proof of Address for Guardian: Any official document that verifies the current address.

- Proof of Age for Minor: A Birth Certificate or any government-issued document that confirms the date of birth of the child.

- Identity Proof for Minor: An Aadhaar Card is recommended if available.

- Contact Information: A valid mobile number and email ID for registration and communication.

- Photographs: Recent passport-size photographs of the guardian.