New Tax Regime Exemption List - Summary

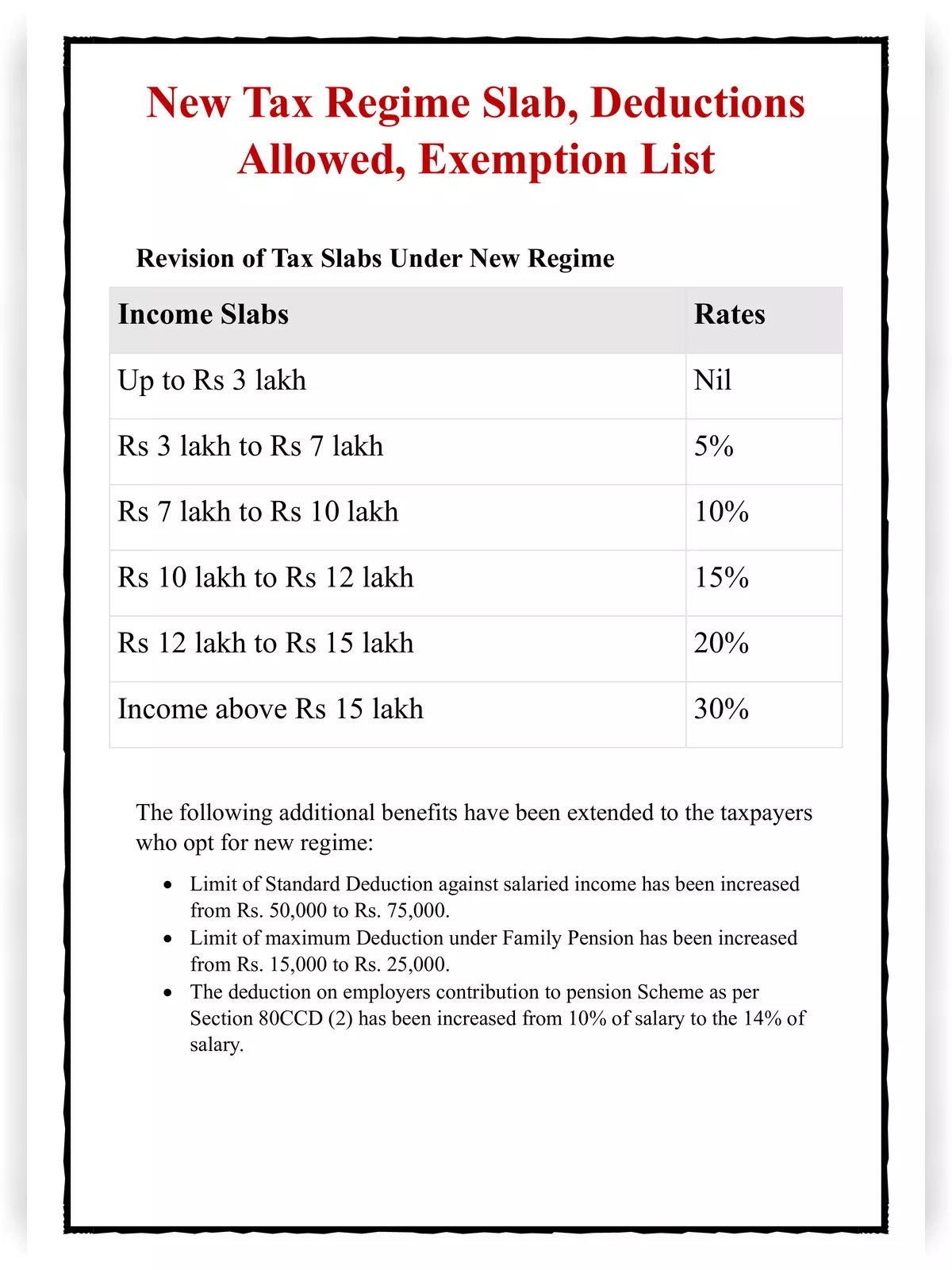

The New Tax Regime was introduced with the altered tax slabs and concessional tax rates. It applies to all taxpayers, including individuals, Hindu Undivided Families (HUFs), and Association of Persons (AOPs).

In the case of salary income, the Standard Deduction of Rs 50,000, which was previously only available under the Old Tax Regime, was extended to the new tax regime. Under the New Tax Regime, you can enjoy a tax-free income of Rs 7.5 lakhs, which is after you apply the standard deduction and tax rebate.

New Tax Regime Exemption List 2025 -26

Allowance Exemption Under New Tax Regime

- Transport Allowances w.r.t. Person with Disabilities (PwD)

- Conveyance Allowance

- Travel/ Tour/ Transfer Compensation

- Perquisites for Official Purposes

- Exemptions for Voluntary Retirement Scheme u/ Section 10(10C)

- Gratuity Amount u/ Section 10(10)

- Leave Encashment u/ Section 10(10AA)

Deduction Under New Tax Regime

1. Deduction for Housing Loan (Let Out Property)

| Nature of Property | Purpose of Loan | Allowable (Maximum Limit) |

|---|---|---|

| Let Out | Construction or purchase of house property | Actual value without any limit |

2. Tax Deductions under Chapter VIA of the Income Tax Act

Section 80CCD(2) – Employer’s Contribution to NPS (Pension Scheme of Central Government)

| Employer Category | Deduction Limit |

|---|---|

| All categories of employers | 14% of salary |

Section 80CCH – Contribution to Agnipath Scheme (Agniveer Corpus Fund)

| Contributor | Deduction Allowed |

|---|---|

| Individual enrolled in Agnipath Scheme (from Nov 1, 2022) | 100% of amount paid or deposited to Agniveer Corpus Fund |

| Central Government contribution to Agniveer’s account | 100% of amount contributed by Central Government |