HDFC RETIREMENT SAVINGS FUND Scheme - Summary

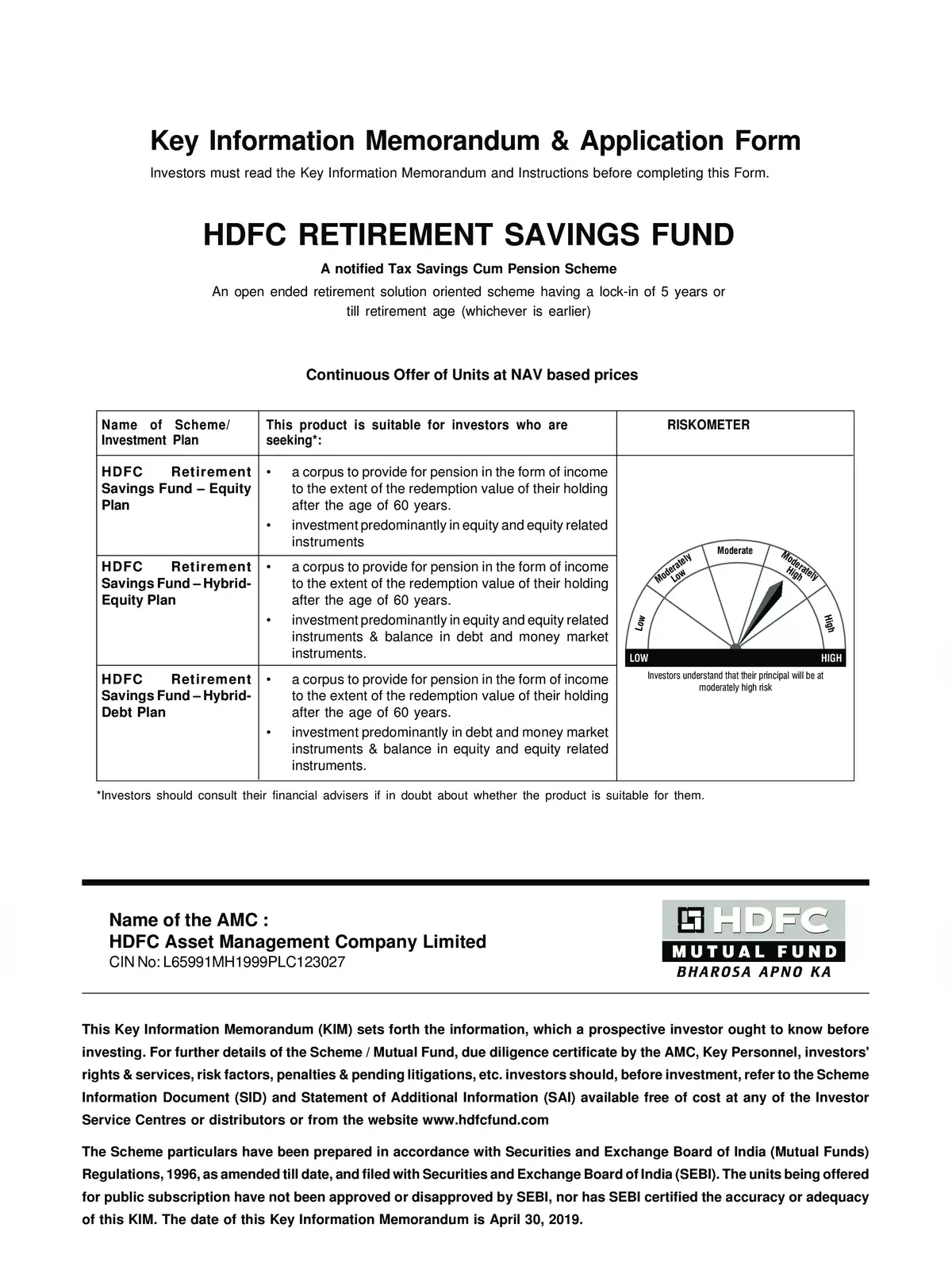

The HDFC Retirement Savings Fund scheme is a notified tax savings and pension scheme that stands out in providing a smart retirement solution while also offering tax benefits. This open-ended scheme comes with a lock-in period of 5 years or until you reach retirement age, whichever comes first. This feature grants flexibility, making it a preferred choice for individuals eager to plan a secure financial future.

Key Features of HDFC Retirement Savings Fund

One of the notable aspects of the HDFC Retirement Savings Fund is its dual benefit of helping you save for retirement and enjoy tax savings at the same time. Here’s why this scheme can be an appealing option for you:

- Tax Benefits: By investing in this fund, you can claim deductions under Section 80C of the Income Tax Act, helping you save more.

- Lock-in Period: The required lock-in period enables your funds to grow for a substantial time, supporting long-term wealth creation and stability.

- Flexible Options: You have the freedom to choose from various investment options based on your risk appetite and financial goals.

How to Download the HDFC Retirement Savings Fund PDF

For comprehensive insights into this scheme, including its benefits, performance, and investment choices, you can easily download the HDFC Retirement Savings Fund PDF from our website. Simply click the link below to get your copy and kickstart your retirement planning!

Note: Knowing your options is crucial for a secure financial future. Be sure to review the HDFC Retirement Savings Fund to see how it aligns with your retirement strategy.

Are you ready to take the next step? Download the PDF now and empower your retirement plans!