SBI Unclaimed Deposits List - Summary

SBI Unclaimed Deposits refers to deposits that typically include dormant accounts, fixed deposits, savings accounts, and other financial assets where the account holders have not accessed their funds for a prolonged period. SBI Unclaimed Deposits List 2023 serves as a public record of such unclaimed deposits, allowing individuals to search and claim their rightful funds. It is an effort by SBI to reunite customers with their forgotten or overlooked assets.

According to the Reserve Bank of India (RBI), as of February 2023, Public Sector Banks (PSBs) have transferred a total of Rs. 35,012 crore in unclaimed deposits to the RBI. This amount represents deposits that have not been operated for a period of 10 years or more. Dr. Bhagwad Karad, Union Minister of State in the Ministry of Finance, provided this information in a written reply to a query in the Lok Sabha on April 3. The disclosure highlights the significant sum of unclaimed funds held by PSBs, emphasizing the importance of reuniting these funds with their rightful owners through proper procedures and awareness campaigns.

SBI Unclaimed Deposits List 2023 – Overview

| Bank Name | State Bank of India |

| Article | SBI Unclaimed Deposits List |

| Purpose | Promoting financial literacy and awareness among depositors |

| Benefit | Unclaimed deposits will be put to productive use |

| Total Amount transferred | 13,274 crore |

| Direct Link to Check SBI Unclaimed Deposits List 2023 | Check Here |

| Official Website | https://sbi.co.in |

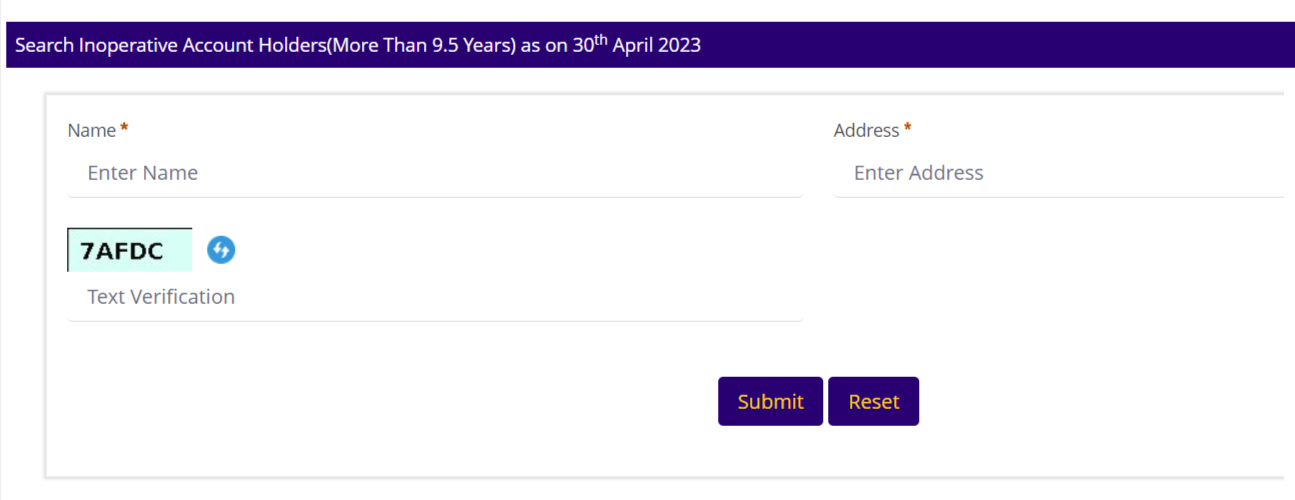

SBI Unclaimed Deposits List – How to Download

Step 1: First visit the official website of the SBI Bank at https://sbi.co.in and then click on the “Customer care section” which is shown on the top of the home page of the website.

Step 2: Now check the name of the account holder and address in the list of unclaimed deposits by SBI. Enter your name, address, and text verification captcha, and click on the submit button as in the image shown is below.

Step 3: Visit the SBI branch in which you have an account and submit the “Claim Form” after filling all required fields with your signature. You have to show your passbook, deposit receipts, recent photographs and valid identity proof, and all relevant original documents.

Step 4: SBI Branche will directly process the application for payment of the unclaimed deposit

and pay the amount after due diligence and KYC compliance.

