PNB RTGS Form 2026 - Summary

PNB RTGS form is a document provided by Punjab National Bank to transfer money from one bank account to another using the RTGS (Real Time Gross Settlement) system. This service is mainly used for sending large amounts of money, usually above ₹2 lakh, in a fast and secure way. By filling out the RTGS form, customers can give details like the sender’s account number, the receiver’s account number, IFSC code, and the amount to be transferred.

The RTGS system is very safe and quick because the money is transferred directly from one bank to another in real-time. The PNB RTGS form helps customers make sure that all the important details are written correctly before the bank processes the transaction. This makes the process simple, reliable, and useful for people or businesses who want to send big payments without delay.

PNB RTGS Form – How to Use

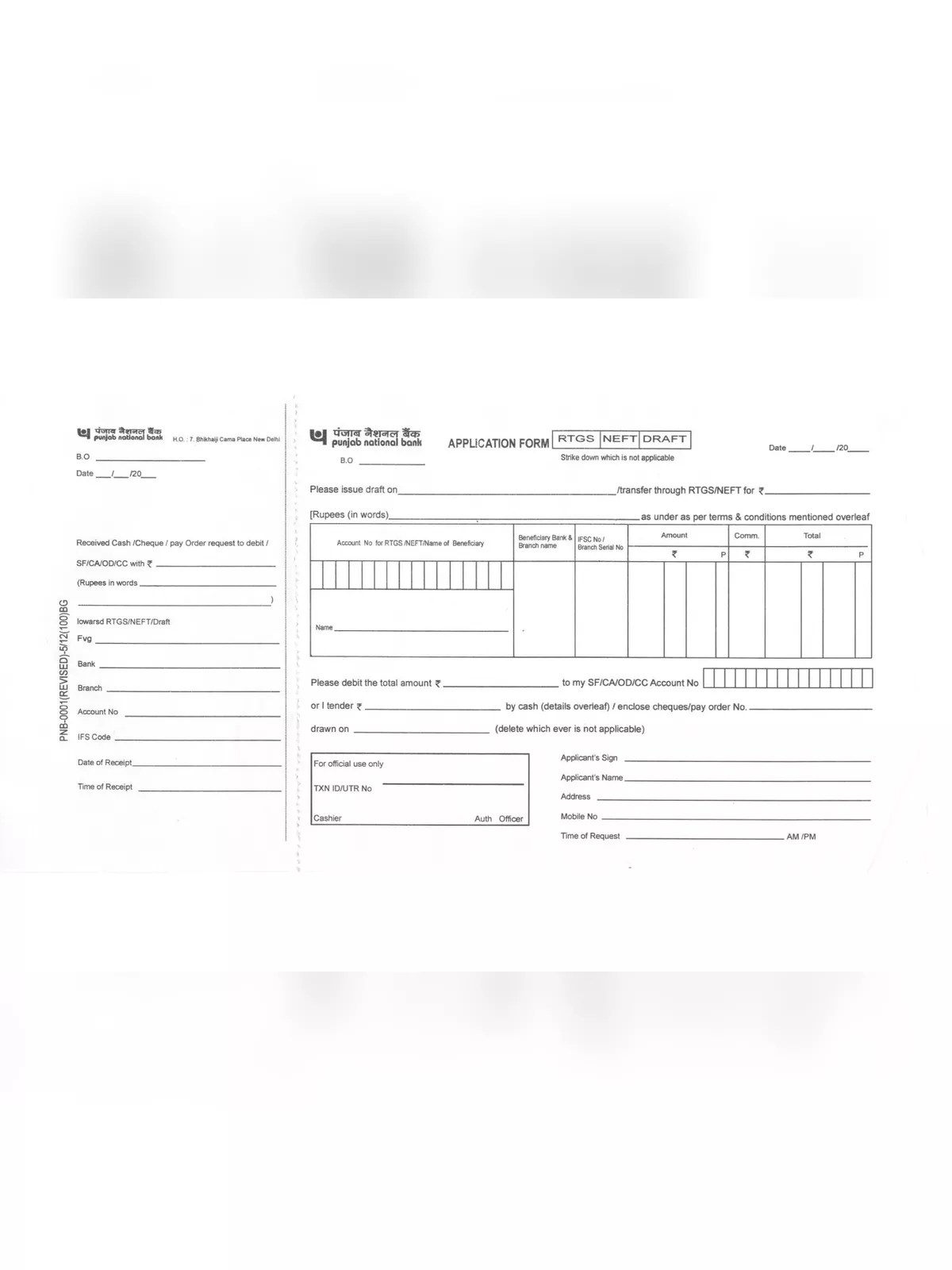

Download PNB NEFT RTGS Form PDF: Applicants may obtain this form from the nearest branch of PNB Bank or the bank’s official website i.e. https://www.pnbindia.in. This PNB RTGS NEFT from PDF can also be directly downloaded using the link given below at the bottom of this page.

Details to be Mentioned in RTGS NEFT Form: Amount to be remitted, Account no. to be debited, Name of the beneficiary bank, Name of the beneficiary customer, Account no. of the beneficiary customer, Sender to receiver information, if any.

Submit the form: After carefully filling this form and attaching the necessary documents, submit the form to the PNB bank branch in which you have an account.

PNB RTGS (NEFT) Timing

Time Schedule: (Change In RTGS Timing Wef. 26.08.2019, Change In NEFT Timing Wef. December 16, 2019)

| Service Type | Remittance Type | Start Time | End Time |

|---|---|---|---|

| Retail Internet Banking | NEFT | 24*7 | 24*7 |

| RTGS | 7:00 a.m. | 6:00 p.m. | |

| Mobile Banking | NEFT | 24*7 | 24*7 |

| Corporate Internet Banking | NEFT | 24*7 | 24*7 |

| RTGS | 7:00 a.m. | 6:00 p.m. | |

| Branch (Within Working Hours) | NEFT | Within Working Hours | Within Working Hours |

| RTGS | 7:00 a.m. | 6:00 p.m. |

Service Charges For NEFT Are As Follows

| Payment System | Revised Charges | |

|---|---|---|

| NATIONAL ELECTRONIC FUNDS TRANSFER (NEFT) | ||

| Inward Transactions | Free | |

| Outward Transactions | ||

| Transaction Value | From Branch | From IBS/ MBS |

| Up to Rs.10000/- | Rs.2.00 | NIL |

| Above Rs.10000/- to 100000/- | Rs.4.00 | |

| Above Rs.100000/- to 200000/- | Rs.14.00 | |

| Above Rs.200000/- | Rs.24.00 | |

Note: RTGS systems work on all days except on Sundays & holidays (declared by RBI). However, NEFT will be available 24*7

PNB NEFT RTGS Form – Highlights

| Type of Form | RTGS NEFT Application Form |

| Name of Bank | PNB (Punjab National Bank) |

| Official Website | https://www.pnbindia.in |

| Uses of Form | Online Transfer of Funds |

| Minimum Limit | The minimum limit is Rs. 2 lakhs for RTGS, No minimum limit for NEFT |

| Maximum Limit | No limit |

| Beneficiary | Bank Customers |

| Form Language | English, Hindi |

Download the PNB RTGS/NEFT Form in PDF format using the link given below.