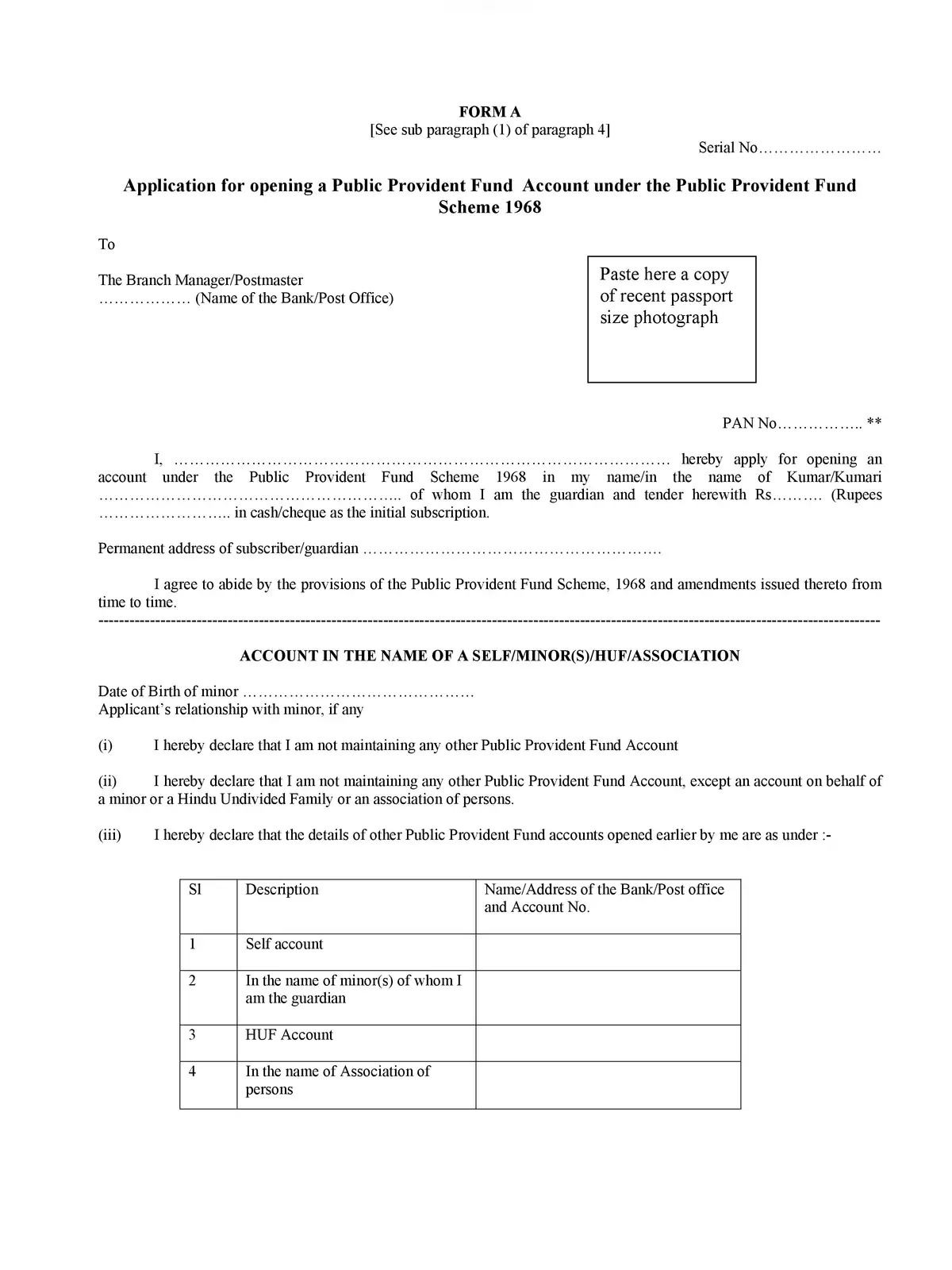

Post Office PPF Account Opening Form - Summary

The Public Provident Fund (PPF) is a popular savings plan in India that provides guaranteed returns and tax benefits. To make the PPF more accessible to everyone, especially in remote areas, the government allows customers to open a PPF account through India Post Offices. This initiative makes it easier for people to save for their future.

In terms of key features, interest rates, and other requirements, a Post Office PPF account is the same as one opened at a public or private bank. The procedure to open a PPF account at a post office is simple and requires similar documentation. Here’s everything you need to know about the Post Office PPF account opening form and the procedure involved.

Eligibility

A PPF account can be opened at a post office by any resident Indian. This includes salaried individuals, self-employed persons, pensioners, and more.

An individual can only have one PPF account, which also includes post office PPF accounts, and joint accounts are not allowed.

A parent or guardian can open a PPF account on behalf of a minor child at a post office, but this is limited to one PPF account for each child.

Non-residents cannot open new PPF accounts. However, if a resident Indian becomes an NRI before their PPF account matures, they can continue to manage the account until its maturity.

Documents Required

- Identity Proof

- Pan Card

- Address Proof

- Photograph

- Nomination Form – Form E

Interest Rates

The interest rates for PPF accounts are consistent across all post offices and banks that offer this scheme, as it is supported by the Government of India. For the second quarter of FY 2021-22, the current interest rate for post office PPF accounts is 7.1 percent.

If you’re interested in understanding more, you can easily download the PPF account opening form as a PDF from our website! This will help guide you through the process even further. Don’t forget to save it for future reference! 📄