PNB Demand Draft Form - Summary

DD number or draft number is a unique serial number printed on the bottom left of the draft. This important DD number functions like a cheque number and is essential for tracking your demand drafts. Each bank, including PNB, has its own series of DD numbers, which may seem unimportant at first, but they can be very helpful if your draft is lost or stolen.

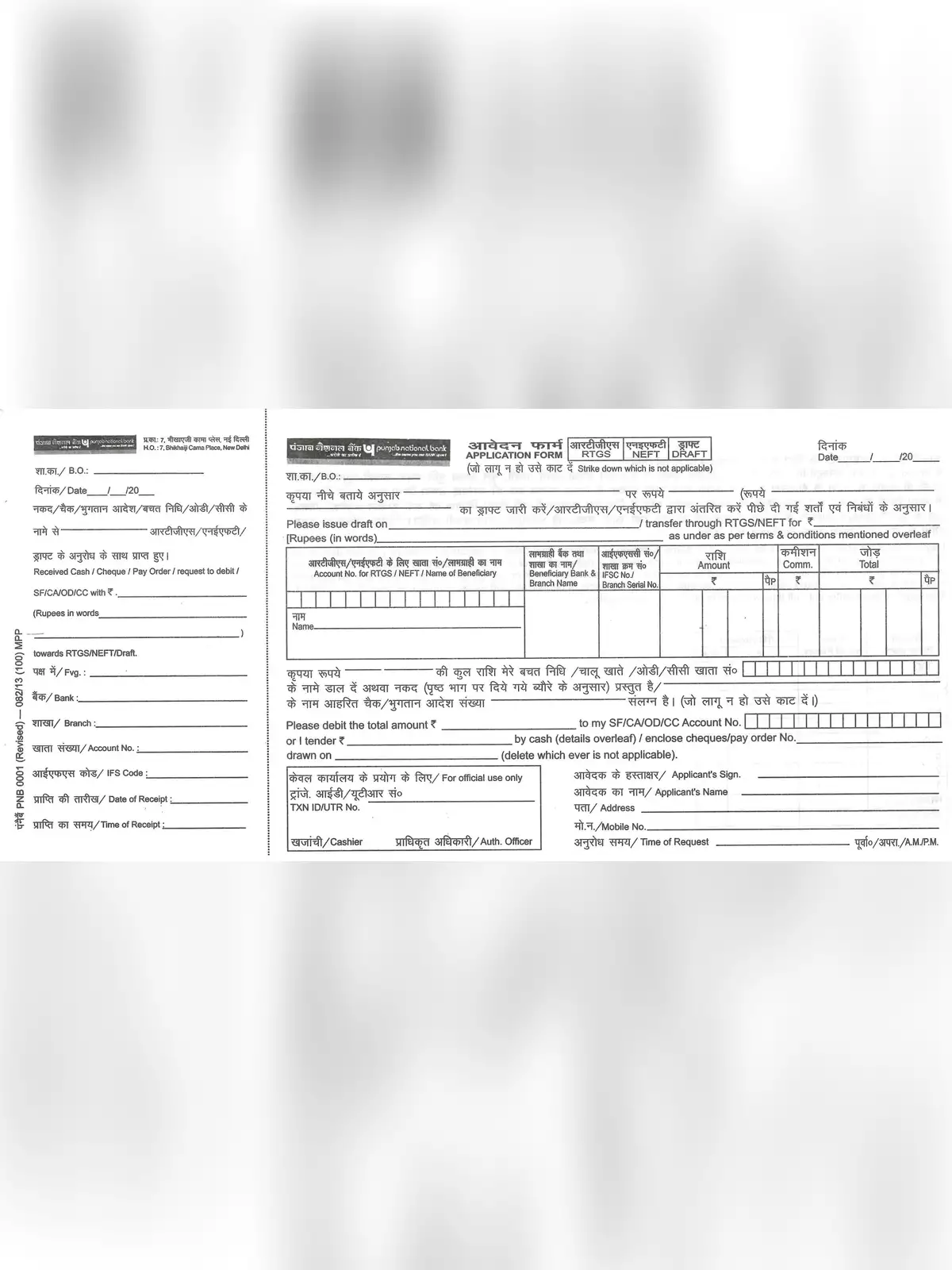

In India, customers can remit funds from one place to another using various methods like RTGS, NEFT/EFT, and Demand Drafts by paying the specified charges. You can easily download the PNB Demand Draft Form in PDF format using the link provided at the bottom of this page.

PNB Demand Draft Form Download

When you are requesting a Demand Draft of Rs 50,000/- and above, it is important to note that banks will only issue them by debiting the customer’s account or against cheques or other instruments submitted by the purchaser. Cash payments for amounts of Rs 50,000/- and above are not accepted, and these transactions must go through proper banking channels.

Before accepting the drafts, please make sure to check that the draft is complete. This includes verifying the signatures of the official(s) along with their specimen signature numbers in the designated area.

The drafts can be revalidated by the payee(s) if they are recognized as the rightful holder. However, remember that the revalidation is only allowed once within one year from the date of issue. After one year, drafts must be canceled at the issuing branch, and a fresh draft can be obtained by paying the required service charges.

If you need a duplicate demand draft, the bank will issue it to the customer within two weeks of the request. In case there is any delay beyond this period, the bank will compensate the customer with interest at the rate applicable for a fixed deposit of the same maturity.

Don’t forget to download the PNB Demand Draft Form in PDF format using the link below. 📄