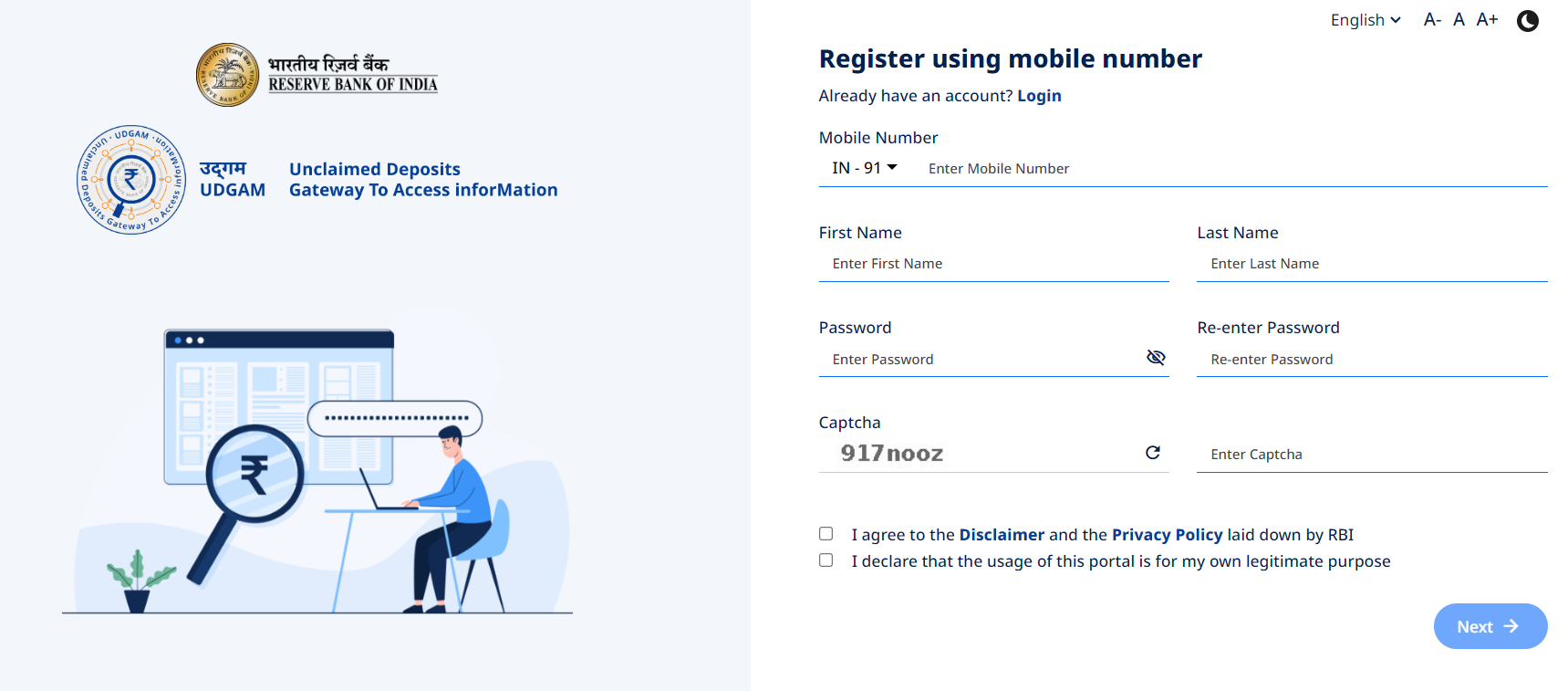

How to Check the SBI Unclaimed Deposit List at RBI UDGAM Portal

Step 1: First visit UDGAM Portal by RBI at https://udgam.rbi.org.in. or direct link https://udgam.rbi.org.in/unclaimed-deposits/#/register

Step 2: On the home page of the official website you have to enter the registered mobile number as the image shown below.

Step 3: Click on the register button enter your mobile number, name, and captcha, and then click the next button. Now enter OTP send at your mobile number and click on the register button.

Step 4: Now login to the Udgam portal with your registered mobile number and password.

Step 5: You can search SBI unclaimed deposits list by entering name of account holder and selecting name of bank as State Bank of India or directly by entering PAN card number or Voter ID or Driving Number or Passport Number and Date of Birth.

Documents Required to Claim SBI Unclaimed Deposit

- Passbook/Term Deposit/Special Term Deposit Receipts

- Statements of account

- Valid Identity proof

- Date of Birth

- PAN Number

- Passport Number

- Recent photographs

- Address proof documents

- Customer Acknowledgment Slip

- Copy of death Certificate of the account holder (if claimed by the legal heir/ Nominee)

Unclaimed Deposit Amount Bank Wise

| Bank Name | Unclaimed Deposit Amount in Crores |

|---|---|

| Bank of Baroda | 3,904 |

| Bank of India | 2,557 |

| Bank of Maharashtra | 838 |

| Canara Bank | 4,558 |

| Central Bank of India | 1,240 |

| Indian Bank | 2,445 |

| Indian Overseas Bank | 1,790 |

| Punjab & Sind Bank | 494 |

| Punjab National Bank | 5,340 |

| State Bank of India | 8,086 |

| UCO Bank | 583 |

| Union Bank of India | 3,177 |

| Total | 35,012 |

You can download the SBI Unclaimed Deposite List PDF using the procedure mentioned above.